Banks and non-banking financial companies (NBFCs) need to regularly optimize their collection processes and evaluate new tech and tools to improve collection rates. Heavy reliance on manual processes and legacy systems hampers daily operations, leading to missed customer visits, higher operational costs, and potential compliance risks.

The BFSI pundits recommend harnessing the power of location intelligence to amp up collections throughput, owing to the geo-spread of the customers and collector network across the country.

At Dista, we offer a unified location-first case management system – Dista Collect – designed to systemically remove inefficiencies in the collections ecosystem and ensure a higher collection rate.

By seamlessly integrating with customers’ existing LOS/LMS and data lakes, Dista Collect turns field data into intelligence. It visualizes the state and spread of operations and strategizes with AI-recommended simulations by tweaking business parameters. The results are then plugged into the system for telecallers, field collectors, TPAs, and campaign builder teams. Dista Collect is designed to achieve higher customer coverage, efficiency, and compliance levels.

Here’s how Dista Collect revolutionizes your end-to-end collection operations:

1. Intelligent Case Mapping

- Proximity-based Dynamic Case Allocation: Leverage accurate location data of borrowers and field collectors to assign cases to the most geographically suitable field agent. This minimizes travel time, reduces operational costs, and accelerates collection.

- Factor in Collector Expertise and Availability: Along with the location component, Dista Collect factors in skill sets, workload or capacity, and real-time field agent availability to ensure relevant agent-case handling to maximize throughput.

2. ML-driven Prioritization and Auto-Assignment

- Boost Daily Efficiency: Maximize field collectors’ productivity with intelligent prioritization and automated assignment.

- Case Prioritization: Identify high-priority cases based on risk scores, geographical proximity, and other business buckets like DPD and P2P.

- Automated Customer Assignment: Configure rules to automatically assign prioritized loan cases to available collectors in the vicinity, ensuring timely follow-ups and positive visit outcomes.

3. Connected Telecaller Operations

- Customer 360 View: Integrate location context into your tele-calling operations for an effective outreach.

- Integration with Calling Providers: Seamlessly connect Dista Collect with telephony systems like ClearTouch and Exotel to provide telecallers with regional and real-time customer insights to improve personalized calls.

- Geo-based Call Queue Prioritization: Queue customer calls to borrowers in specific geographies or those requiring immediate attention based on regional holidays, offers, and delinquency status.

4. Integrated Collection Processes

- Settlement Workflows: Single stop for campaign builders to trigger automated workflows for settlement offers based on borrower location, payment history, and other predefined rules.

- Repo Management: Optimize repossession processes by identifying the nearest available recovery agents/TPAs and pushing documentation and logistical steps to their systems.

- Asset Disposal & Yard Management: Ensure compliant and well-recorded disposal of repossessed assets by leveraging location data for efficient valuation, storage, and potential buyer identification. A single system will also recommend yard allocation for recovered vehicles.

5. Actionable Location Intelligence for Collections Heads

- Resource Forecasting & Rebalancing: Analyze historical collection data and geographic patterns to forecast resource hiring, case allocation and proactively rebalance field teams for maximizing customer facetime.

- New Branch Opening Recommendations: Use location data from disparate sources (pincode, census, POI, competitor, etc.) to identify underserved areas with high potential for loan origination and collections, factoring in delinquent geo-patterns.

