Location-first Field Force Management for Banking & Financial Services

Maximize sales and customer coverage, reduce lead leakage, and boost field force productivity for BFSI firms.

Challenges in Banking & Financial Services

Refine Each Step of Your Field Force Operations

Business Impact

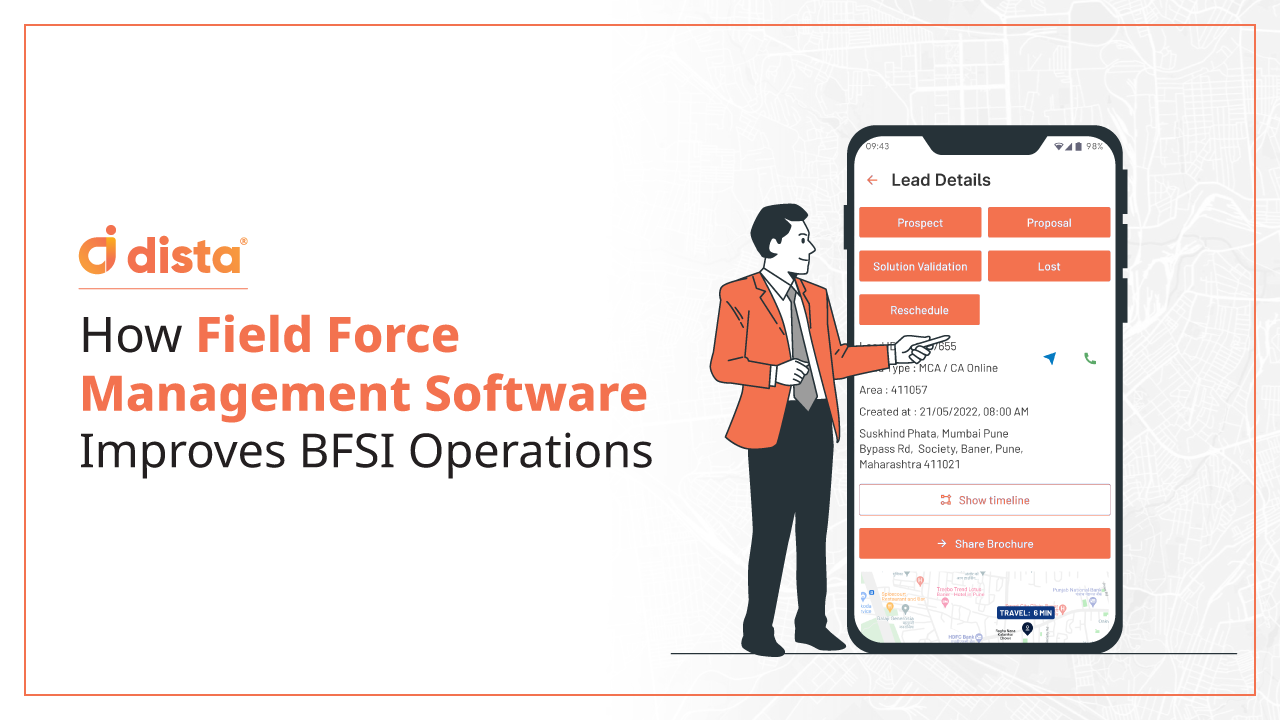

Location-first Field Force Management Solutions for Banking & Financial Services

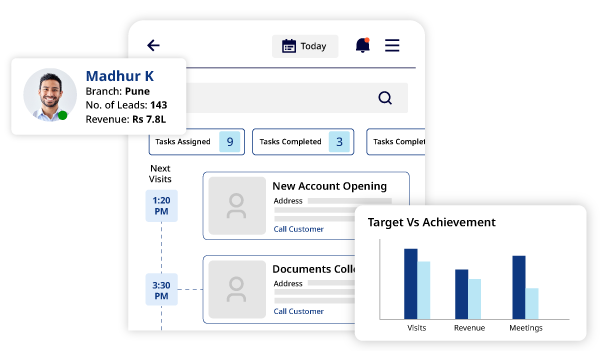

Field Sales Productivity & Performance

Enhance field sales productivity and performance by leveraging location intelligence to optimize routes, prioritize visits, and gain real-time insights.

