Key Takeaways

- NBFCs are adopting location intelligence to streamline field operations, improve visibility, and enhance decision-making.

- Dista enables smart case allocation, route optimization, and live tracking to boost recovery outcomes and agent productivity.

- McKinsey reports AI-led collections can reduce operational costs by 40% and increase recovery rates by 10%.

A growing demand for personalized, convenient, and secure services has prompted Banking and Financial Services (BFS) companies to evaluate their operations. Business leaders are exploring data-driven software to strategize better and meet customer expectations.

Leveraging intelligent insights derived from spatial data helps them develop banking products and services tailored for specific demographics or regions.

From improving personalized communication to providing customized banking services, location intelligence (LI) provides a more seamless customer experience. Decision-makers can identify and monitor under-served markets, spot coverage gaps, and expand their business operations.

They can embrace intelligent AI/ML-enabled field sales management software to develop strategies to streamline their field operations.

Also Read: 7 Location Intelligence Trends for 2025

Here are the key benefits of leveraging location intelligence for BFS companies.

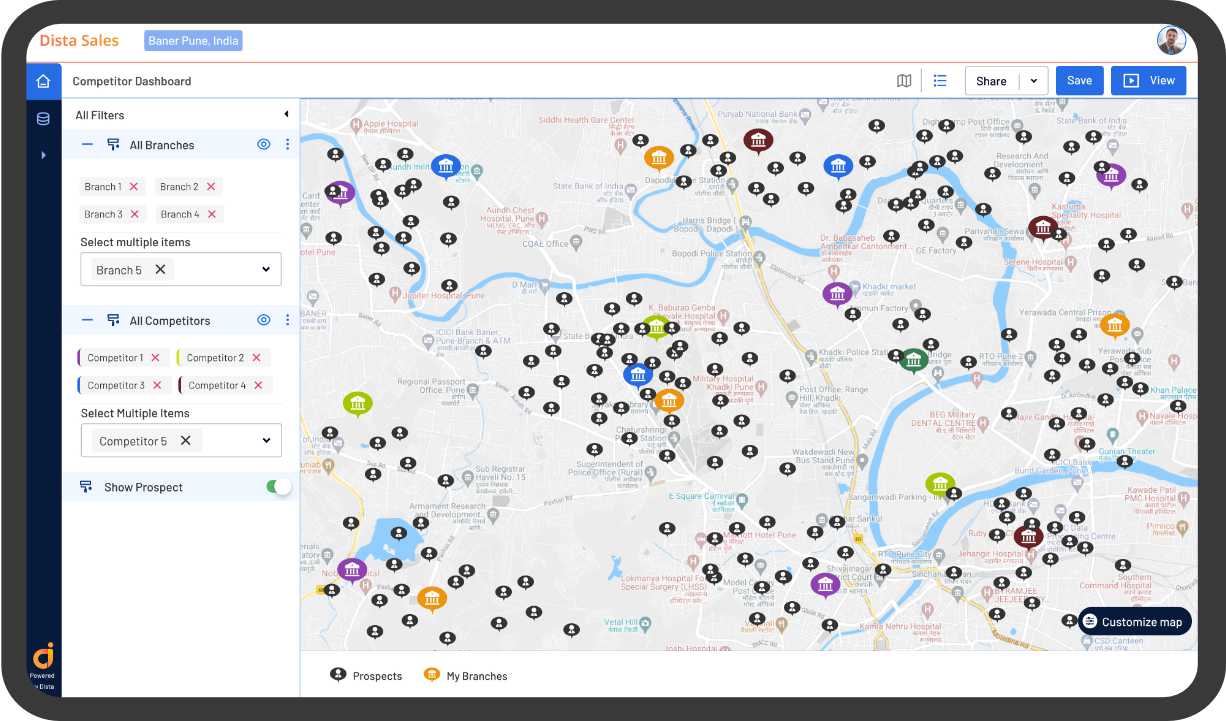

1. Identify Coverage Gaps

Banks can apply location intelligence to analyze demographics, market trends, and customer distribution in a particular region. Business leaders can leverage the insights to pinpoint gaps in service coverage, identify potential overlaps in territories, and target specific groups of customers.

