A BCG study found that location-based strategies help banks reduce costs by up to 12% while improving customer coverage. Location intelligence enables banks, NBFCs, and MFIs to analyze spatial data, gain actionable insights, and optimize field force orchestration. It accelerates data-driven decision-making to strengthen business processes.

From optimizing field force movement to strategic branch placement,, location intelligence helps financial institutions maximize sales coverage, streamline field operations, and enhance customer experience.

This blog explores five key ways location intelligence is transforming BFSI operations.

1. Field Force Orchestration

Banks, NBFCs, and MFIs depend on field agents for customer verification, loan disbursement, debt collections, and sales. Tracking and managing a large field force is challenging for managers. With location-first field force management software like Dista Sales, banks can verify addresses with geocoding, optimize agent routes, and reduce travel time by factoring in location data.

Geo-tagging helps verify true customer visits, reducing unproductive trips while recommending nearby prospects to improve engagement. Managers can track agents in real-time, assign ad-hoc tasks, and assist.

2. Territory Management

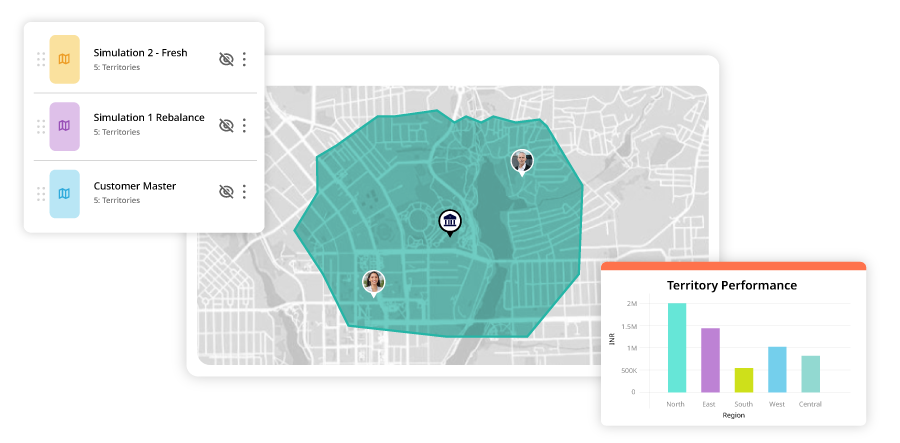

Poorly defined territories lead to overlapping agent assignments, inefficient resource allocation, and gaps in market coverage. With location intelligence, BFSI firms can create well-balanced territories by adding multiple data layers, including customer density, loan repayment behavior, financial activity, and competitor presence, to geospatial data.

A territory management software with location intelligence at its core can run AI/ML simulations to carve equitable territories and balance the workload among reps to improve customer engagement. It identifies gaps, minimizes cannibalization, and spots business expansion opportunities.