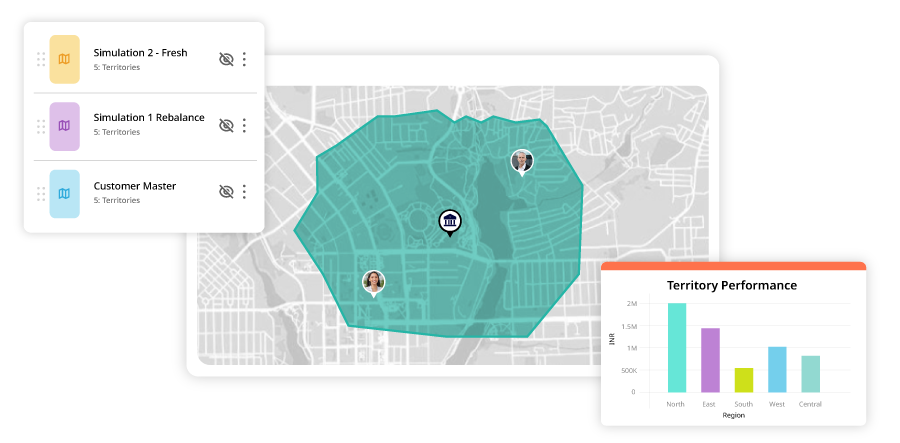

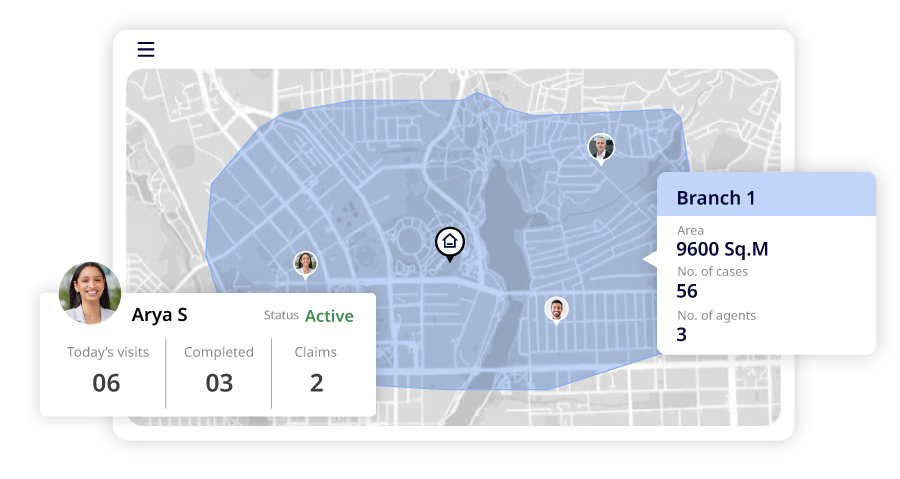

Territory Management & Insights

Design equitable territories to balance sales and collection workloads. Run multiple simulations to design optimized area clusters.

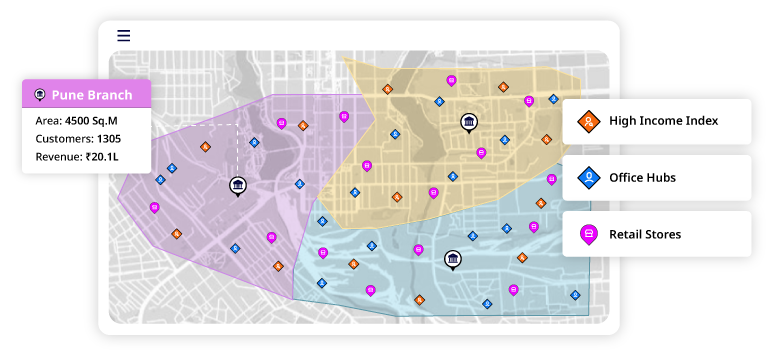

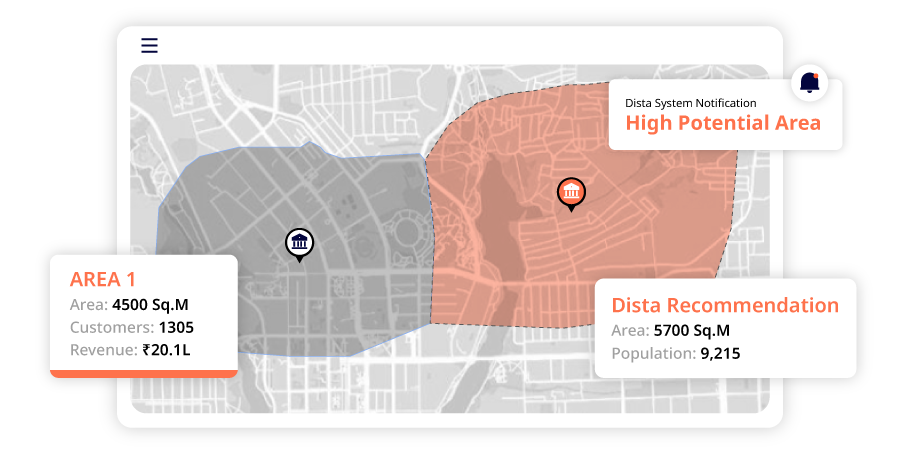

Catchment Area and Micro-market Mapping

Visualize and map customer demand, existing bank branches, partners, etc and overlay it with different PoI variables like population, income index, office hubs, and more to spot growth opportunities.

