Location-first Field Force Management for Group & Individual Loan Meetings & Collections

Improve true visits, record km tracking, ensure visit compliance, seamless travel allowance disbursals, and boost market penetration.

Business Impact

Reduction in Travel Time and Distance (km)

1

%

Increase in Customer Facetime

1

%

Reduction in Field Force Requirement

1

%

Optimize Field Force Orchestration for Group and Individual Loans with Location Intelligence

Edit Content

Track distance (km) traveled by agent

Seamless travel reimbursment calculation

Verify center meeting compliance with real-time location tracking

Track duration of center meetings to measure its quality

Monitor field agent attendance with check-in and check-out alerts

Adhoc reconnaissance tasks to hunt new villages for prospect business expansion

Edit Content

Field agents can locate and view nearby cash deposit points on the app

They can access and log cash deposit details

Backend reconciliation for each deposit

Edit Content

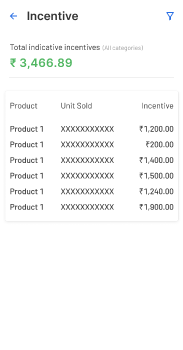

Enable agents to track targets and manage incentives

Set quotas and targets for the agents across regions and hierarchies

Edit Content

Gamify daily tasks to motivate agents and boost healthy competitionIncentive meter

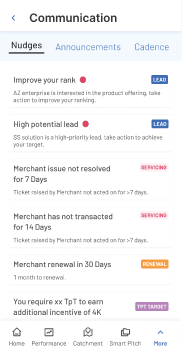

Prescriptive nudges for customer follow-ups, ad-hoc, and nearby visits

Alerts for cross-selling offers to individual loan customers based on group loan recovery trends

Quizes for training and enablement of agents on the mobile app

Group and 1:1 chat for better collaboration

Help agents conduct adhoc surveys

Edit Content

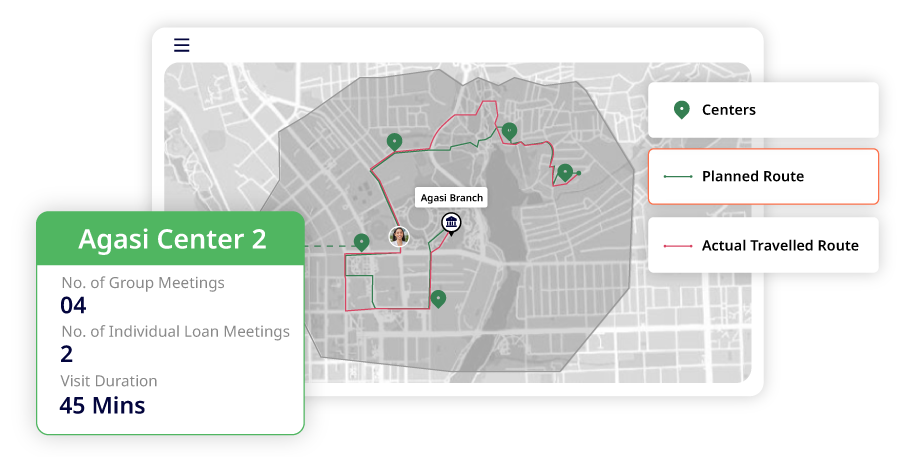

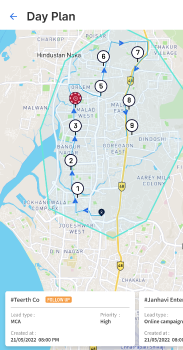

Consider branch and center location, center visit frequency, center visit day, field agent who attends to the center and create an optimal beat plan

Optimize the number of field resources, travel time, and travel KM's

Run multiple simulations to choose between business variables - change field agent's center visit, center meeting day, and more

Edit Content

Adhoc daily visits for - previous collections, field office leaves, and upcoming public holidays

Input the beat plan and instances of daily adhoc variables to create optimal day plan for each field agent

Completely automated process to account for various scenarios

Edit Content

Relook at the territory addressed by the branch

Create snug clusters based on business parameters like centers, cumulative groups, and distance between the centers

Each cluster can be allocated to a field agent

Reduce the travel time of the field agent drastically, increase customer face time, and expand business penetration

