A Location-first Unified Debt Collections CRM

Increase Debt Resolution and Boost Collections

Dista Collect empowers Banks, NBFCs, and MFIs to streamline RBI-compliant debt collections. With location-aware field operations and centralized agency controls, managing collections becomes smarter and more efficient.

Why Dista Collect

Location-powered Collections

Centralized Agency Operations

360° Customer Overview

Compliant and Secure System

Trusted By Leading Brands

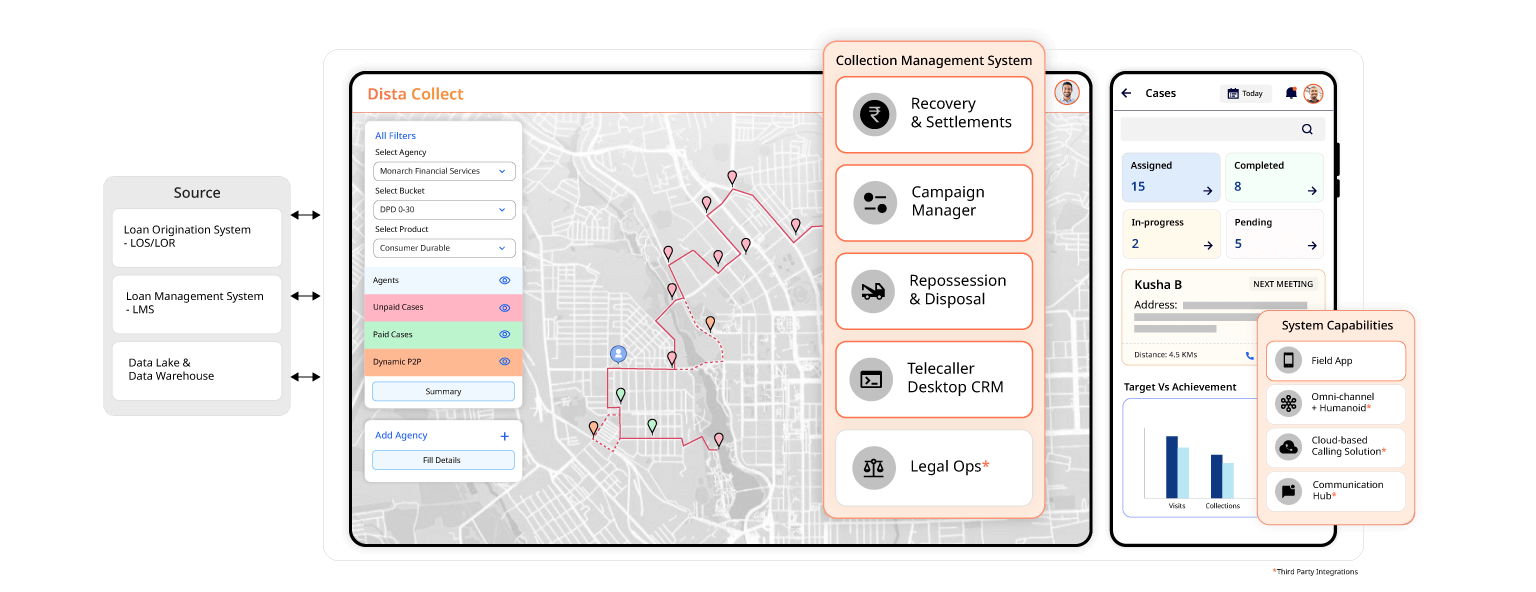

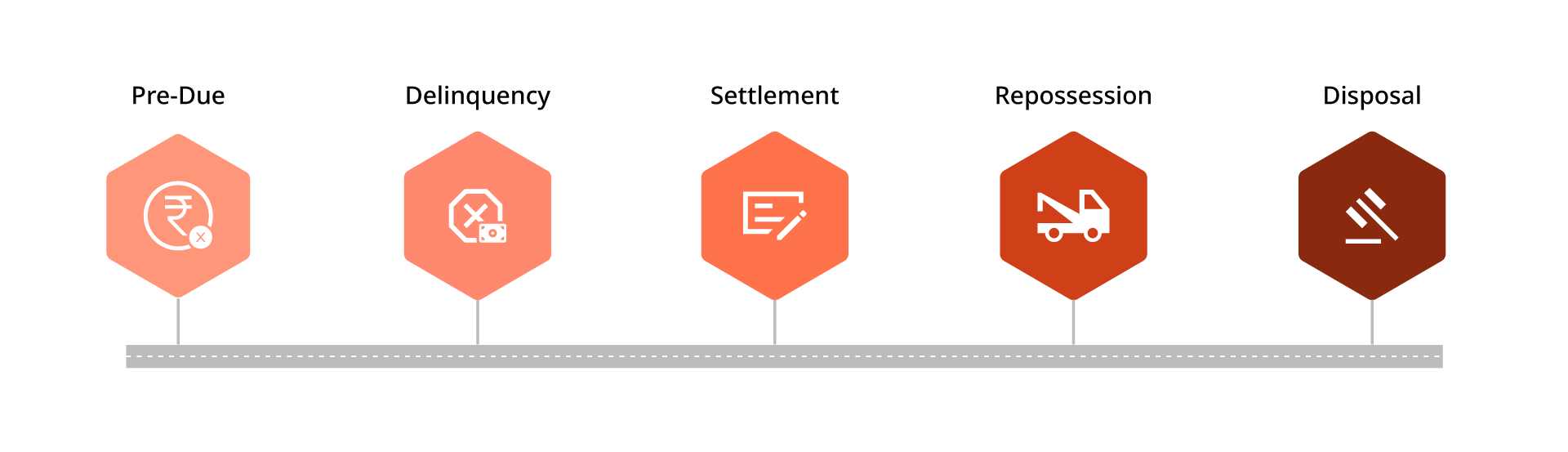

Dista Collect Enables End-to-End Debt Collection

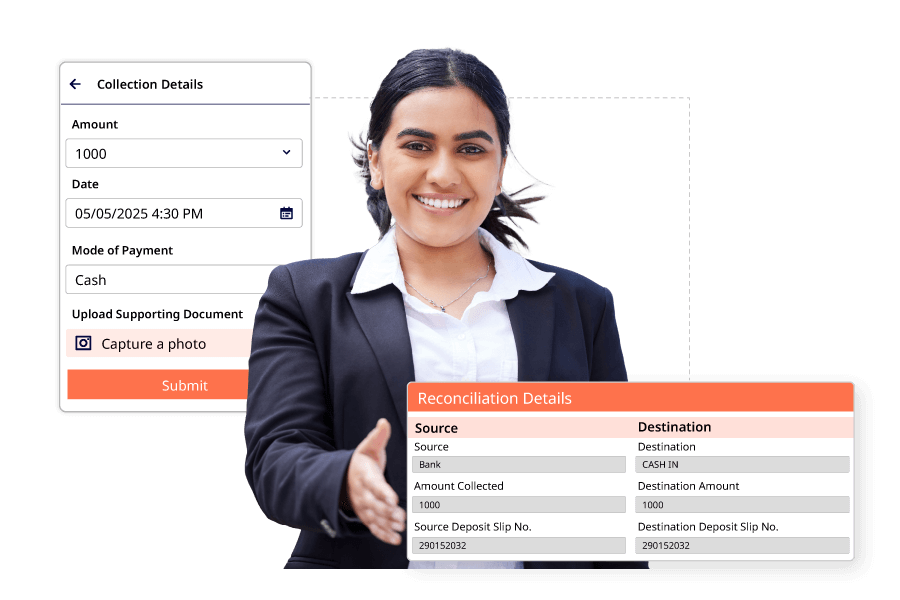

Cash Collection and Reconciliation

Get automated reconciliation with full visibility and support for all major payment modes like cash and NEFT/RTGS.

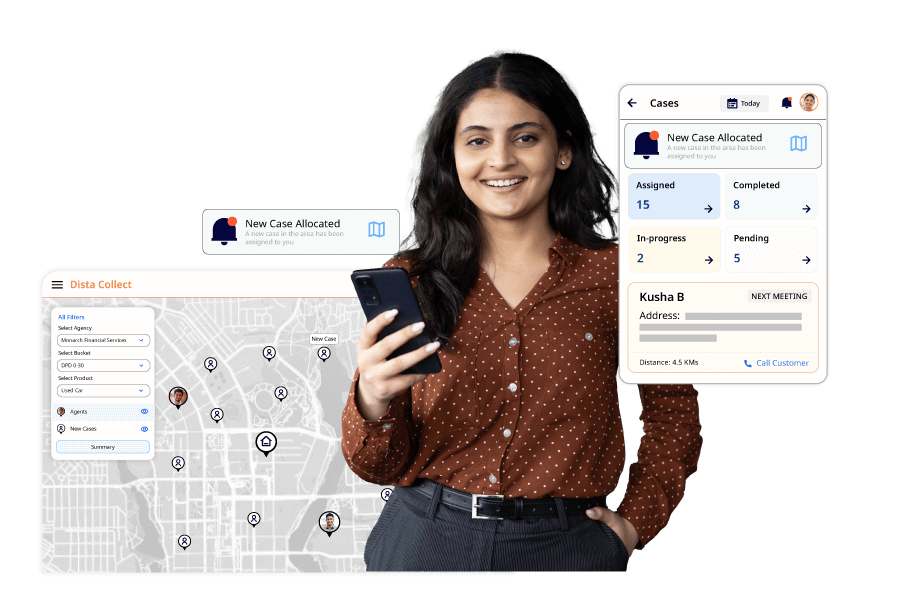

Allocation Intelligence

Assign the right accounts to the right field agents using hyper-localized clustering and dynamic allocation.