Let’s say a bank wants to sell its Point-of-Sale (POS) machines in a new sales territory. Before expansion, they need to know if there is a requirement for such products in that area.

An AI-powered location intelligence platform analyzes historical bank data, customer behavior, purchase patterns, banking transactions etc. to provide key demand insights for business expansion. The software helps target the right areas and prioritize customers requiring these banking products or services.

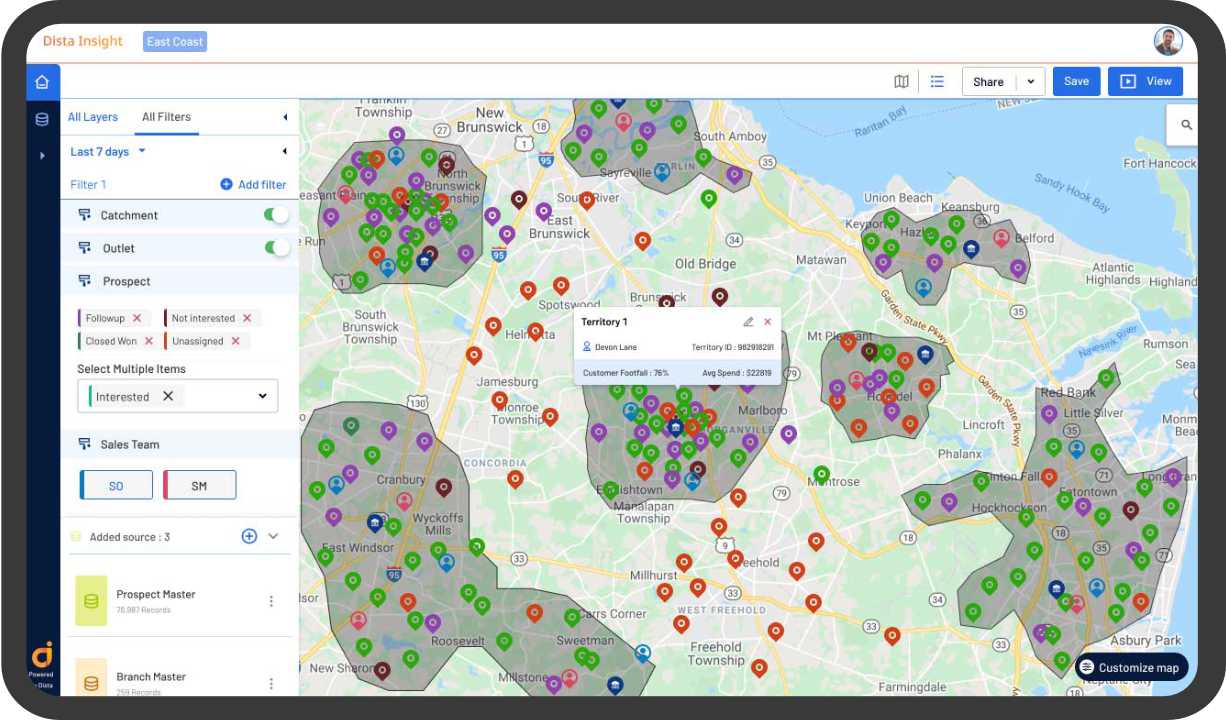

2. Analyze Catchment Areas

An AI-enabled location intelligence platform analyzes large volumes of demographic data including average age, income levels, education status, and economic status of a region. A detailed customer profiling helps banks create catchment areas.

Catchment area analysis identifies under-served or untapped areas. It helps banks assess the market potential providing loans and investment products. Business managers can also realign their strategies and optimally allocate resources to cover areas with more sales potential.