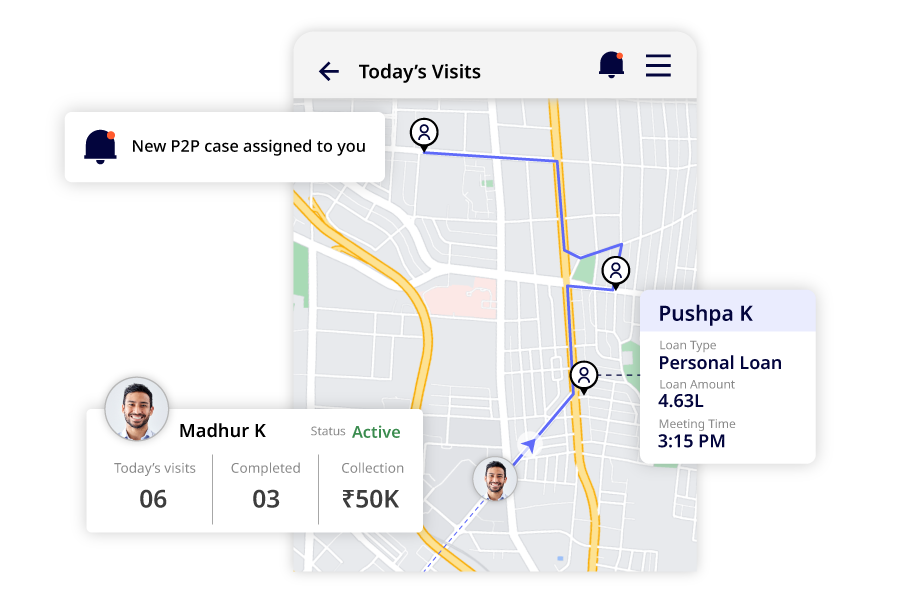

Location Intelligent Collections & Recovery

Auto-allocate cases to the FCE based on location-specific business variables. Monitor and track Collections agent activity, recommend cases to be taken up in the day, add P2P customer visits dynamically to the beat plan, and get a real-time cockpit view of the collections cycle and status.

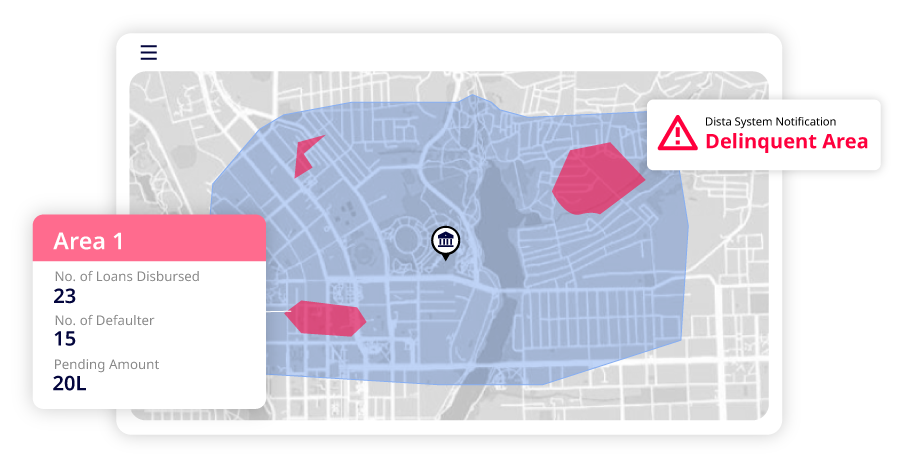

Delinquency and Risk Insights

Unlock map-based visualization of customer territories with high or low risks with intelligent geo-insights based on historical data on risk exposure. Refine loan offerings and recovery schemes based on delinquency insights.