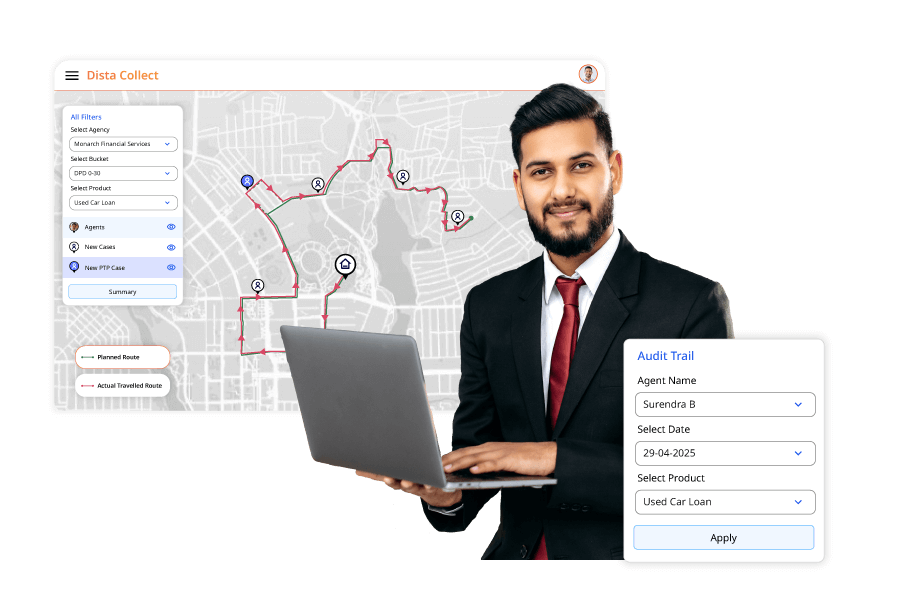

Beat Plan and Audit Trail

Optimize agent routes daily based on priorities with real-time prompts and location validation. Track all interactions with audit logs for compliance and transparent operations.

Case View / Prioritization

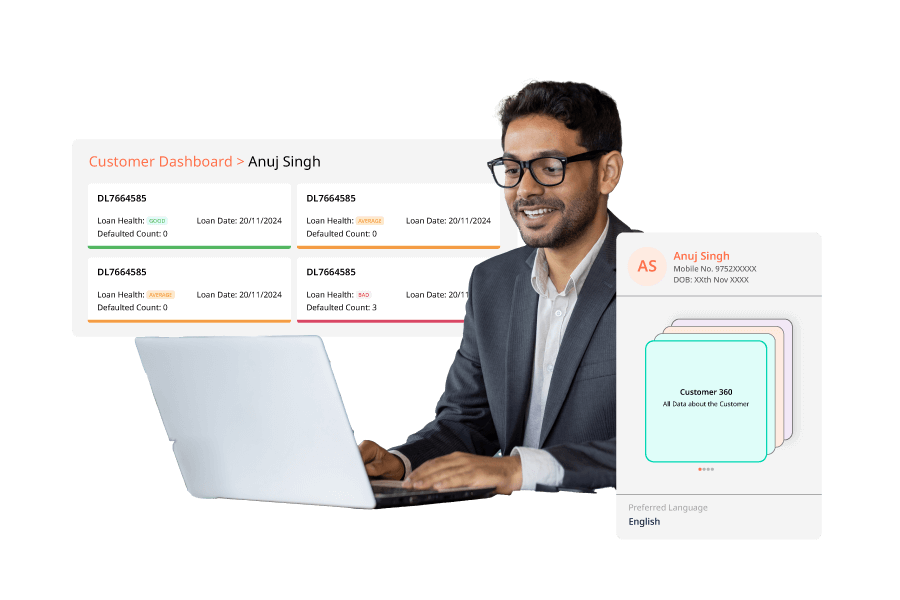

Gain a 360-degree view of each customer, with intelligent and timely prioritization logic. Empower your team to understand the full context of every case and focus their efforts on the most critical and urgent matters effectively.