Catchment analysis also enhances lead actioning. Once leads are identified in a defined area, a field sales management software prioritizes the assignment to field sales reps closest to those leads.

3. Improve Sales Territory Planning

A geospatial analytics software provides detailed map-based visualization of leads and offers efficient sales territory planning. Managers can plot leads into defined clusters, review relevant point of interest (POI) locations, and highlight the competition in the identified territory.

Mapping leads to the best field sales reps also improves the chances of engagement, thereby boosting lead conversions. With a dedicated sales team for each territory, banks can build stronger relationships with customers.

By dividing the market into distinct territories, banks also allocate their resources more effectively. Territory planning ensures that each region receives the appropriate level of attention and support to close more deals and boost sales volume.

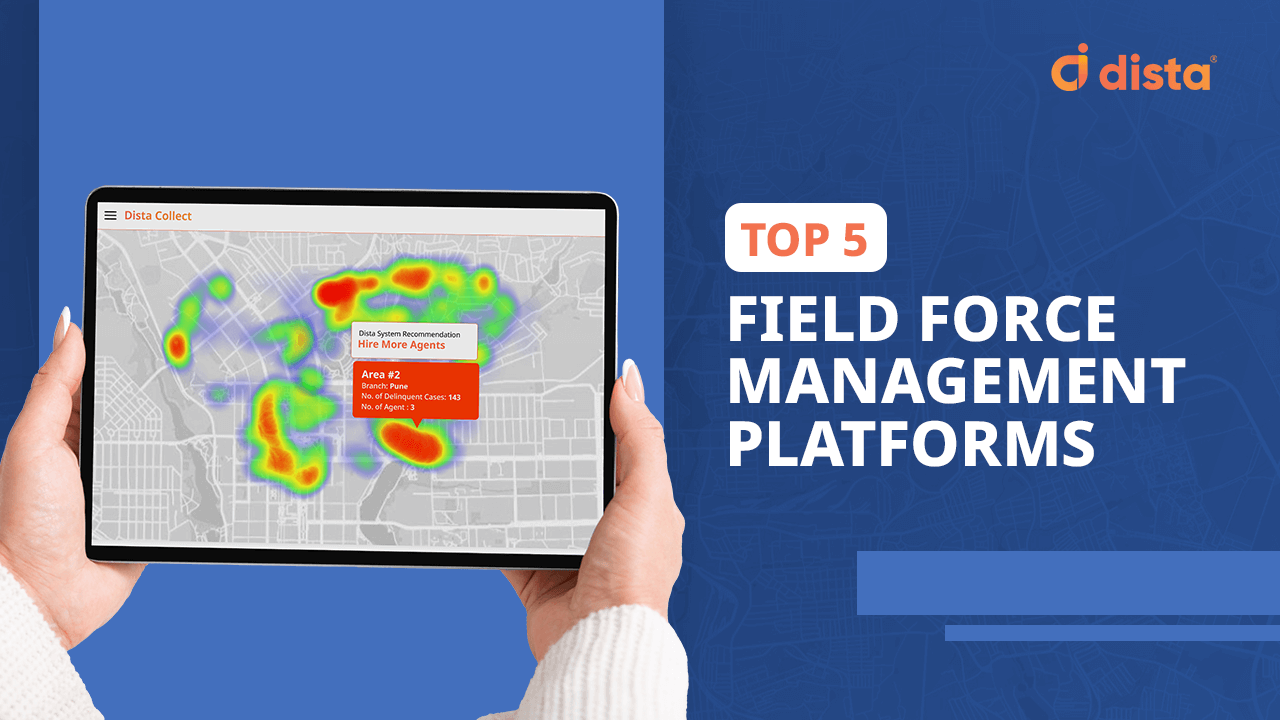

4. Boost Field Collections and Recovery

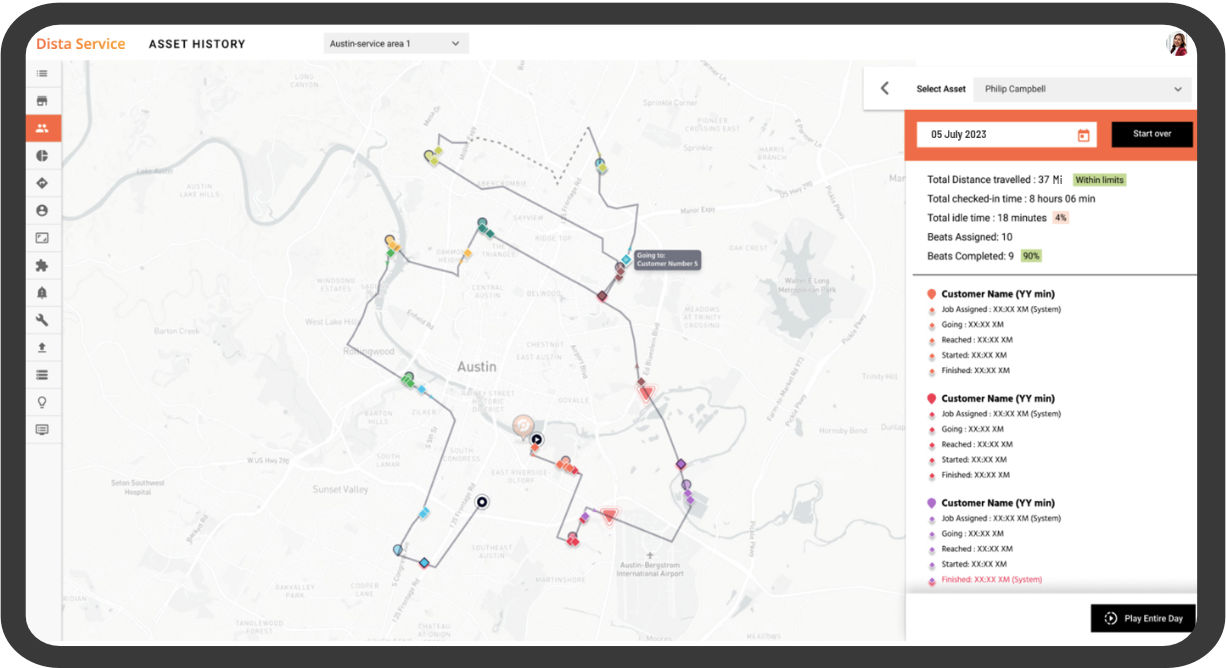

Banks using legacy systems lack a way to effectively track collection agent activities and monitor their tasks. A dedicated field collections management software leverages location intelligence to provide better visibility into the end-to-end debt collections process.

