Debt recovery is getting harder. Rising interest rates, tighter household budgets, and economic uncertainty are pushing more borrowers into delinquency. In India alone, retail loan delinquencies increased by 14% in 2023, according to TransUnion CIBIL.

For collection managers, this means larger portfolios of overdue accounts, higher field costs, and mounting pressure to meet recovery targets.

Running collections on spreadsheets, phone calls, and disconnected tools is no longer sustainable. Manual processes slow down follow-ups, make tracking unreliable, and leave too much room for missed payments.

Debt collection management software changes this. It centralizes case management, gives you real-time visibility into field operations, and uses data to help your team recover more, faster.

Why Collection Managers Need Debt Collection Management Software

1. Manual Tracking

When field collection agents record case updates on paper or send them via messages, errors happen. Receipts get lost. Visit details are incomplete. Managers have to chase updates.

This manual process not only wastes time—it risks compliance breaches and lost revenue. For example, an agent might collect payment in cash, but the receipt isn’t uploaded until the end of the day. If the borrower disputes the payment, it becomes harder to resolve.

2. Poor Visibility on FCEs

Without live tracking, collection managers can’t see where agents are or what they’re working on. Lead allocation becomes guesswork.

You only find out about missed visits or delayed follow-ups after it’s too late to fix them. Businesses with real-time workforce tracking improve task completion speed by up to 30%, as per the McKinsey report.

3. No Insights to Guide Recovery Strategy

Legacy systems don’t show which areas are high-risk or which agents have the best recovery rates. They can’t suggest the fastest route for an agent’s daily visits or flag nearby opportunities.

Without these insights, recovery planning stays reactive. AI-powered decision-making can improve collections efficiency by up to 40%, according to a PwC report.

What are the Top Features of Debt Collection Management Software?

A purpose-built debt collection management platform like Dista Collect offers features like auto case allocation, location-powered orchestration, and customer 360 view to optimize the recovery cycle. It gives collection managers visibility, control, and insights that manual systems can’t match.

1. Smart Case Assignment

A robust debt collection platform, like Dista Collect, enables auto case allocation based on multiple business rules. The system allocates the right FCE for a case depending on factors like proximity, availability, priority, and more.

It also enables managers to manually allocate cases to FCEs. This ensures lesser or no cases are left unaddressed and fastens the collection process.