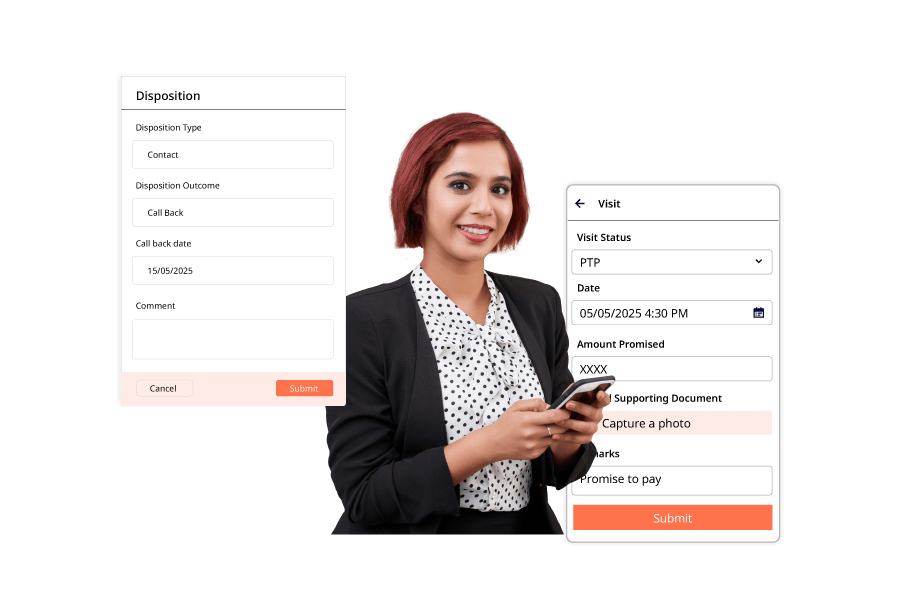

Disposition Quality

Maintain high-quality records with accurate disposition tracking after every customer interaction. Get clean, reliable data to drive next steps.

