What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

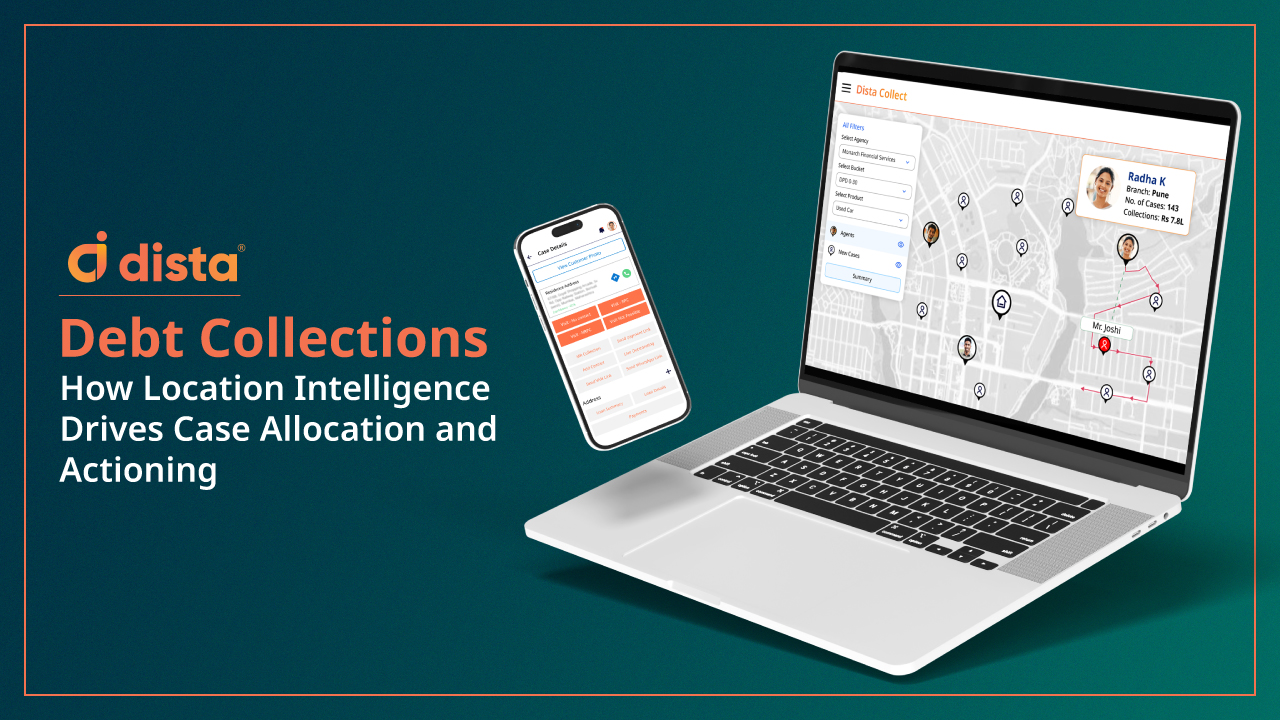

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

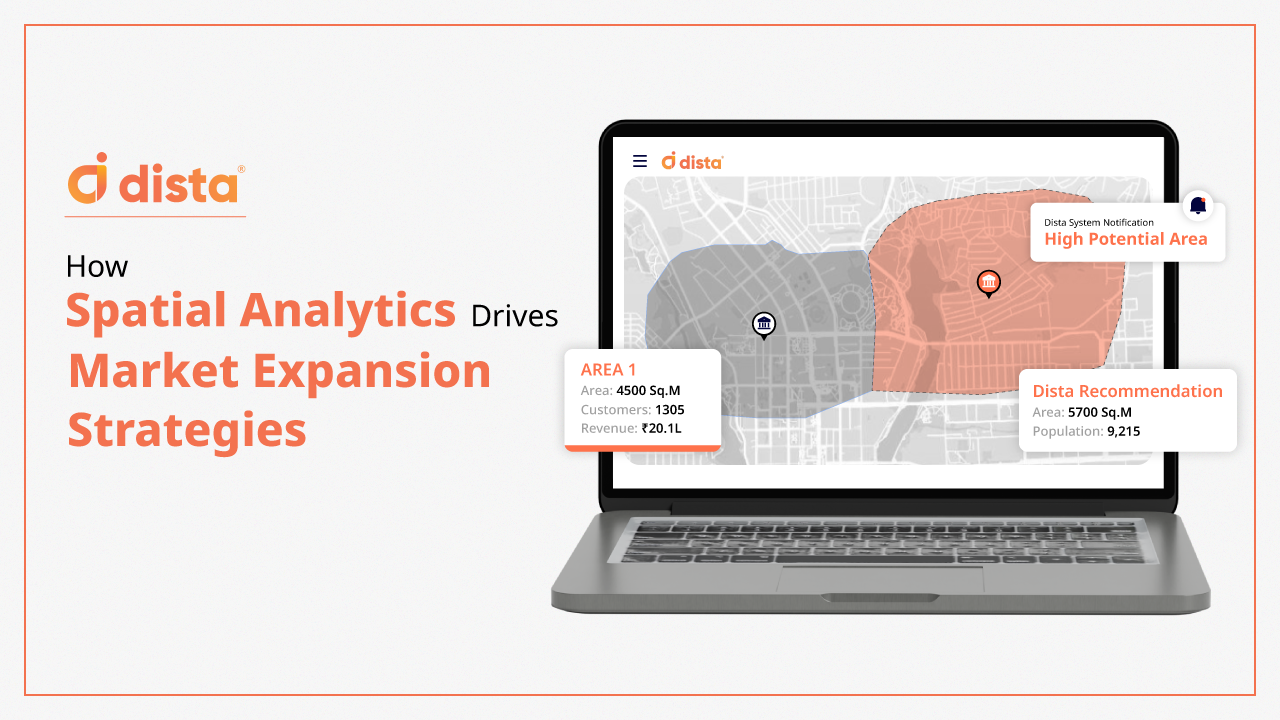

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.

What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.

What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.

What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.

What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.

What is Claims Management?

Claims management is the process of managing and evaluating insurance claims. It streamlines and improves the end-to-end process right from creation to settlement.

What is Claims Management Software?

Claims management software automates and streamlines the claim settlement procedure. It reduces errors, manual work, and enhances operational efficiency by leveraging artificial intelligence and machine learning based smart systems. Claims management solutions are applications that support end-to-end claims workflow and collaboration for life insurance products, from the entry of claims information through claims payments.

Key Dista Claims Management Benefits

- Area definition and mapping multiple agencies based on geography, zones, and pin codes facilitates smoother agency management

- Personalized dashboards offer deeper insights into fraudulent data and improves fraud detection for banking and insurance companies

- Dedicated app for claims officers and supervisors for easier communication

- It offers standardization, operational efficiency, reduced manual work, effective process tracking, and fraud detection

How Does Dista Claims Help?