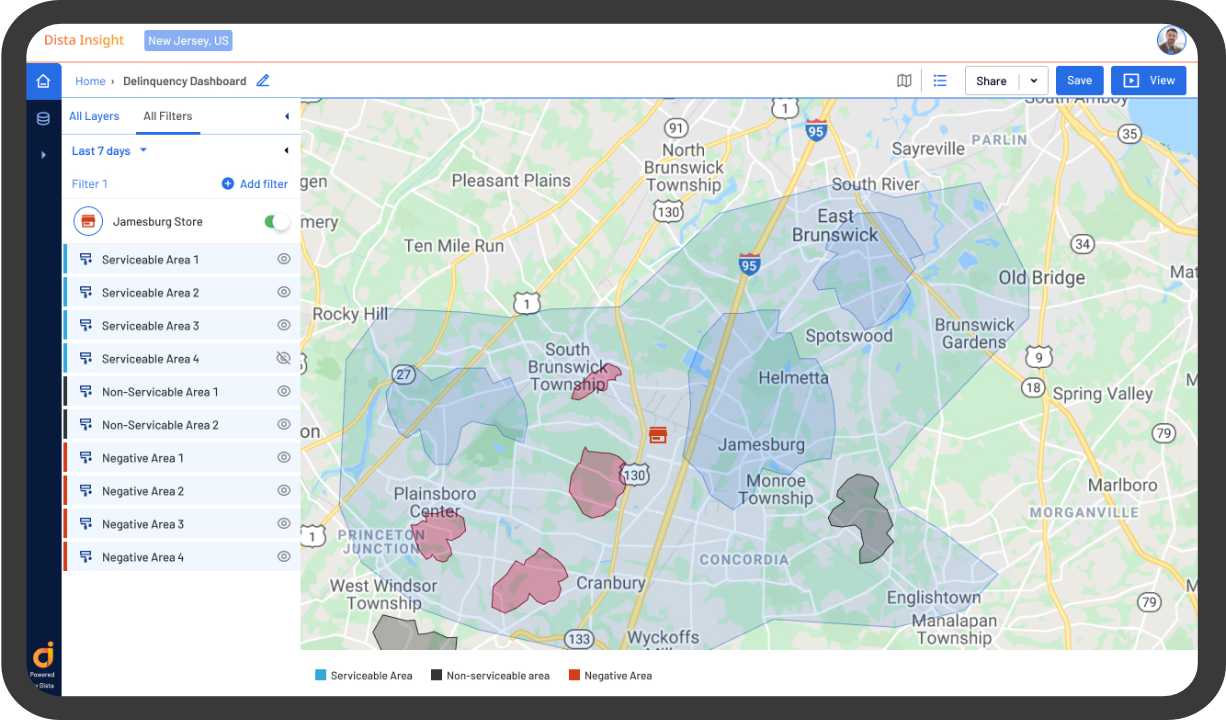

The software analyzes historical data acquired from industry/government bureaus to highlight defaults in collections, missed EMIs etc. This data is used to provide a comprehensive map based visualization of delinquent customers for managers to assess the risk and refine their field collection strategies.

The software also provides an intelligent beat plan to prioritize visits based on the cases and reps assigned. It enables collection agents to follow a schedule to improve their collections response time.

5. Branch Network Optimization

Location intelligence enhances the site selection process by providing a better understanding of geospatial factors in a particular area. A geospatial analytics software analyzes average population, age groups, demand for banking products, income level, existing competition, and even real estate trends.

Using demographic and geographic insights, businesses can assess the demand for financial services by location and map out new areas with potential customers. The software improves the decision making process for selecting the best location for ATMs and branches. Banks can also determine the existing branches that need service optimization based on historical customer visit and location data analysis.

6. Orchestrate Doorstep Banking

Managers can utilize an AI/ML-powered location intelligence platform to orchestrate and streamline workflows for doorstep banking services. It simplifies field operations to provide better personalized services thereby strengthening customer relationships.

Location intelligence empowers field agents with the right tools to deliver a quick and seamless doorstep banking experience. Using a dedicated app, they can eliminate manual paperwork, digitally collect onboarding documents, perform background verification, and open bank accounts at the customer’s doorstep among providing other banking services.

Providing efficient doorstep services is the key differentiator that boosts customer satisfaction and influences overall CSAT scores.

7. Risk Assessment for Delinquency

Spatial analytics provides a holistic map-based view of critical geographic data in a particular region. An AI-powered geospatial analytics software helps identify regions with a higher concentration of delinquent accounts.

Visually mapping these data points to represent delinquent customers helps banks and financial institutions map negative areas. The software also analyzes historical transaction data to track delinquency rates of customers who are not prompt with loan repayments.

8. ATM Cash Management

Banks can use spatial insights to improve the orchestration of cash vehicles in ATM services management. An AI-powered location intelligence platform provides live vehicle tracking allowing business managers to collectively track ATM fleets.

The software monitors cash pickup and deposits and provides ETAs for vehicles in transit. It also enables secure and efficient cash transportation with two factor authentication between retailers and field custodians.