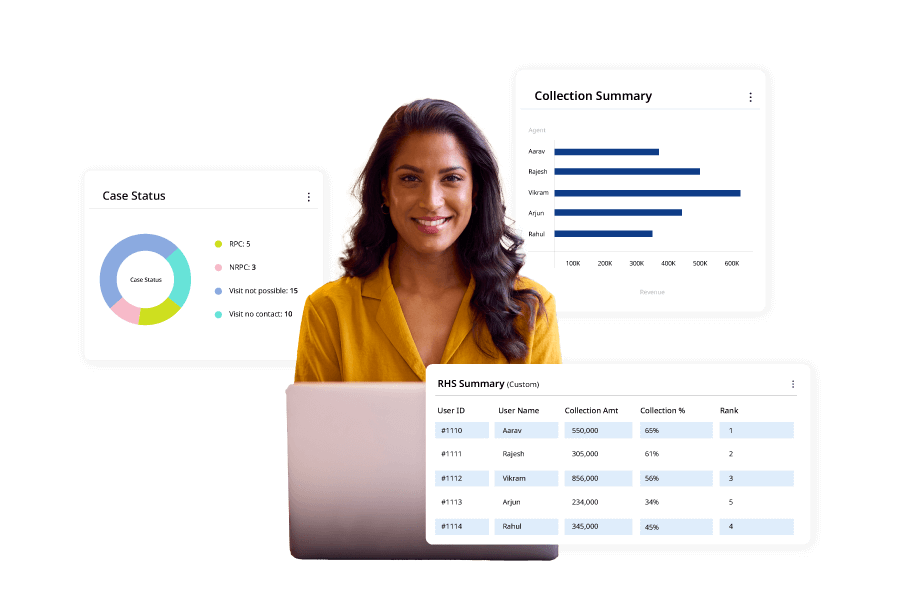

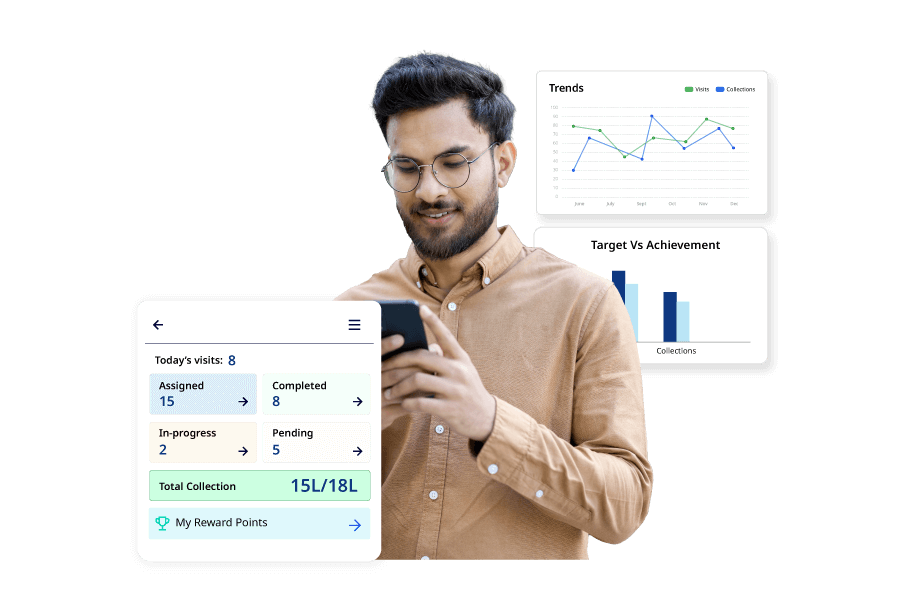

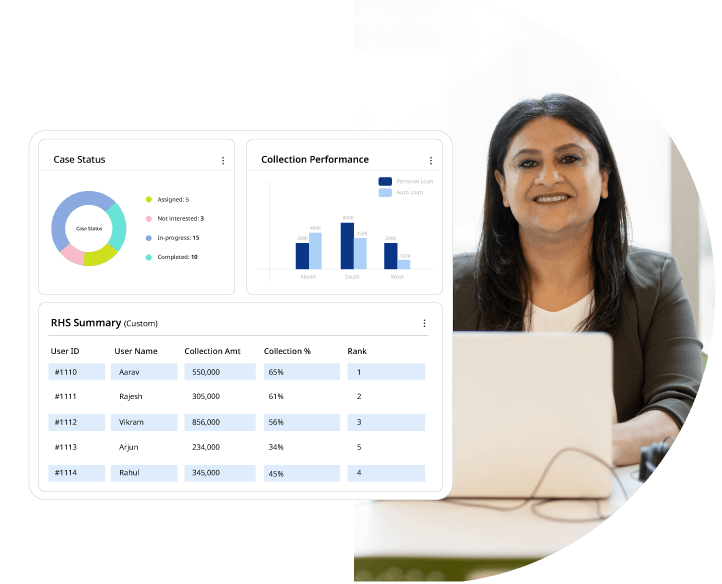

Performance & Leader Dashboard

Monitor individual and team performance with live widgets, reports, and leaderboards. Motivate teams and take data-backed decisions with ease.

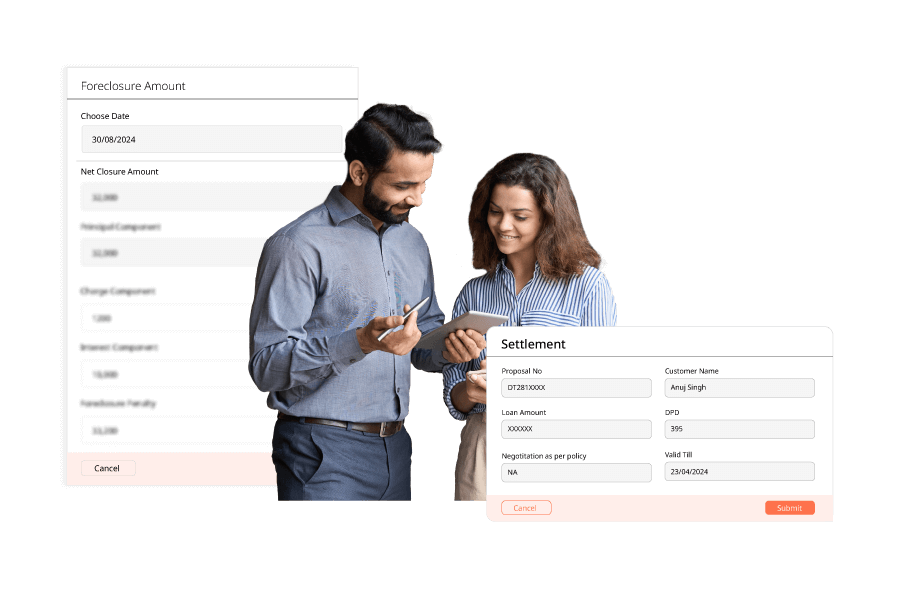

Settlement / Foreclosure

Simplify settlements with digital requests, approvals, and customer communication in one flow. Enable quicker closures with digital consent.