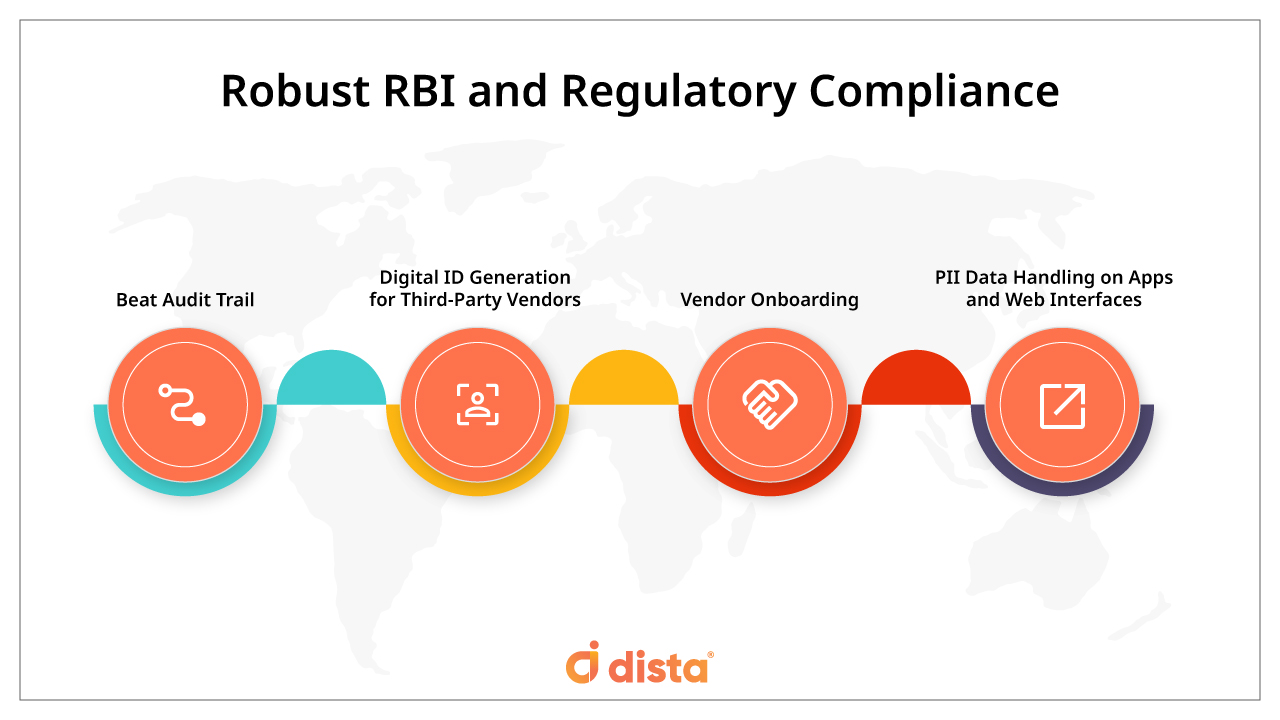

6. Robust RBI and Regulatory Compliance

- Beat Audit Trail: Track field collector agent movement and activities ensuring they adhere to designated routes and provide a verifiable audit trail.

- Digital ID Generation for Third-Party Vendors: Securely onboard and manage third-party collection vendors with digitally generated IDs linked to their location and authorized territories.

- Vendor Onboarding: Streamline the onboarding process for collection agencies and individual collectors, associating their profiles with specific geographic areas and compliance requirements.

- PII Data Handling on Apps and Web Interfaces: Implement secure protocols for handling Personally Identifiable Information (PII) within location-aware applications and web interfaces, adhering to data privacy regulations.

The Dista Collect Advantage

Our low-code/no-code platform, patented technology ensures:

- Faster time-to-market: Quickly implement and iterate on your location-aware, unified collections processes.

- Increased Case Resolution: AI-powered algorithms designed to ensure timely visits to customers for faster case actioning and resolution.

- Increased Efficiencies: Easily integrate with current systems, and scales as per market requirements while ensuring regulatory compliance.

Embrace the Future of Collections with Location Intelligence

By integrating location intelligence into your collections system with Dista Collect’s low-code/no-code prowess, NBFCs and Banks can achieve significant improvements in customer coverage, compliance, and, ultimately, collection rates. Move beyond traditional, manual, and inefficient methods and unlock the power of location data to run AI-driven business outcomes and unified collections operations.

Want to see how leading MFIs are transforming their collections strategy?

Get in touch with us to get a free demo of Dista Collect.