Edit Content

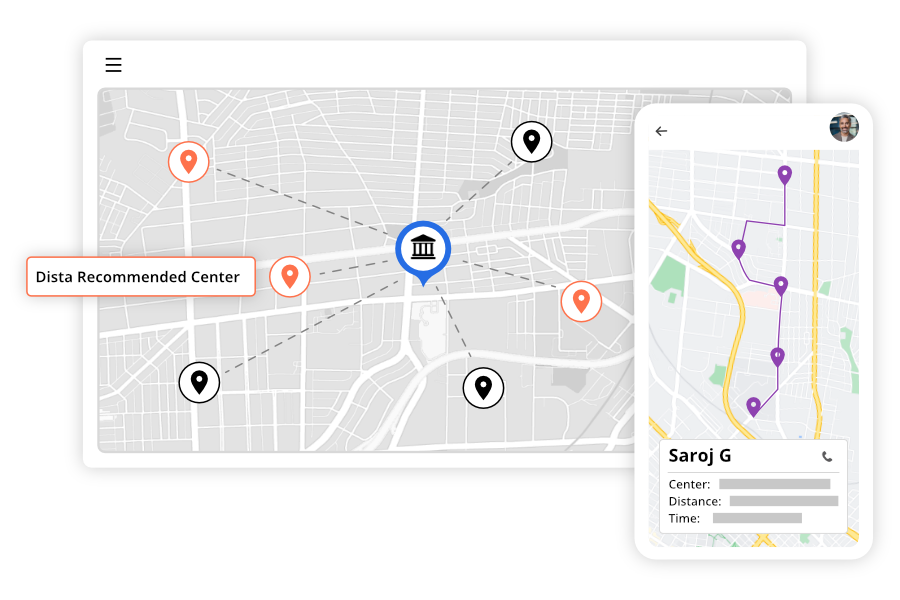

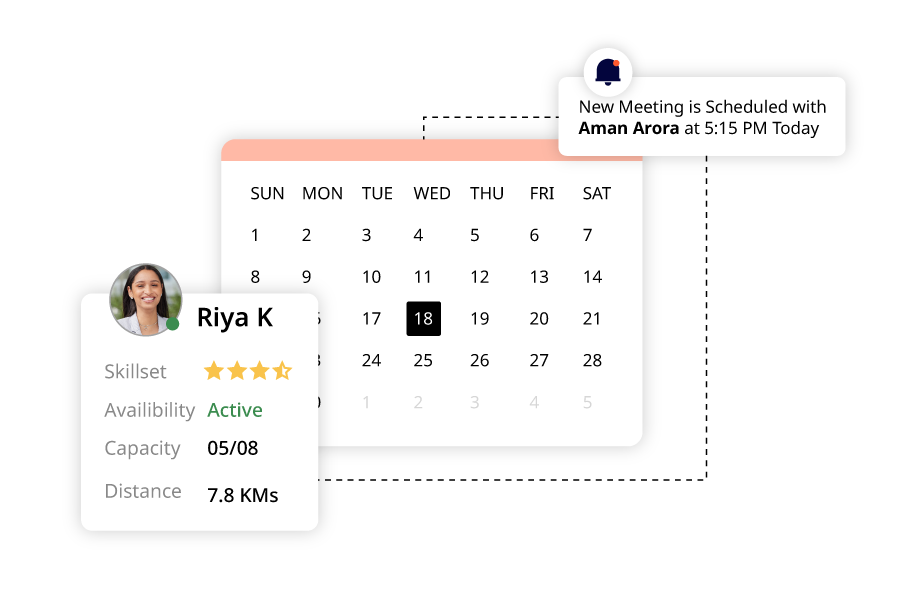

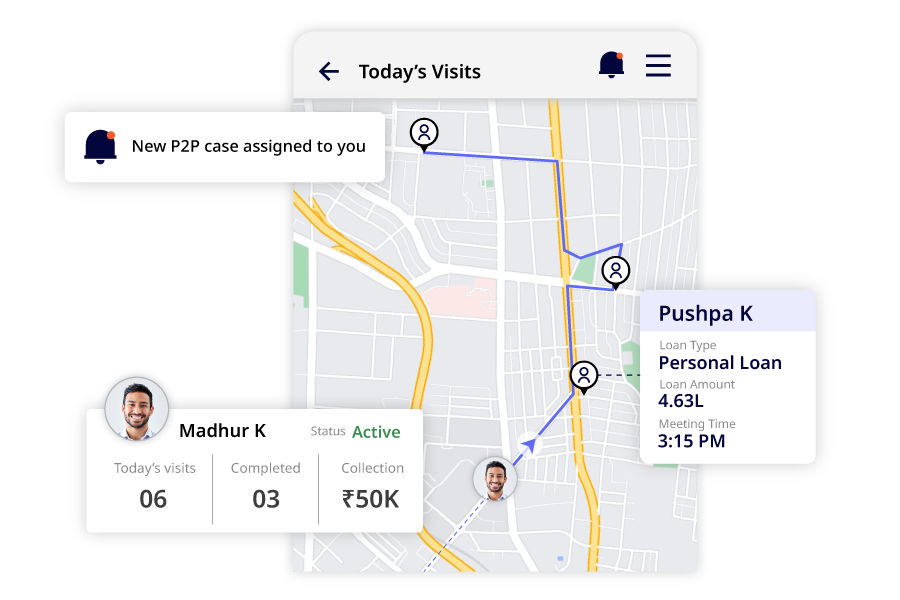

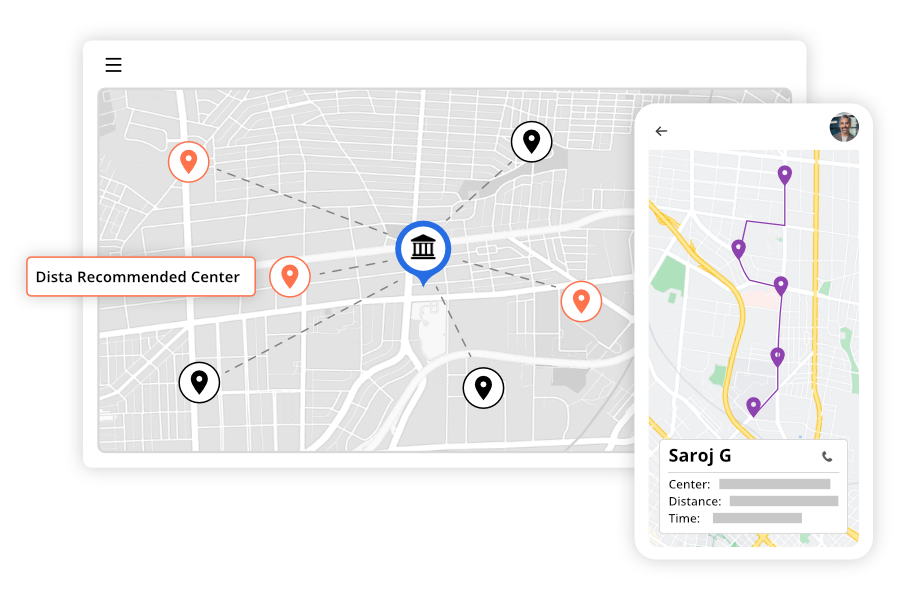

Daily case allocation engine decides which collection agent attends particular cases based on DPD bucket, delinquency amount, skill set, location, propensity to pay etc.