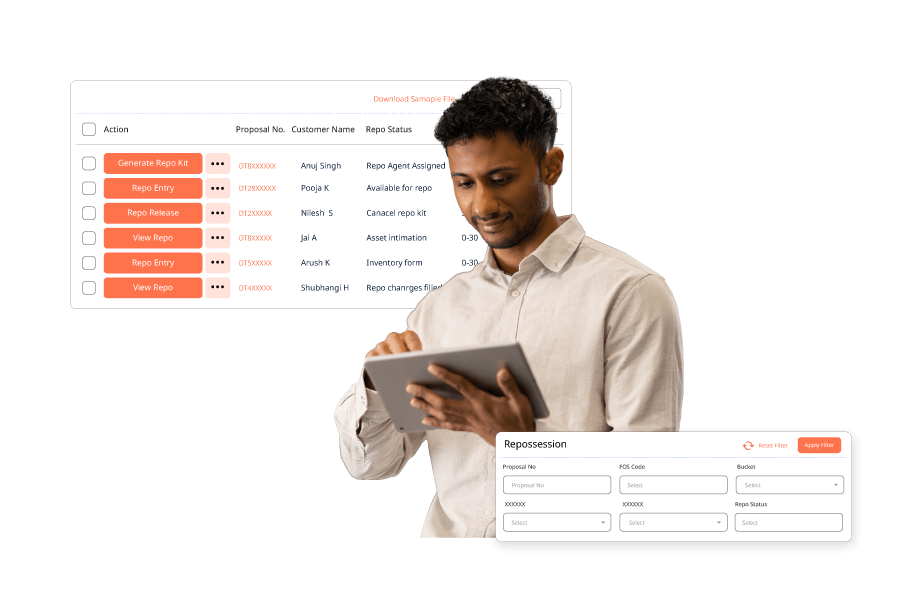

Repossession & Disposal

Manage repo cases end-to-end – from initiation to disposal. Assign agents, track stock, and approve actions directly from your dashboard.

Incentives & Gamification

Drive performance with customizable incentives and gamified targets. Reward achievements instantly to keep your teams motivated on the ground.

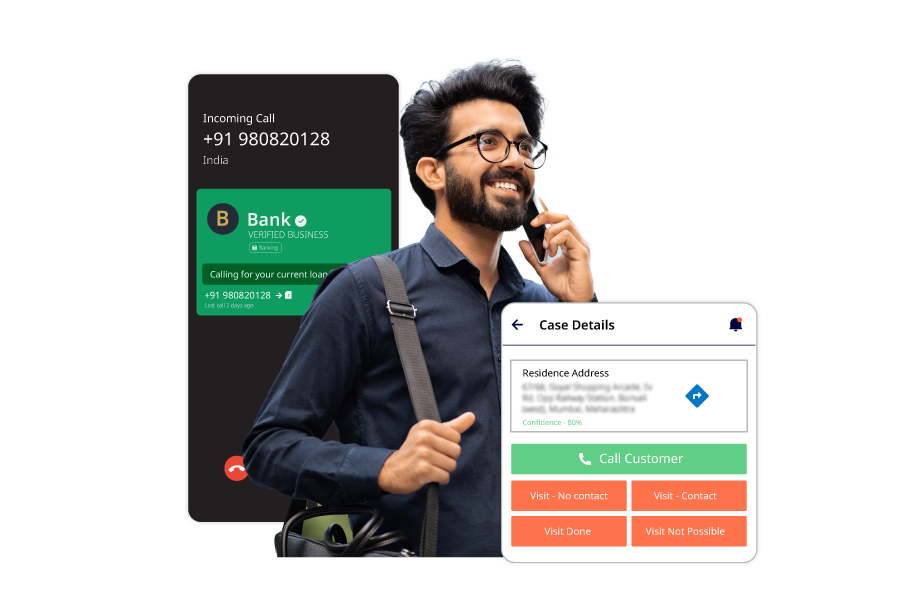

Deep Integration & Phone Number Masking

Protect customer data with number masking and enable seamless records exchange. Deep integrations ensure core systems talk to each other in real time.

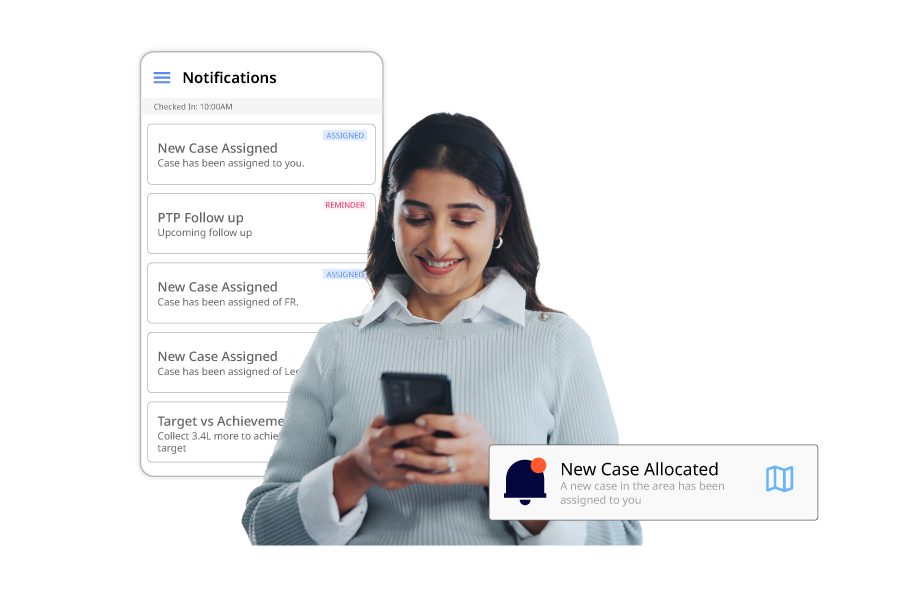

Contextual Nudges

Use nudges like in-app banners, read receipts, and reminders to guide agent behavior. Keep field teams engaged, informed, and on track.