9. Verify and Validate Addresses

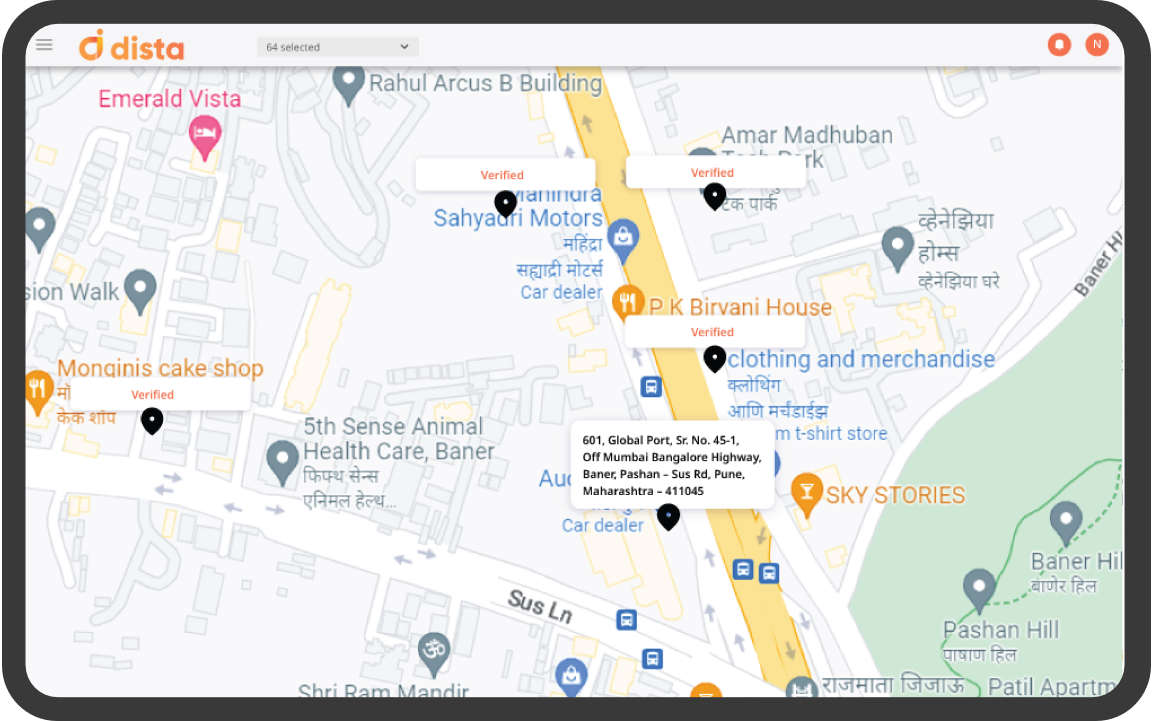

Banks can benefit from using an address geocoding tool that cleans and authenticates bulk addresses. They can apply location intelligence to optimize the verification and validation of addresses.

Intelligent geocoding eliminates invalid data, incorrect pin codes, and inconsistent addresses. Business leaders can benefit from reverse geocoding to convert latitude and longitude data into readable addresses.

Dista’s unique geocoding software also provides a confidence score to determine the accuracy of these cleaned addresses. It helps organize and categorize text addresses based on the level of accuracy thereby providing some structure to the raw data.

Final Thoughts

Geospatial analysis improves your understanding of spatial data and how it influences customer engagement and satisfaction. Location intelligence plays a pivotal role in optimizing branch location, personalizing marketing services, assessing credit risk, and streamlining banking operations by leveraging insights derived from spatial data.

Analyzing location data empowers business leaders to stay ahead of market trends, identify expansion opportunities, and boost customer experience by strengthening their offerings.

If you are also looking to leverage the power of location intelligence, Dista can provide geospatial insights to boost strategic decision-making.

Book a free demo today!