Dista Sales, our sales productivity platform, helps improve sales productivity and enhances lead conversion rate. Our system offers area definition and analysis of potential leads in a specific area. It provides analytics and insights on your customers, conversion metrics, agent performance, etc.

How Does Dista Sales Help in Terms of Analytics?

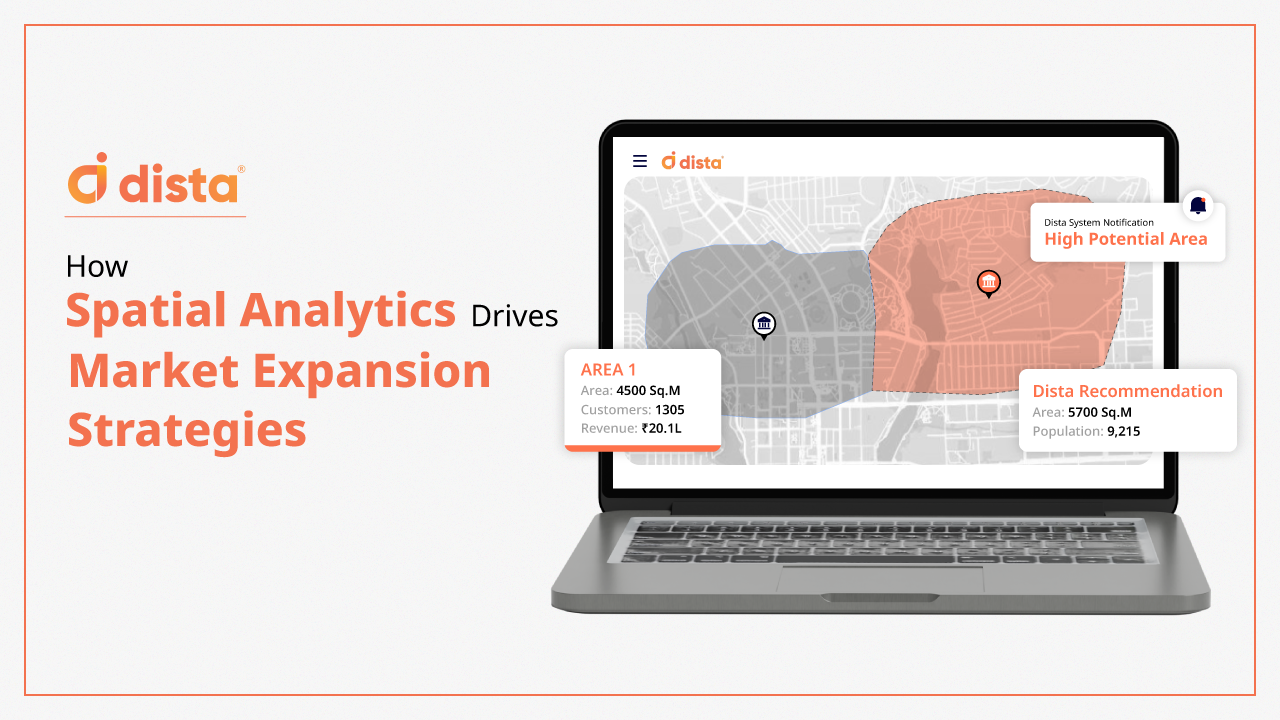

Dista’s AI-based recommendation helps business leaders make strategic decisions related to expansion. Dista Sales offers resource planning forecasts based on past data and ML-based engines. Custom reporting and dashboarding help them get instant reports for better decision-making.

Here are a Few Analytics Which Dista Sales Offers

1) Site Selection

Our AI/ML-based engines provide map visualizations that reveal populations and demographic groupings. With location intelligence, banks get a deeper understanding of the profiles and advantages of one location compared to another. This helps them clarify which areas would best serve their needs.

Our intelligent system layers relevant and contextual data attached to a particular area, thereby helping build a fuller picture of the customers in a specific location. By leveraging this data, banks understand how to staff the branch and determine sales and profitability targets.

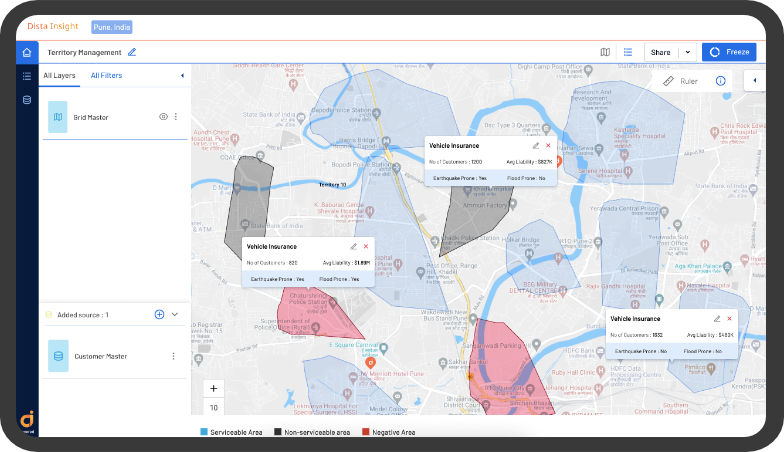

2) Positive and Negative Areas

Our system maps areas in a city with high or low delinquencies by leveraging data that is fed into our sales engine. The data, primarily acquired from the sales team and government bureaus, about these areas is identified by the bank where residents don’t fit the credit approval criteria. We also use our ML engines for resource forecasting and planning.

3) Decongestion

Banks can leverage analytics derived by Dista Sales and make strategic decisions about opening a new branch or closing an older one. The solution’s AI and analytics offering helps banks with real estate selection and resource planning decisions. They can analyze a particular location and understand the benefits of one location over the other. This helps banks decide where to open a new ATM or bank branch and decide on staffing.

Also read – How to control decongestion of bank branches

4) Lead Area Definition Management

Identify serviceable and non-serviceable areas by leveraging location data w.r.t. economics, demographics, and more. We can map multiple sites to optimize market coverage with factors like other branches, direct competitors, traffic patterns, social demographics, population density, etc., playing a critical role in impacting the profitability of a store location. Dista Sales offers analytics that helps banks make vital decisions like which branch needs to be consolidated or closed, how many branches to open in an existing location, where to open the next branch, and so on.

Are you looking for a platform that provides banks with deep analytics that help banks with crucial decisions related to expansion, improve sales productivity, and boost customer experience? Contact us to check out Dista Sales.