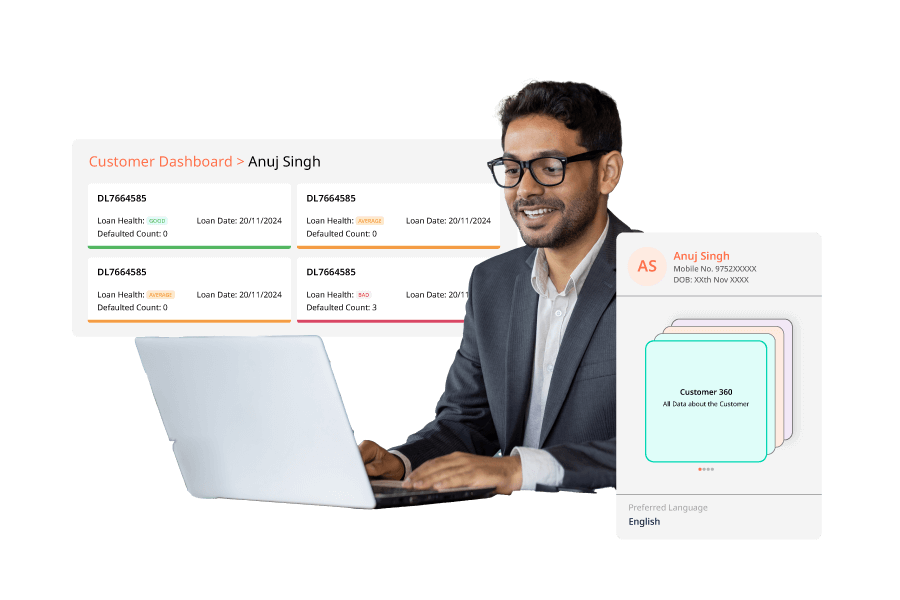

Collections CRM

Get a unified view of each customer with 360 profiles, chat/voice integrations, and campaign tools. Everything your team needs to collect smarter.

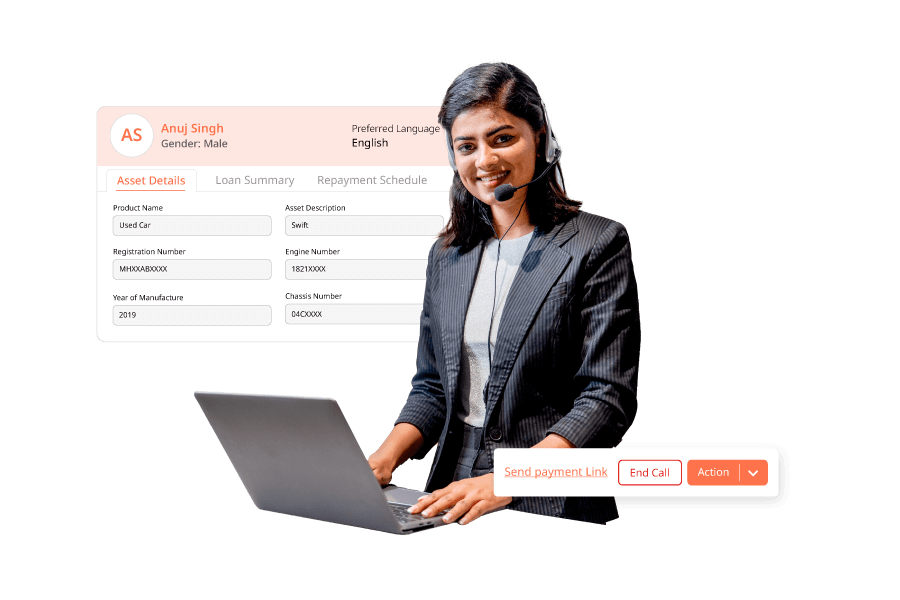

Telecaller - Operations (Call Center)

Empower your telecallers with seamlessly integrated calling tools. Log detailed audit trails, track all interactions, and manage individual and team performance with a single, unified CRM.

Security

SOC 2

ISO

VAPT

Compliance Framework

Integrations

Telephony

Credit Bureau

Campaign Builder

LOS/LMS

Scalability

Low-code/No-code

Rapid Go Live

Enterprise Readiness

- See Dista Collect in Action

Streamline debt recovery with location-first unified debt collections CRM powered by Customer 360. Boost recovery rates with 100% RBI Compliance.

Watch this video to see how Dista Collect can transform your debt collections and drive faster resolutions.

