Field Collections

Empower Field Agents to Maximize Collections

Amplify Recovery Rate and Field Collections Throughput

Orchestrate Field Agents for Collections and Recovery

Empower recovery executive with a smart field collection software to manage end-to-end debt collection.

Monitor Agent Performance

Track and get full visibility of your field collections executives (FCE). Get real-time cockpit view of collections cycle. Send prescriptive nudges to FCEs to increase collections coverage.

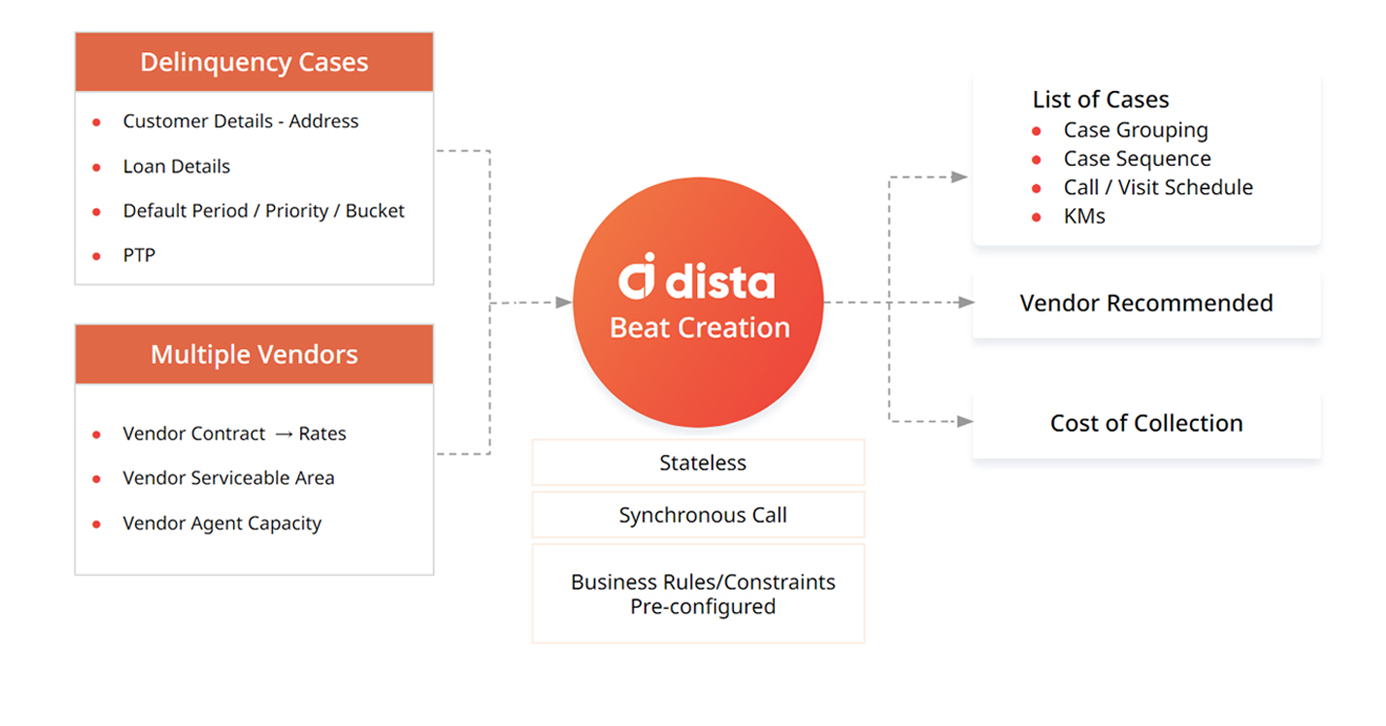

Intelligent Beat Plan

For corporate collections, Dista’s algorithms recommend intelligent beat plans for FCEs. It helps optimize field resources to increase geographical coverage and improve collection rates.

Address Cleansing and Verification

Streamline address data of leads, customers, etc and map it accurately. This helps identify serviceable areas, reduce travel time of FCEs, and control fuel costs.

Increase Collections Throughput

Eliminate manual paperwork by digitizing the complete field collection process.

Automate Case Allocation

Auto-allocate cases to the right field agent based on collection executive skills, location, case proximity, executive capacity, and availability. Increase the first call resolution rate to improve the collection response time.

