The Impact of Location Intelligence in Transforming India’s Microfinance Industry

India’s microfinance industry relies heavily on field agents operating in Tier 2 and Tier 3 towns and villages. Owing to this, field force management powered by location intelligence can revolutionize how microfinance institutions (MFIs) operate in rural and remote areas. By leveraging geographic data and analytics, MFIs can streamline operations, enhance field agent productivity, and ensure true visit compliance.

1. Orchestrate Field Agents

Managing field agents in India’s remote villages is a constant challenge for MFIs. With location intelligence, MFIs can facilitate real-time tracking, work allocation, and center analysis, increasing field agent productivity and customer handshakes.

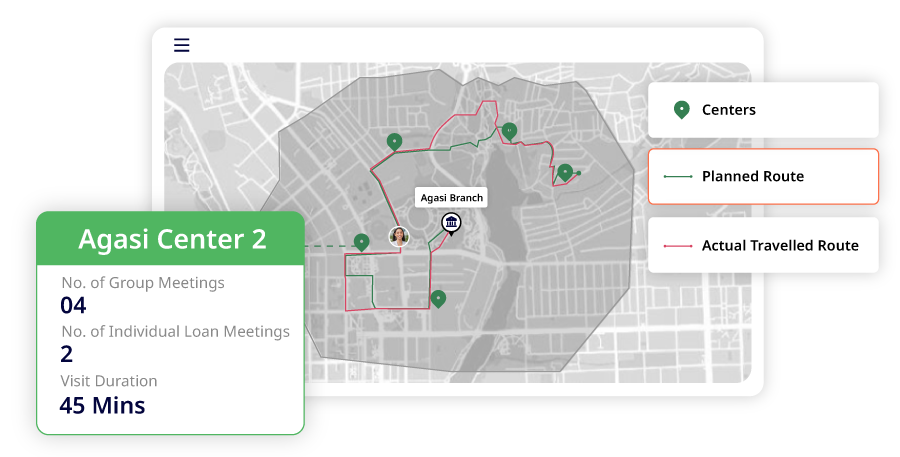

Location-powered field force orchestration helps MFIs to allocate center meetings and individual loan meetings based on client proximity, thereby reducing travel time and costs. For instance, if an agent is visiting a particular village for planned loan collection at a center, location intelligence can additionally recommend high-potential individual loan customers with the propensity to repay loans, allowing agents to cover multiple tasks in one trip. This dynamic intelligent resource allocation enhances efficiency and minimizes redundancy.

Moreover, location intelligence enables route optimization. AI-powered algorithms can design the shortest or most cost-effective routes for agents, reducing operational expenses and fuel/travel (km) reimbursements while ensuring timely client visits. Such capabilities are particularly valuable in rural areas, where infrastructure may be inadequate, and reaching customers can be logistically challenging.

2. Optimize Agent Productivity

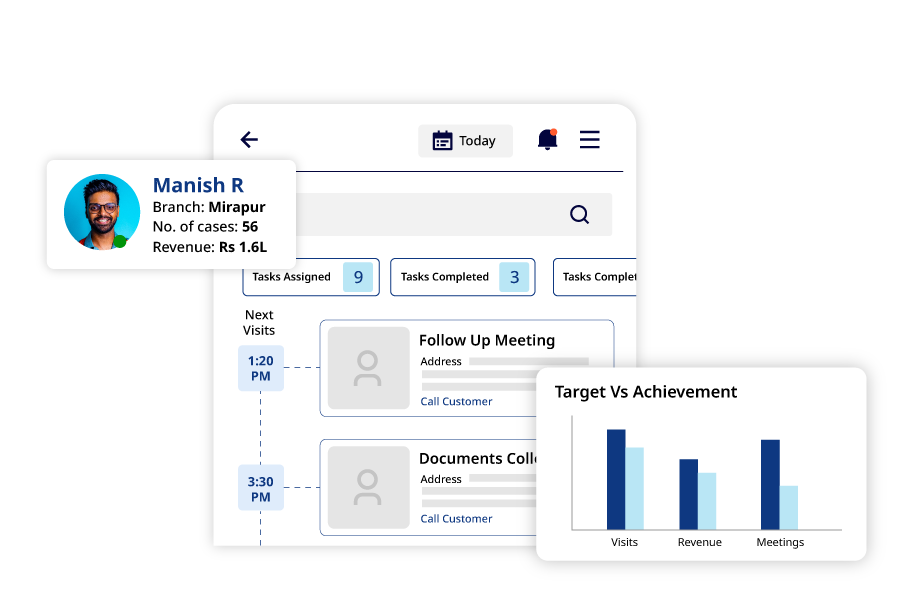

The productivity of field agents is directly tied to the profitability and service offerings of MFIs. Location intelligence enhances productivity by equipping agents with data-driven insights and tools for efficient fieldwork.

Field agents can use a location-powered field force management app to access customer profiles, payment histories, and their addresses. This ensures they are prepared before meetings, improving client interactions and reducing time spent on administrative tasks. Furthermore, location-based insights can help agents identify potential clients within their area of operation, thereby strengthening business expansion.

Location intelligence can also monitor and evaluate agent performance. By analyzing patterns in geospatial data, MFIs can identify areas where agents are most effective or underperforming. Back office teams can use these integrated insights to provide targeted training, reallocate resources, or adjust coverage areas, thereby maximizing overall field force productivity.

3. Ensure Compliance

The regulatory framework governing India’s microfinance sector requires adherence to stringent norms to protect group and individual loan customers and ensure transparency. Location intelligence facilitates compliance by enabling precise tracking and documentation of field activities.

MFI leaders need to maintain operational compliance and enhance productivity and efficiency for:

I. Real-Time Field Visibility

- GPS tracking monitors field agents’ real-time locations and movements.

- This ensures adherence to assigned routes and schedules while offering transparency in day-to-day operations.

II. Visit Logging and Outcomes

- Location intelligent systems allow agents to digitally log visits with geotagging and timestamping.

- Leaders can review visit outcomes, customer interactions, and any issues raised during meetings, fostering accountability.

III. Journey Plan Compliance

- Mileage tracking ensures agents travel according to pre-approved journey plans.

- Deviations trigger alerts, ensuring resources are used efficiently.

IV. Customer Interaction Verification

- By using geofencing, apps can confirm if agents physically visit the required locations, such as customer homes or centers.

- Minimizes false reporting and ensures meaningful customer interactions.

MFIs can additionally use location intelligence to confirm that their services reach underserved areas, fulfilling their mandate of financial inclusion.

The Road Ahead

Aggregated data from field visits provides insights into agent performance, customer needs, and operational challenges. MFI leaders can use these insights to visualize rural operations, refine strategies, optimize routes, and improve customer experience. The location-intelligent approach promises greater benefits for the microfinance industry.

In a country as vast and diverse as India, location intelligence offers MFIs a powerful tool to overcome operational challenges, enhance field agent productivity, and ensure compliance with regulatory norms.

Using a location-first field force management software like Dista Sales empowers MFIs to strengthen financial inclusion with our custom loan workflows for group and loan individual loan offerings. This technological transformation has the potential to reshape the microfinance sector, bringing it closer to its goal of empowering underserved communities across India.

If you want to optimize your field force orchestration, get in touch with us to see Dista Sales in action.