2. Real-time Field Tracking

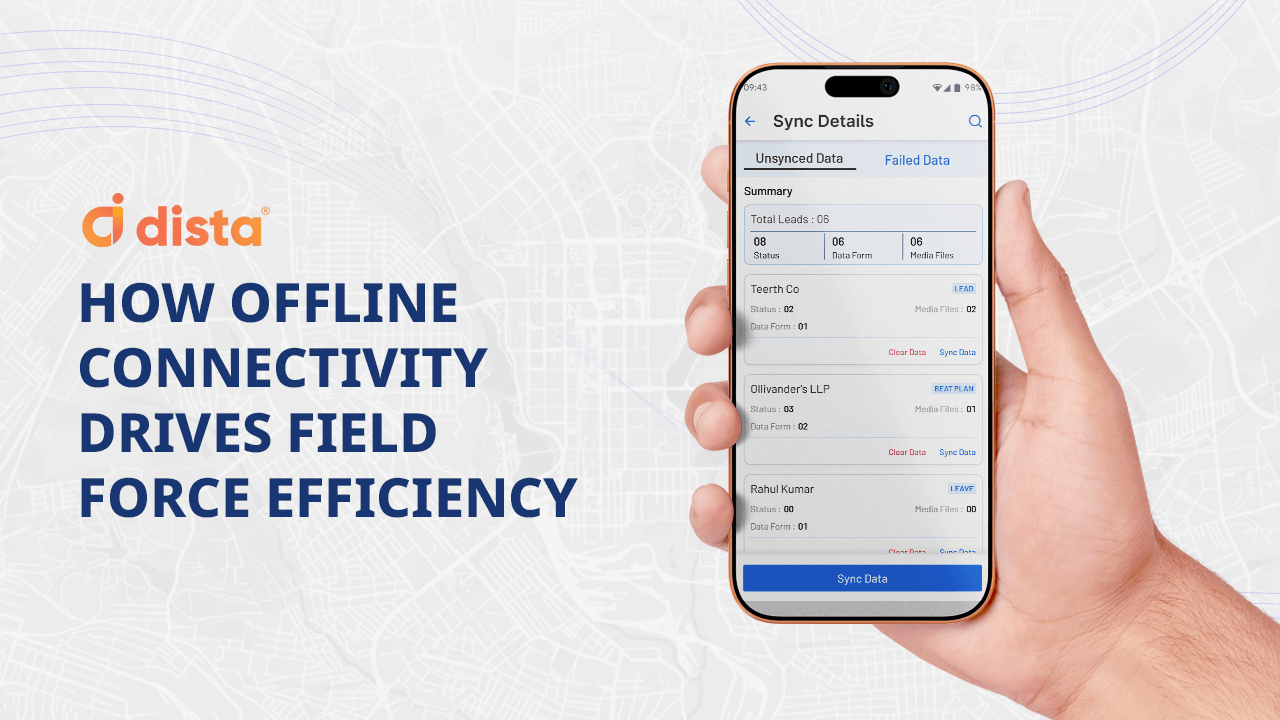

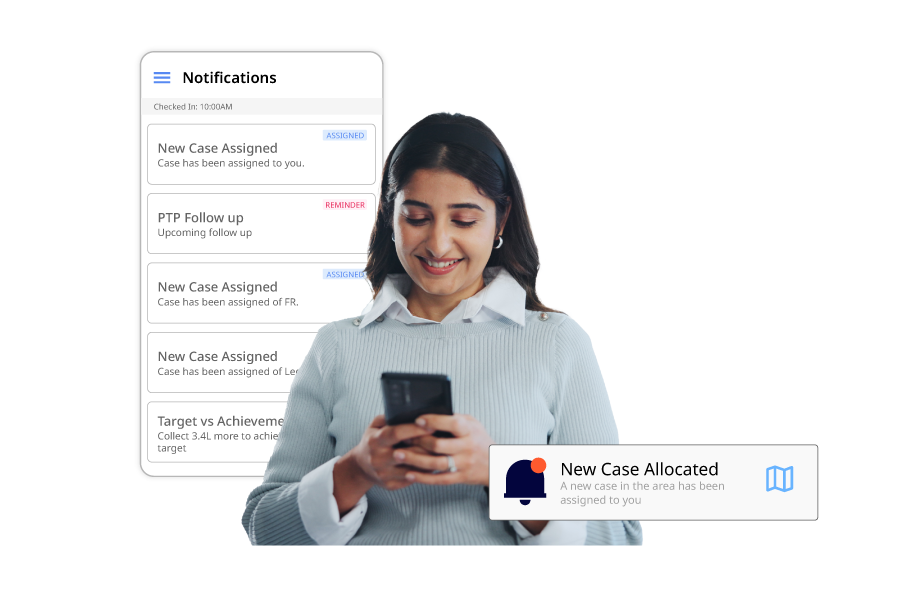

Managers or supervisors can get their team’s overview with real-time status updates via multiple dashboards. A dedicated mobile app offers transparency and visibility in field operations, live location of FCEs, enables seamless communication with one-tap calling, and more.

The system provides intelligent contextual nudges for supervisors to stay updated about the collection process. Debt collection management software also helps managers with skill recommendations and the real-time capacity of FCEs.

3. Data-driven Area Planning

Dista Collect helps organizations identify and visualize areas that have customers with low/high spending potential, increased chances of delinquencies, and other insightful data.

The system runs intelligent analysis by leveraging demographic and socio-economic data that is fed into our sales engine. It helps identify high-risk (negative) areas of a city that a bank has identified where residents would not qualify for credit approval.

4. AI-powered Agent Support

The software shares smart recommendations with all stakeholders to help them complete their tasks efficiently. FCEs receive intelligent contextual nudges about the next-best-action, like details about ad-hoc cases near their location, route optimization for faster TAT, and more.

Similarly, nudges related to FCE’s location and tasks help them with better management. In case of business leaders, Dista Collect leverages AI/ML engines to assist with resource planning forecasts based on historical data.

Final Thoughts

A comprehensive debt collection management platform like Dista Collect leverages location intelligence and AI/ML-based engines to offer:

- Delinquency management and area definition and analysis for business leaders

- Real-time visibility and ETA on field collection executives for supervisors

- End-to-end case execution via an app that acts as a mobile office for FCEs

Success Story

India’s leading NBFC using Dista Collect achieved 100% visibility into their field collections team, automated case allocation, and improved recovery rates by 19% within six months across 120 branches.

If not addressed in time, outstanding debts can substantially affect lending firms. Hence, it is important to leverage delinquency management software. Get in touch with us to know more.