3. Geomarketing

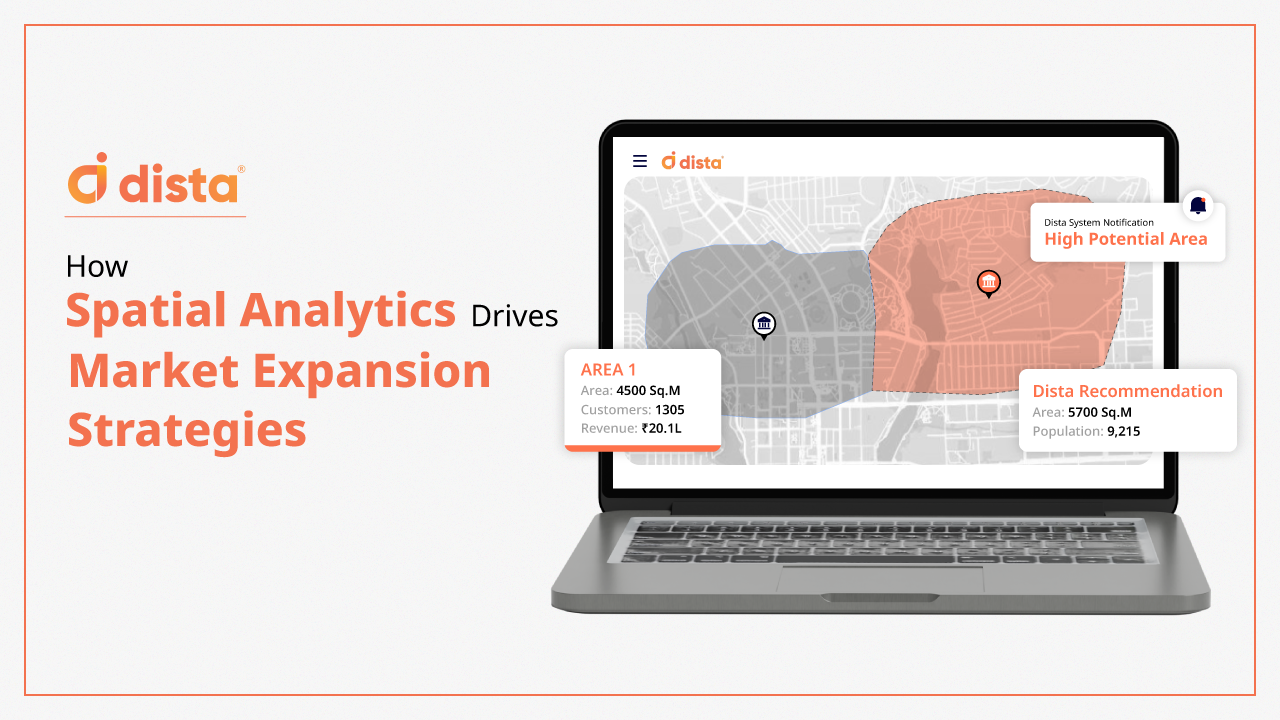

Geomarketing enables banks, NBFCs, and MFIs to target customers by location by analyzing demographics, spending patterns, and competitor presence. It enables BFSI organizations to design geo-targeted campaigns for omnichannel communication.

Financial institutions can use location intelligence to map high-potential markets, refine customer segmentation, and personalize outreach efforts, leading to better conversions and higher engagement. For example, a bank launching a new credit card can use geospatial insights to identify areas with high-income professionals and heavy retail activity, ensuring targeted promotions for higher adoption rates.

Similarly, MFIs can map and avoid areas with high delinquencies while offering loans. With location intelligence, BFSI leaders can reduce marketing spend, improve targeting accuracy, and drive higher ROI on customer acquisition efforts while ensuring services reach the right audience at the right time.

4. Optimize Branch and ATM Placement

Banks can identify which branches are underperforming by analyzing geospatial data on customer demographics, transaction volumes, and foot traffic. This insight enables them to consolidate branches in areas where they serve the same market, thereby reducing operational overhead while maintaining and improving service accessibility.

For ATM placement, location intelligence provides detailed information about high-traffic areas and underserved regions. Banks can pinpoint locations with high transaction volumes and customer demand, ensuring ATMs are strategically placed.

It reduces customer wait times and travel distances and improves cash management by aligning ATM supply with real-world usage patterns. Banks can avoid oversaturation by monitoring competitor ATM networks and focusing on capturing untapped markets.

5. Lead Allocation and Management

Location intelligence transforms BFSI lead distribution, scheduling, and management by integrating geospatial insights into every step of the process. A location-first field force management software like Dista Sales factors in the location component to auto-allocate leads using multiple variables like skillset, proximity, priority, capacity, and experience. An intelligent lead allocation improves lead actioning, reduces lead leakage, and boosts sales performance.

Final Thoughts

A report by McKinsey highlights that financial institutions using geospatial data see a 15-20% improvement in operational efficiency. Location intelligence coupled with AI-powered field force management software, like Dista Sales, can transform BFSI operations and boost overall sales efficiency. Want to see the power of location intelligence? Get in touch with us to see our platform live in action.