We created Dista Claims to introduce automation and ensure the entire claim process is completely digital. It also eliminates the room for discrepancies and sets standardized processes. Our main aim is to solve key challenges faced by field claims agents, supervisors, and business leaders. Let’s take a look at how Disa Claims offers hassle-free claim management.

1) Intelligent and Effective Claims Allocation and Management

Managing a higher volume of claims is a challenging task. Our smart system facilitates effective capacity mapping and planning by intelligent claims allocation to the claims officer based on the day, time, skill, distance, and more. This results in faster turnaround time (TAT) thereby leading to higher productivity. Dista Claims ensures effective claims handling and workload management to make maximum use of the resources.

2) Managing Multiple Agencies

Dista Claims enables management of multiple agencies for field investigations as it leverages data insights for easier and more efficient claims management. It defines geographies for different agencies, plots existing dealers, and finds potential businesses that qualify as channel partners. Seamless management of third-party agencies (TPA) for claims investigation.

3) Fraud Detection Analytics and Data Verification

Dista Claims offers smart recommendations and insights on real-time claim settlement thereby facilitating effective business decisions.

4) Media Upload and Storage

Dedicated Dista mobile app for claims officers allows them to capture media proof and documents and reduces the hassle of handling paperwork. It also enables submission of media files and data in offline mode in case of poor or no network. Our system can customize field insurance forms for data collation and create specific fields as per requirement.

Final Thoughts

Insurance claims management system helps streamline the claims processing and settlement process. Looking for a robust claims management software? Get in touch with us to see Dista Claims in action.