Near-by' view to show other cases in proximity. Collection agents can visit them adhoc and try to do the collection

Edit Content

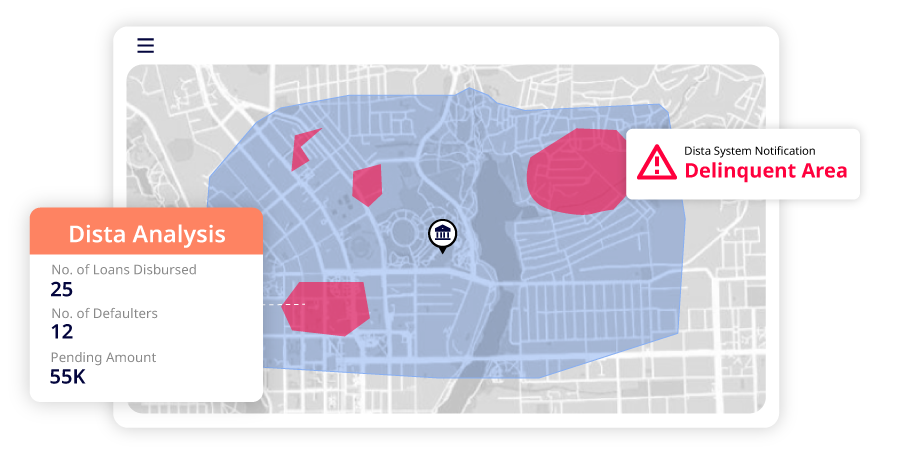

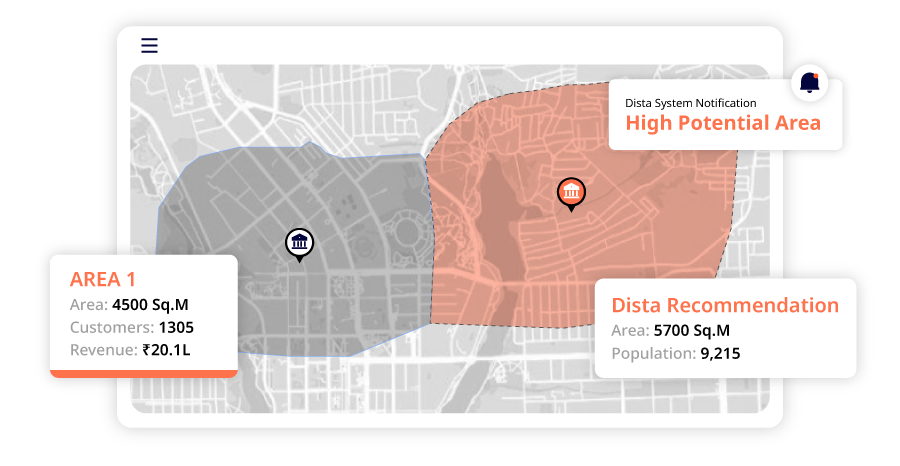

Intelligent recommendations on risk exposure in territories

Derive actionable insights on areas with high/low risks

Edit Content

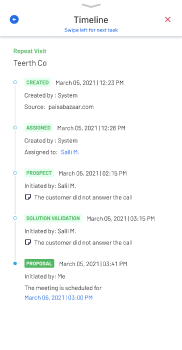

In case of unavailability of an agent, delegate customer visit to another agent

Edit Content

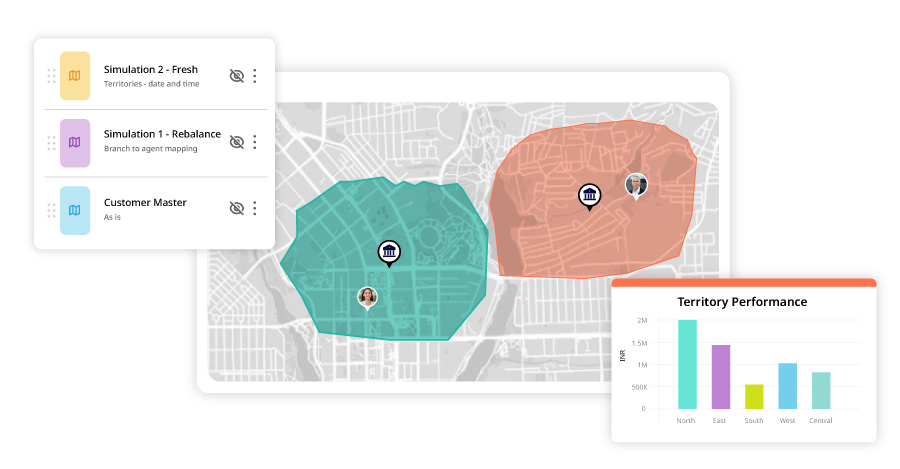

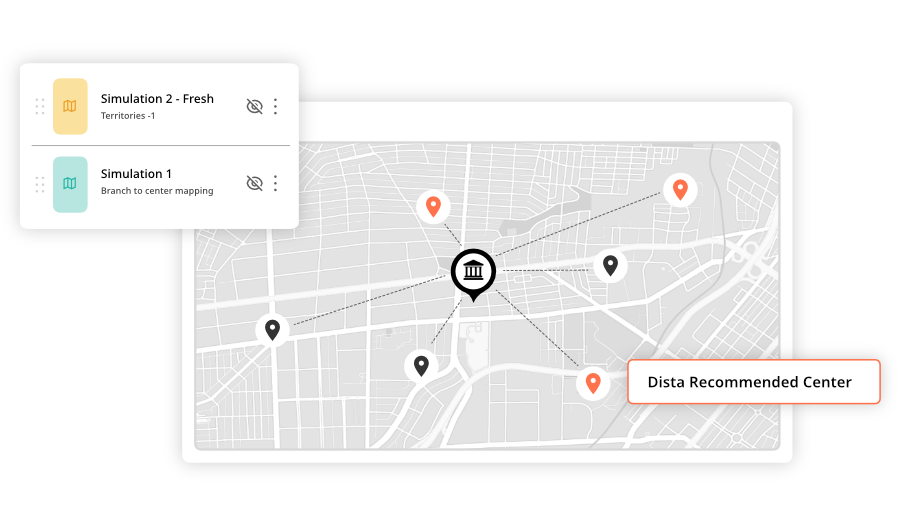

Run simulations to streamline existing branch networks

Branch to center mapping revisit

Optimize count and location of branches and find opportunities to open new ones

Edit Content