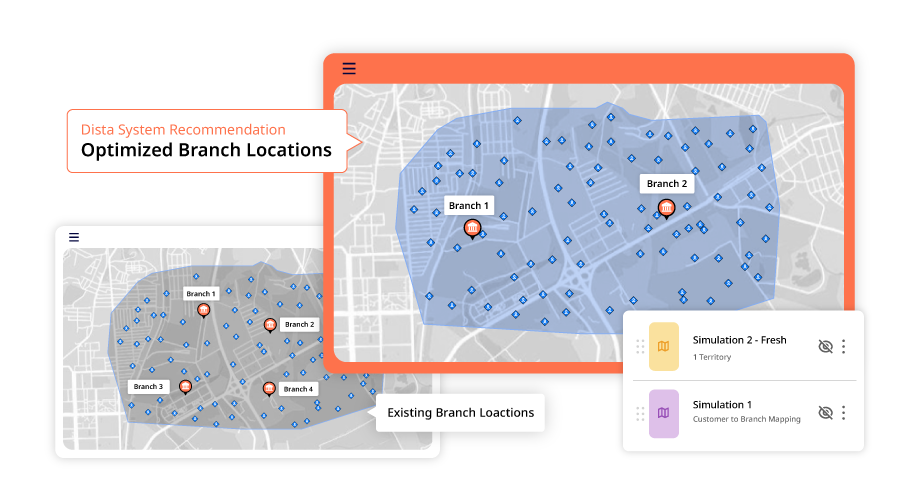

Site Selection

Uncover new locations to open new branches for banks, centers, or ATMs. Rely on location intelligence to even advise on cannibalization and shut down existing assets. Use PoI data variables, including lead and demand density, consumer purchase behavior, road network, competition, and more.

Location Intelligent Lead Scheduling

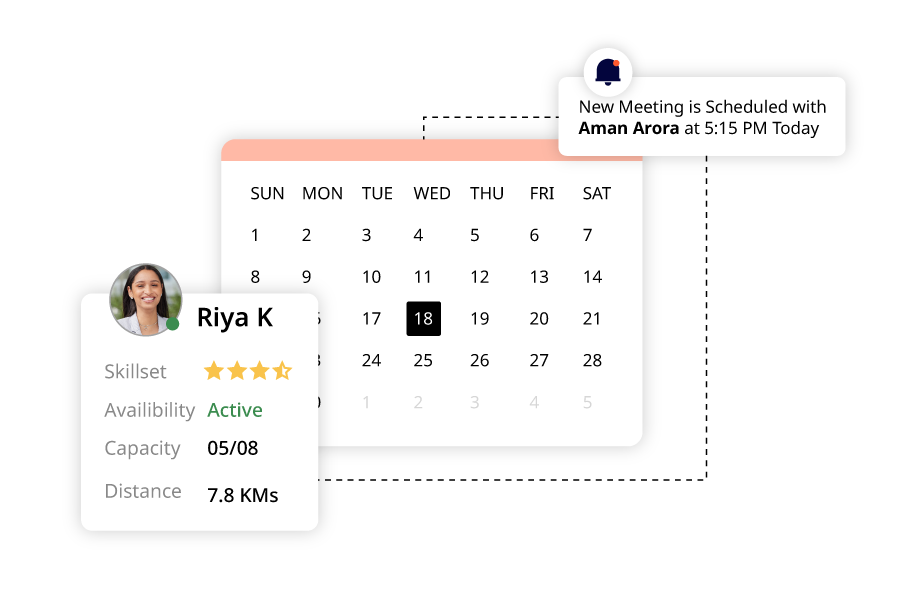

Dista Sales’s SPACE framework auto-allocates leads or cases by rep skillset, lead location proximity, rep availability, capacity, experience, and custom business rules.

Decongestion in Banks

Use intelligent location-specific recommendations to relocate existing branches and suggest optimal allocation of personnel to service customers and leads effectively.

Easy Fraud Detection

Identify fraudulent claims faster via location data by using geospatial insights. Detect trends and patterns based on location-based behavior. For example, if claims inspectors suspect multiple claims filed from the same area, they can flag the location and mark it as suspicious activity.

What’s In It For

- Location Intelligence: A Guide to Transform BFSI Organizations

With its ability to visualize spatial data and derive actionable insights, location intelligence helps banks and financial companies streamline field operations, strengthen decision-making, and improve customer experience.

We have created this guide to help BFSI industry leaders combat key challenges by leveraging location intelligence software.

Applying Location Intelligence to Banking & Financial Services Customers

Customer Testimonials

“By leveraging Dista Sales, we offered seamless doorstep services to our customers. The field sales management software auto-allocated leads to sales reps based on their real-time location. This helped them reach the customer location within the defined SLA and increased our customer onboarding.”