Features

AI and Location-based Case Allocation

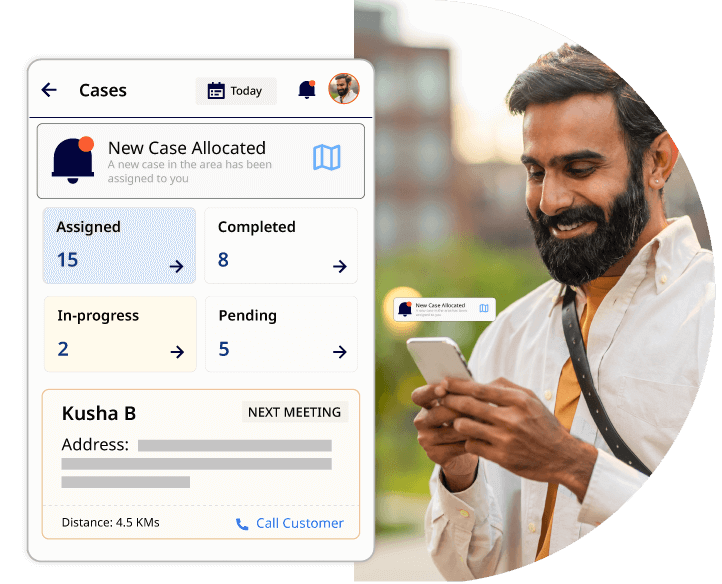

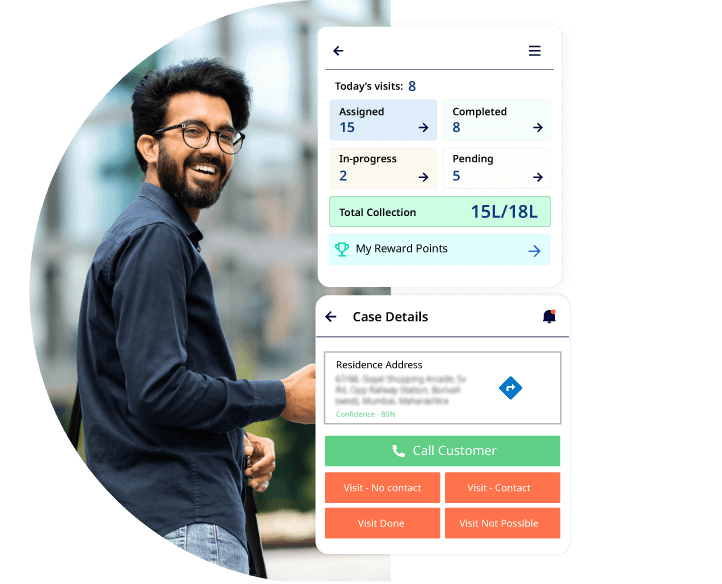

Unified Field App for Collectors

Operational Recommendations for Managers and Leaders

Enhanced Customer Engagement

Security & Compliance

FAQs

Browse our FAQs section to know more about debt collections platform and how it can contribute to your success.

Still have questions ?

Dista Collect leverages location-based case allocation along with AI, to ensure smart deployment of field collection agents. By factoring in location proximity, agent availability, skillset, and workload, the platform minimizes travel time and maximizes the number of effective daily engagements. This approach not only improves field productivity but also contributes directly to higher resolution rates and an uplift in the overall ACR from collections.

Yes. Dista Collect’s centralized approach to operations provides end-to-end visibility into field and agency performance. Collection heads can monitor key metrics, such as visit outcomes, agent productivity, and cases across designations and territories.

This real-time, layered visibility enables proactive decision-making, facilitates regional benchmarking, and enhances governance and control over field operations.

The Customer 360° view within Dista Collect equips field agents and telecallers with a consolidated profile of each borrower, including repayment history, current outstanding, prior interactions, and behavioral insights. This single-screen access enables data-backed, contextual conversations—helping agents personalize customer engagement, drive faster closures, and improve collection efficiency.

Yes. Dista Collect is designed to help lenders adhere to RBI’s fair collection practices while maintaining rigorous data protection protocols. The platform is VAPT certified, SOC 2 Type II, and ISO 27001:2022 compliant—ensuring enterprise-grade security, process transparency, and accountability. These certifications reflect our commitment to safeguarding borrower data and supporting ethical, regulation-aligned collections operations.

Dista Collect is a unified debt collections CRM built to manage the full collections lifecycle. It supports digital pre-due reminders to contain early-stage delinquencies, enables efficient field collection planning and execution, and simplifies agent routing and disposition tracking. The platform also manages active defaults with tools for digital settlements, payment link sharing, and field visit scheduling. For high-risk or chronic delinquencies, it supports loss mitigation strategies including legal escalation, repossession, and asset disposal—ensuring seamless handoffs across stages on a single platform.

The Dista Collect field app equips agents with optimized visit schedules, dynamic routing, real-time access to borrower information, and log dispositions instantly. It also enables them to trigger digital settlement requests or share payment links with borrowers in just one click. By centralizing access to task lists, customer data, and action tools, the app boosts daily productivity and resolution efficiency.