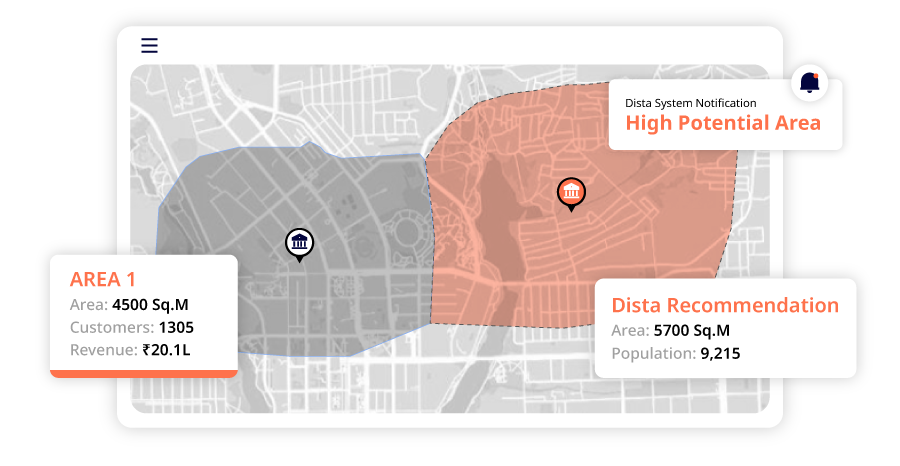

Quantify the opportunity size in the addressable area for each branch

Compare that to the actual penetration and analyze the opportunity

Implement steps to increase penetration

Edit Content

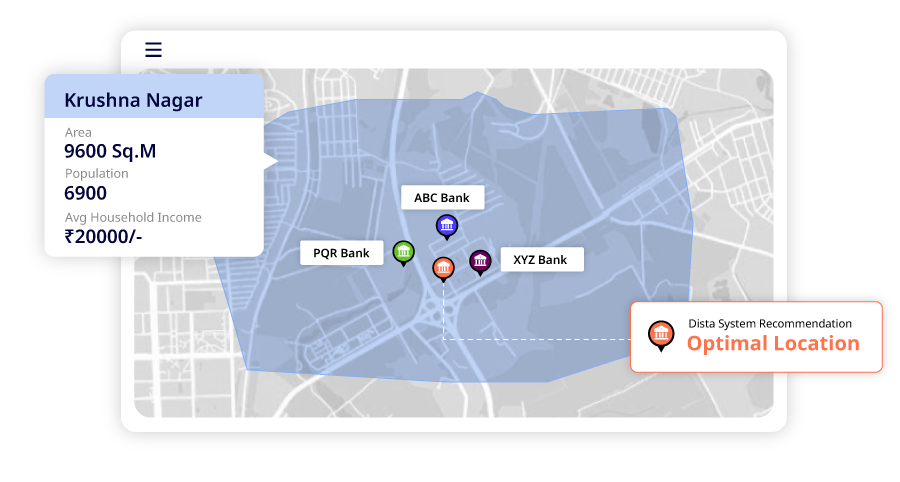

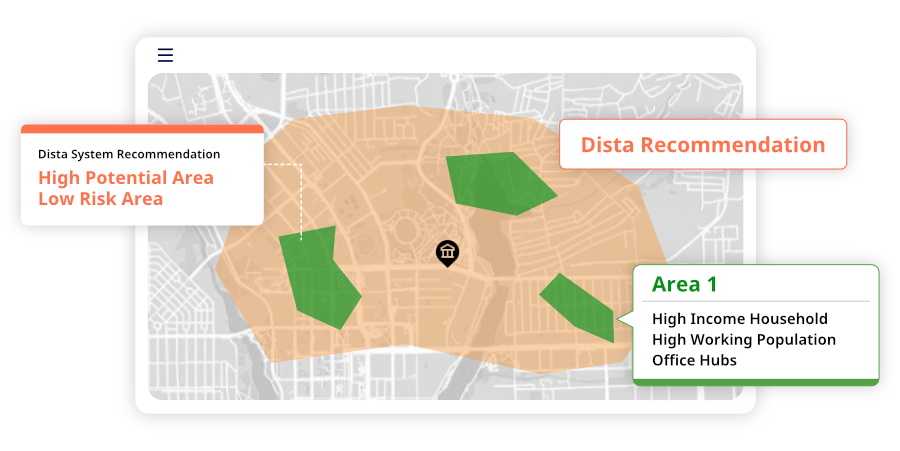

Identify the most optimal location for new branches

Use Point of Interest variables like working population, income index, banks nearby, type of shops nearby, competition presence, geo reach etc. to identify and recommend new branch locations

Analyze various areas around the proposed branch to identify center locations

Edit Content

Conduct town/village surveys to set up town centers/branches at locations with high prospect clusters

