Microfinance Institutions (MFI) in India are on the brink of massive growth and are integral to enabling financial inclusion for underserved communities.

According to a report by Financial Express, the microfinance gross loan portfolio took a leap of 24% in FY24. However, scaling microfinance operations to keep pace with this growth is fraught with organizational and logistical challenges. MFIs operate in geographically dispersed areas, often lacking proper infrastructure, making loan disbursement, debt collection, and field force monitoring challenging.

What is Visit Compliance in MFIs?

Visit compliance in MFI refers to maintaining and adhering to predefined organisational guidelines and protocols, as well as ethical standards when field officers or collection agents visit borrowers for debt collection.

Visit Compliance: A Key Challenge for MFIs

In the case of MFIs, the scope of work for field agents extends beyond simply visiting customers. It also includes conducting center meetings, collecting documents, facilitating debt collections and recovery, onboarding new customers, meeting prospects, initiating cross-sell offers, and more.

While tracking field agent movement is important, MFIs face a more profound challenge—operational blind spots that hinder true visibility and verification. This goes beyond simply knowing where an agent is; it’s about understanding what they’re doing and how effectively they’re doing it. Managers and back-office staff often grapple with fundamental questions such as,

- Did the Loan Officer (LO) actually conduct the scheduled visit, and can we validate their presence?

- What was the duration and quality of the customer interaction – was it a productive meeting or a brief encounter?

- Were all required KYC documents, loan agreements, and repayment records collected and verified?

- Was the correct customer or center meeting location visited?

- Did the LO follow the planned route, and visit all scheduled locations?

Lack of clarity on these can lead to inflated visit reports, incomplete customer data, compliance risks, and missed opportunities for improved loan recovery and customer engagement.

In such a scenario, ensuring visit compliance is essential for maintaining transparency, accountability, and efficiency in loan recovery operations. A field force management app like Dista ensures that field collection agents follow a structured, trackable, and verifiable process when interacting with customers.

Role of Field Force Management in Ensuring Visit Compliance

MFIs often struggle with monitoring and managing their field force efficiently, especially when it comes to ensuring visit compliance. The unpredictability of customer availability, the vast geographical spread, and the need for real-time tracking make this a complex challenge to solve.

1. Lack of Real-time Tracking & Visibility

Problem

Field agents operate in remote and widely dispersed locations, which makes it difficult for managers to track and ensure agents are completing their daily visits.

Solution

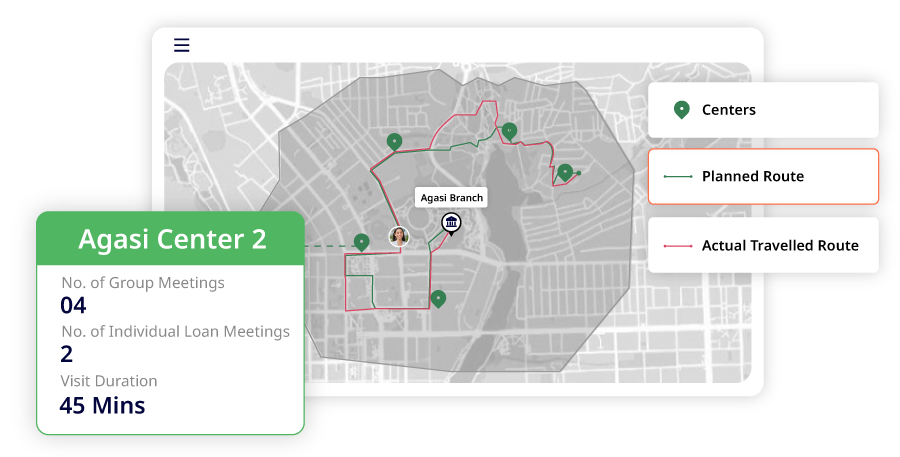

- GPS tracking to help sales managers and business leaders monitor real-time field agent locations and movements.

- A field force management solution like Dista is equipped with the ability to auto check-in and check-out for the loan officers. This ensures that their daily travel is recorded invariably and accurately. The app automatically checks-in officers at a fixed time in the morning and starts recording their distance traveled till the end of the day.

- Geofencing customer locations, centre meeting locations and/or branch locations to ensure the right agents visit the right places, like customer homes or centers, reducing incidences of false reporting and improves customer interactions.

2. Missed or Delayed Visits Due to Unoptimized Scheduling

Problem

Agents may prioritize group meetings over individual customer visits because group meetings allow them to address multiple customers at once, improving their efficiency and outreach. However, this approach can result in missed or delayed individual appointments.

Solution: Smart Visit Scheduling

- Dista’s AI-powered smart scheduling system optimizes field agent visits by dynamically assigning tasks based on location, skillset, priority, availability, capacity, geography, and past interactions.

- This intelligent approach helps with designing efficient beat plans, maximizing geographical coverage, improving collection rates, and ensuring the right agents are meeting the right customers at the right time.

3. Compliance Gaps and Insufficient Data

Problem

Field agents may miss recording visit outcomes or collecting mandatory documents and signatures, leading to compliance risks. This may make follow-ups difficult and also hamper data-driven decision-making.

Solution

- Dista’s field agent app facilitates the efficient collection, disposition, and management of critical field data from start to finish. This ensures accurate, real-time information capture, optimized task assignment, and streamlined communication, enabling MFIs to enhance operational efficiency and data integrity.

- The system also has the ability to send out AI-powered contextual nudges that can prompt agents to collect required documents and signatures to comply with corporate policies.

Final Thoughts

Improving visit compliance in MFIs isn’t just about ticking boxes but also about securing customer trust and transparency by making every interaction count. A field force management software like Dista can help MFIs streamline operations, optimize field visits, and enhance agent productivity.

Looking to optimize your field force to enhance visit compliance? Click here to get in touch with our team.