Risk Profiling and Delinquency Insights

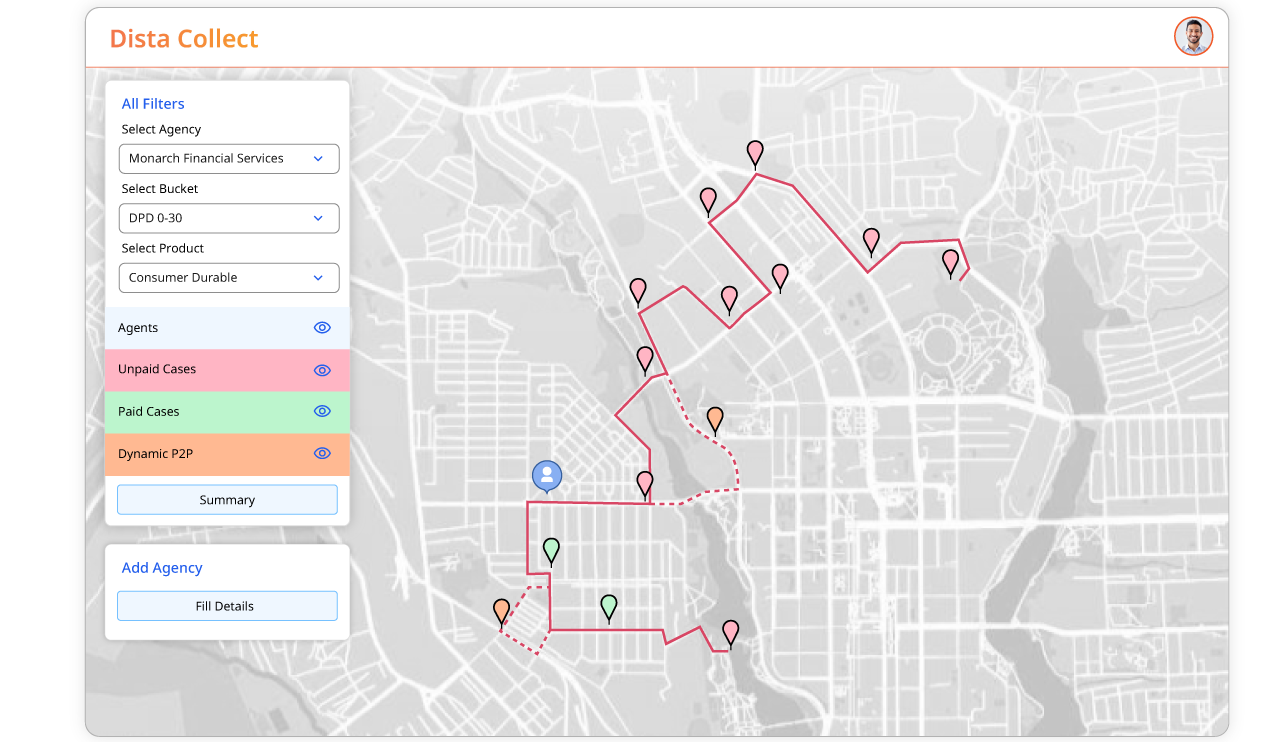

Visualize areas with high/low risks. Get intelligent insights on risk exposure based on risk map indicators, historical data of recoveries, missed EMIs, etc. Perform location-based credit evaluation for real-time lead qualification.

Actionable Visual Insights

Get actionable visual intelligence to refine collection strategy. Analyze geographic data from multiple sources through map-based visualization. Priortize, track your collections and recovery by area/region/territory.

FAQs

Browse our FAQs section to know more about our field collections tool and how it can contribute to your success.

Still have questions ?

Yes. By mapping customer locations, payment behavior, and agent performance, Dista ensures every visit is purposeful, minimizing fuel costs and increasing debt collection success rates.

Using dynamic data like agent availability, past performance, and proximity to defaulters, the platform auto-assigns tasks for maximum efficiency and adherence to field compliance.

Absolutely. Dista supports strategies from soft follow-ups to hard recovery cases, helping NBFCs and banks create customized playbooks for each delinquency stage.

Yes. The solution integrates with core systems, CRMs, and loan management software to ensure seamless data sync and end-to-end visibility across the field collection processes.

Leaders get access to dashboards that monitor recovery rates, agent productivity, delinquency trends, and region-wise performance—empowering data-driven interventions.