Edit Content

Facilitate group/individual offer communication to members

Offer workflow to track them to closure

Edit Content

Attendance of group loan members at center meetings based on face recognition

Edit Content

Remove inconsistent addresses and unwanted geographical data points

Use AI to convert text addresses to spatial database

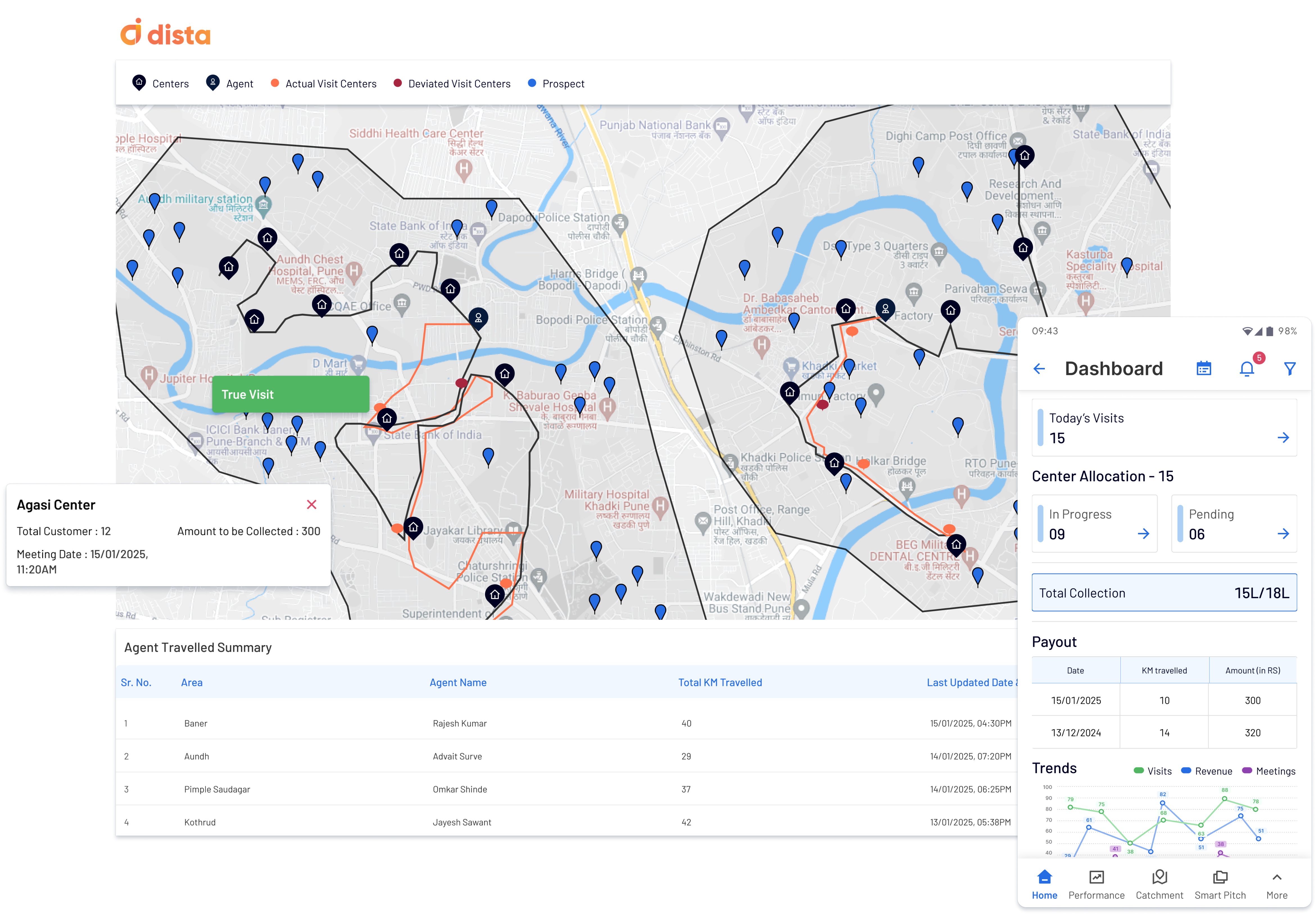

Field Force Management

Tracking and Compliance

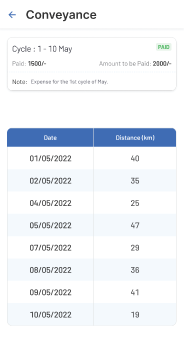

Track distance (km) traveled by agent

Seamless travel reimbursment calculation

Verify center meeting compliance with real-time location tracking

Track duration of center meetings to measure its quality

Monitor field agent attendance with check-in and check-out alerts

Adhoc reconnaissance tasks to hunt new villages for prospect business expansion

Cash Deposit Points

Field agents can locate and view nearby cash deposit points on the app

They can access and log cash deposit details

Backend reconciliation for each deposit

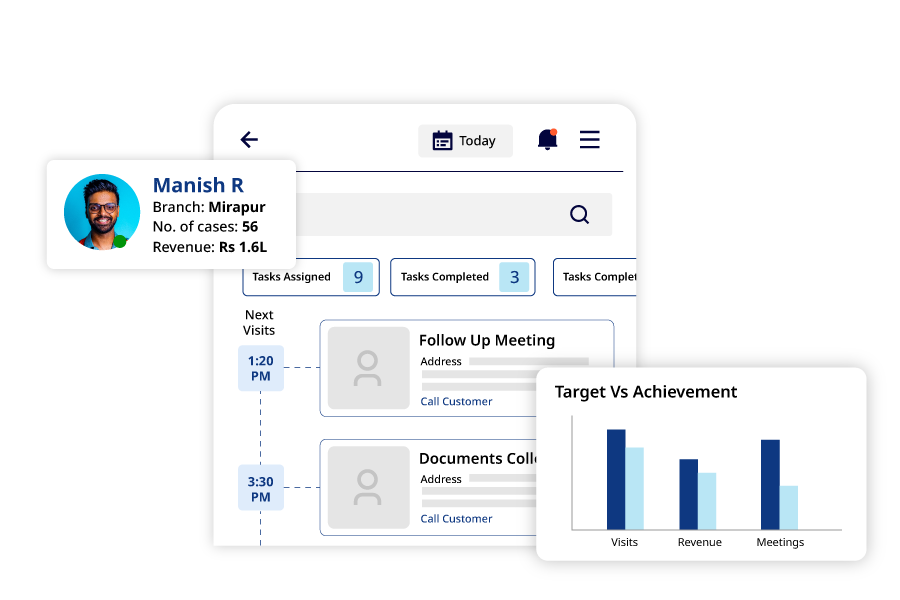

Target and Incentive Management

Enable agents to track targets and manage incentives

Set quotas and targets for the agents across regions and hierarchies

Core Features

Gamify daily tasks to motivate agents and boost healthy competitionIncentive meter

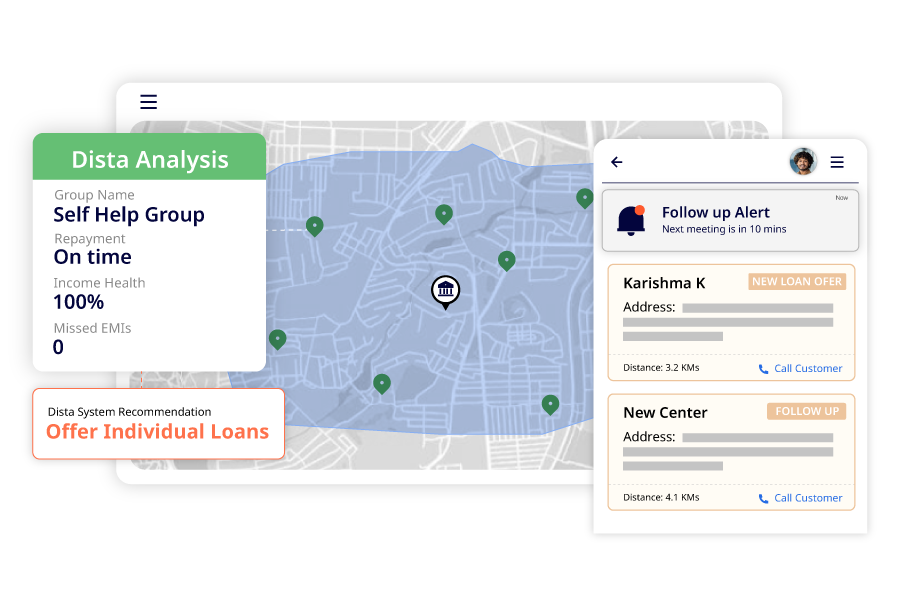

Prescriptive nudges for customer follow-ups, ad-hoc, and nearby visits

Alerts for cross-selling offers to individual loan customers based on group loan recovery trends

Quizes for training and enablement of agents on the mobile app

Group and 1:1 chat for better collaboration

Help agents conduct adhoc surveys

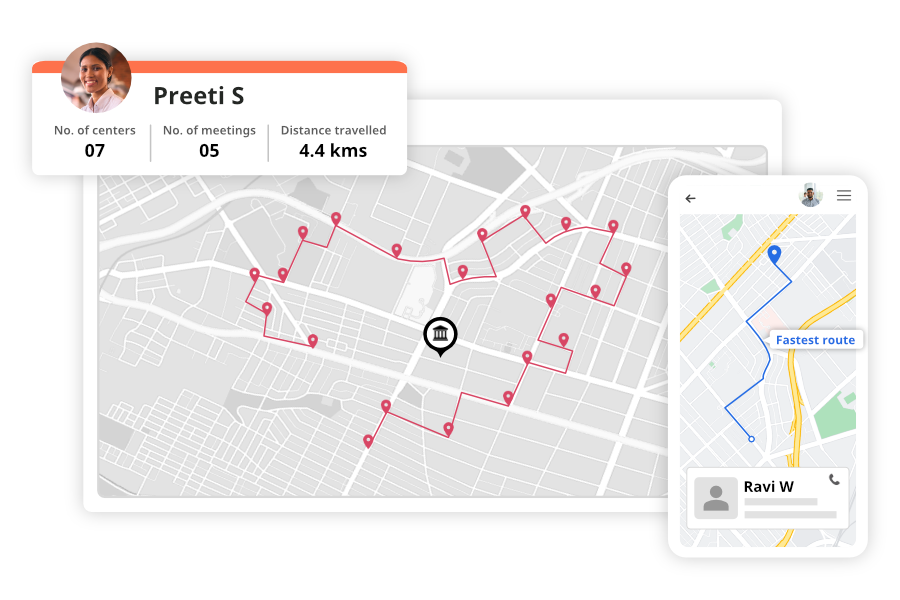

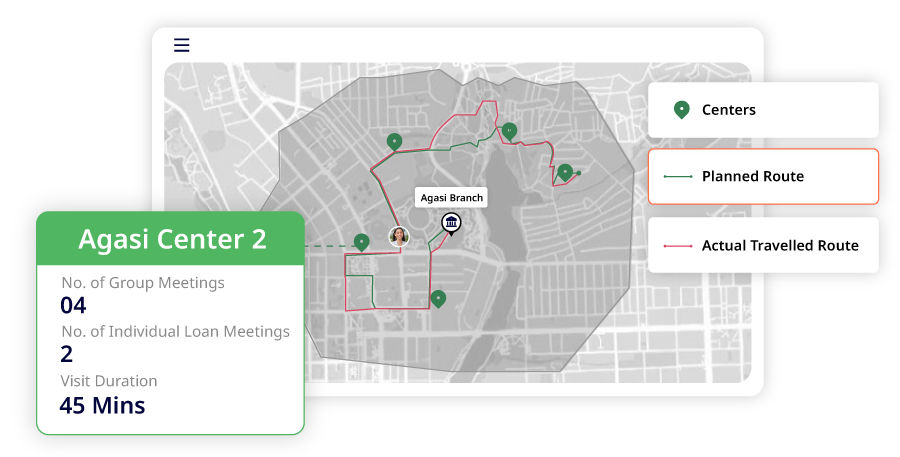

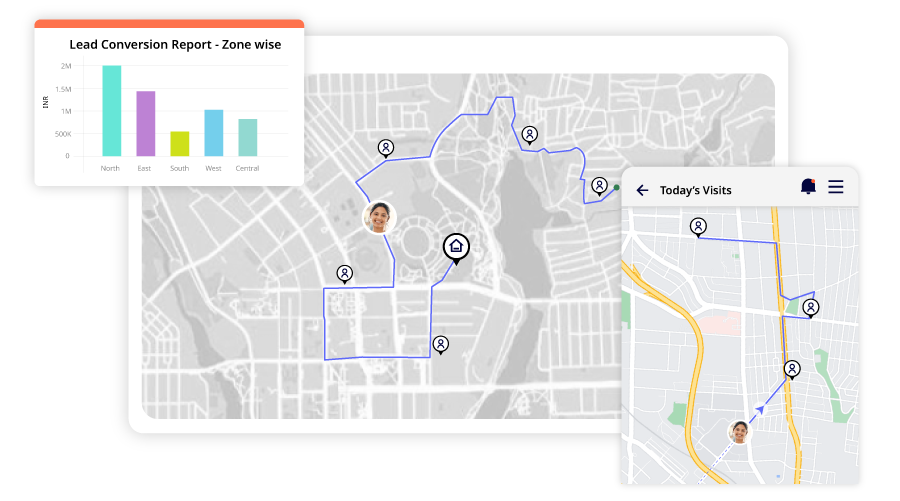

Route Optimization

Center Visit Beat Plan

Consider branch and center location, center visit frequency, center visit day, field agent who attends to the center and create an optimal beat plan

Optimize the number of field resources, travel time, and travel KM's

Run multiple simulations to choose between business variables - change field agent's center visit, center meeting day, and more

Daily Optimization

Adhoc daily vists for - previous collections, field office leaves, and upcoming public holidays

Input the beat plan and instances of daily adhoc variables to create optimal day plan for each field agent

Completely automated process to account for various scenarios

Agent Territory Mapping

Relook at the territory addressed by the branch

Create snug clusters based on business parameters like centers, cumulative groups, and distance between the centers

Each cluster can be allocated to a field agent

Reduce the travel time of the field agent drastically, increase customer face time, and expand business penetration

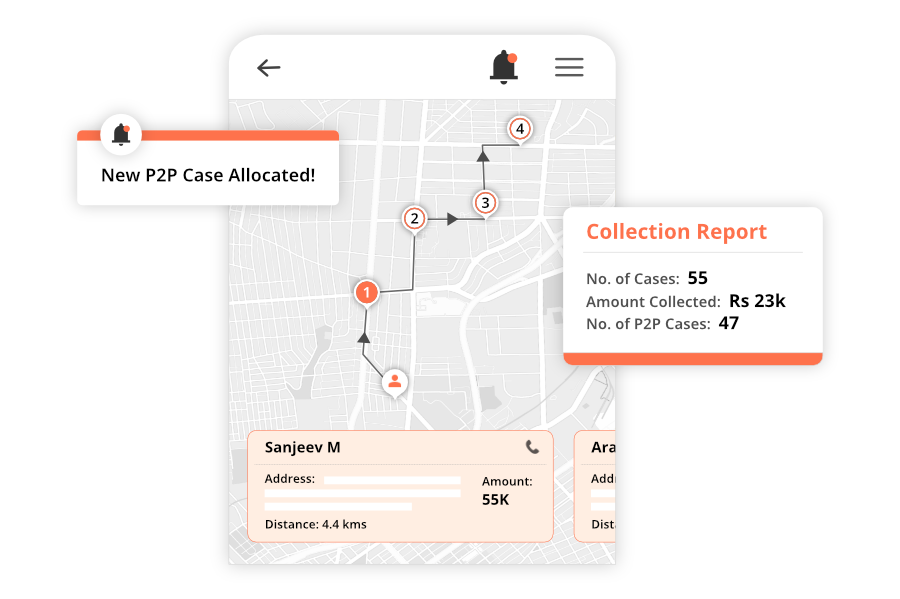

Collections

Intelligent Case Allocation

Daily case allocation engine decides which collection agent attends particular cases based on DPD bucket, delinquency amount, skill set, location, propensity to pay etc.

Near-by' view to show other cases in proximity. Collection agents can visit them adhoc and try to do the collection

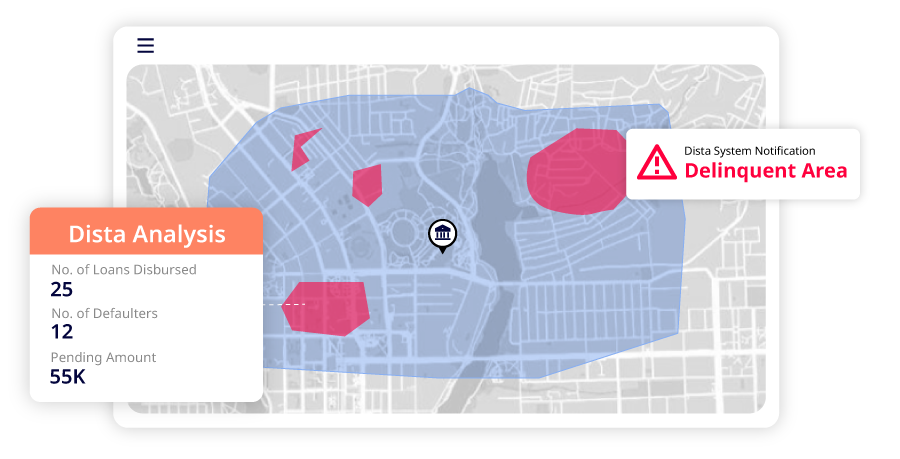

Risk Exposure Analytics

Intelligent recommendations on risk exposure in territories

Derive actionable insights on areas with high/low risks

Visit Delegation

In case of unavailability of an agent, delegate customer visit to another agent

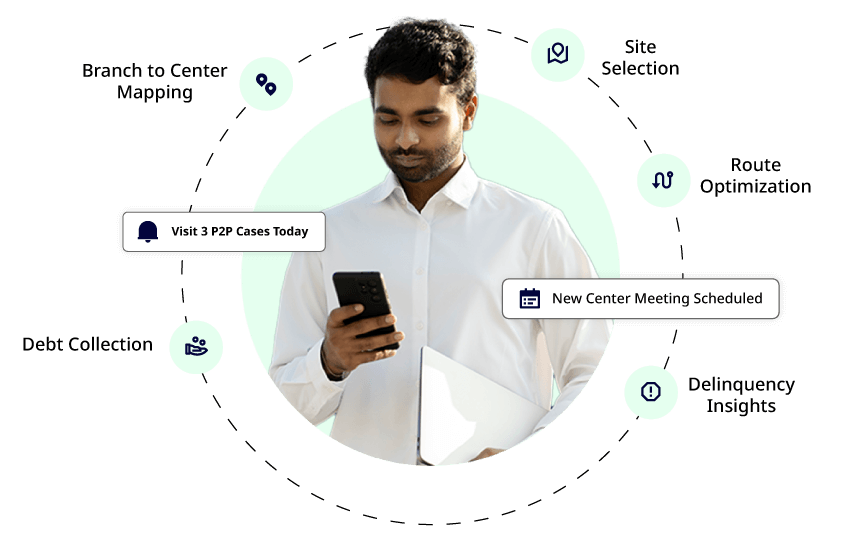

Market Penetration

Network Optimization

Run simulations to streamline existing branch networks

Branch to center mapping revisit

Optimize count and location of branches and find opportunities to open new ones

Identify Penetration Strength

Quantify the opportunity size in the addressable area for each branch

Compare that to the actual penetration and analyze the opportunity

Create road map to increase the penetration

Business Expansion

ID New Branches & Centers

Identify the most optimal location for new branches

Use Point of Interest variables like working population, income index, banks nearby, type of shops nearby, competition presence, geo reach etc. to identify and recommend new branch locations

Analyze verious areas around the proposed branch to identify center locations

Recce/Village Surveys

Conduct town/village surveys to set up town centers/branches at locations with high prospect clusters

Others

Offer Dissemination

Facilitate group/individual offer communication to members

Offer workflow to track them to closure

Face Recognition

Attendance of group loan members at center meetings based on face recognition

Address Verification

Remove inconsistent addresses and unwanted geographical data points

Use AI to convert text addresses to spatial database

Location-intelligent Field Force Management for Microfinance Institutions

Route Optimization

Intelligent scheduling combining beat plans with optimized routes for higher market penetration and meeting & exceeding KPIs

Prescriptive day plan recommendations to the field force to cover more customers with shortest and fastest routes

Club multiple customer visits on the same route and reduce travel time

Interlace individual loan customers with planned group loan visits; prioritizing P2P, delinquent case and more

System recommendation to visit a nearby customer who is at risk or not visited recently

Optimize routes based on center visit dates, km saved, hours in the field

Field Collection and Recovery

Proximity-based case allocation to field agents

Improve collection throughput

Actionable visual intelligence

Location-driven collection strategy

Branch to Center Mapping

Align town centers to bank branches by running multiple simulations

Find the most optimal location for town centers

Optimize all constraints of the branch network

Ensure field agents are not making dead runs to centers far from other town centers

Intelligent Case Recommendation & Cross-sell Offers

Smart recommendations to field agents for lead follow-ups and new lead generation

Customized individuals and group loan offerings based on multiple variables including historical repayments, income health, socio-economic conditions

Custom offers to individual loan customers based on group loan recovery trends

Delinquency Insights

Derive actionable insights on areas with high/low risks

Get intelligent recommendations on risk exposure in territories

Use risk map indicators like historical data of recoveries, and missed EMIs

Role-based Challenges

Edit Content

Lack of intelligent insights on potential markets and opportunities

Unbalanced territories and center workload

Limited customer facetime, low agent productivity

Location driven optimization to optimize journey/day plans

Inability to visualize and run simulations or experiments to increase agent productivity

Lack of strategic optimization to increase customer facetime on center visit dates -which branch the agent is allocated, field agent (who will visit), center visit time

Lack of systems to run geo-intelligent simulations factoring in km, ideal base location of agent, POI data and more at district level

Edit Content

Lack of real-time visibility on field agents

No system to validate true visits and visit outcomes

Manual individual loan customer assignment to agents leading to inefficiencies

Ineffective mapping of customers to agents and centers

Unable to introduce timely offers and schemes to individual loan customers with existing systems

Edit Content

Inefficient day plan with poor route optimization

Spread out customers and centers leading to fewer customer visits

Lack of central system for beat plan, recording visit outcomes and managing KPIs

Functional Features

Prescriptive Daily Route Optimization

Optimized Beat Planning

Center, Branch and Agent Network Planning

Prescriptive Nudges and Alerts

Risk Profiling

Facial Recognition for Smart Attendance

Expense Management

Visit Compliance and Audit Trail

Address Geocoding

Applying Location Intelligence to Microfinance