In today’s chaotic world, insurance companies have endured critical disasters. The past few years have witnessed a series of hurricanes, wildfires, floods, and storms. The series of record-breaking events and disasters exhausts insurance companies’ resources, and the economic impact of these events also poses a significant challenge for them.

The rise in several health risk factors in the last two years among younger demographics caused directly or indirectly by the pandemic increased premium payouts. This increase in payouts resulted in a severe cost impact on the top-line growth of the insurance carriers. In addition, insurance companies are still dealing with either legacy systems with slow processes or depend on error-prone manual processes that are incredibly time-consuming.

Critical stakeholders in insurance companies need help to get actionable intelligence due to disparate data sources and the lack of availability of structured information. Insurance policy decisions must consider a wide range of variables from multiple datasets hiding in disparate sources. Insurance company leaders have a variety of sources of truth to extract meaningful insights and determine policy decisions.

Read More: Location intelligence for insurance

At a fundamental level, location intelligence is a platform to extract meaningful information by uniting multidimensional geospatial data sources into a single integrated view. Most of the policy decisions are, in some or the other way, tied to location. Therefore insurance organizations must use this powerful tool to drive better decision-making.

In recent years, insurers have been under increasing pressure from regulatory agencies and consumers to reduce costs and expand their policy coverage reach. The result is that insurers are looking at ways to improve their operations by better understanding where their customers live, work, and play.

In this specially curated piece, we will see the top 5 areas where location intelligence can have a transformative impact on driving insurance sales growth.

1. Amplify Insurance Sales Agent Productivity

Location intelligence software helps insurance sales agents to streamline beat planning, ensuring effective sales visits, and determining the necessary sales frequency. It helps in minimizing the time and effort spent in verifying prospect addresses and scheduling appointments. It equips agents with route optimization capabilities along with live location updates.

Dista’s field sales management software integrates all information in a single place, eliminating any possibility of your teams missing out or overlooking any critical issues. A field sales management application enhances sales agent productivity and improves team collaboration. It automates lead allocation based on several parameters such as skill set, location proximity, policy type, location risk, and more to accelerate pipeline velocity.

Also Read: The ultimate guide to sales productivity.

Moreover, features such as smart notifications or nudges inform and update your field sales teams to keep tabs on relevant prospects in a particular location. It plays an important role in reaching the prospects faster, giving a competitive advantage to your sales teams. It also ensures that your sales teams cover more prospects resulting in accelerating sales conversions.

One of the core attributes of any field sales application is to assist sales agents with their follow-ups, track meetings or calls, track daily attendance, expense management, and incentive tracking. Automating these tasks improves sales productivity significantly and boosts sales pipeline velocity.

2. Simplify and Boost Claims Processing

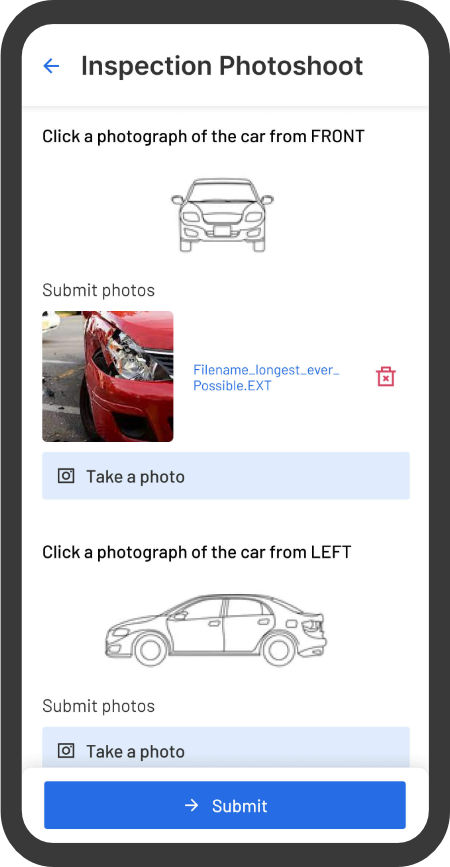

In case of accidental, property, or casualty claims processing, claims teams can leverage location intelligence to prioritize resources before deploying any adjuster. Onsite inspection can be made easy and faster by having consolidated information on one platform with a mobile-first approach. Critical field information is captured for inspections, appraisals, and claims on one integrated platform, improving the time to close claims.

Moreover, insurance companies can leverage location intelligence for major catastrophic events or natural disasters by getting a clear picture of the damage caused in the respective neighborhoods and towns. This insight enables insurers to triangulate claims processing for all their customers within the area immediately, even before the policyholders have returned to the concerned site guaranteeing an unparalleled service during their time of need. Additionally, the proactiveness of the insurance company also helps them reduce costs and improve efficiency.

Dista’s claims management system enables teams with quick, hassle-free claims investigations and ensures a seamless claims inspection process. Real-time fraud detection provides quick data verification with a centralized data storage system for easier re-verification and revisits.

3. Empower Underwriter Teams

Insurance underwriters need to have complete visibility into the risks involved with each prospect. Underwriters must analyze the insurance company’s books holistically to maintain a delicate balance between new business generation and solvency. For instance, underwriters should have adequate information about an applicant to determine the relevancy of a policy for the applicant. This information depends on the applicant’s profile and past behaviour regarding financial records. Insurance underwriters must be entirely sure about the risks involved and ensure that the company makes only a few premium payouts.

Location intelligence gives underwriters a 360-degree view of the risks involved within geography and provides clear visibility of how additional strategies and policies will impact operations. On-field underwriters can rely on location intelligence for real-time insights to determine if a particular applicant qualifies for a specific policy. For instance, for people from particular geography prone to floods, insurance underwriters can evaluate the risks accordingly to decide if there need to be any discounts. Similarly, underwriters must determine all the risks for home insurance applicants living in a high-crime zone.

On-field underwriters of any insurance organization need a powerful assistant such as Dista’s field force management software that offers scheduling and dynamic route optimization but also increases the efficiency of the insurance company’s on-field underwriters and augments customer experience.

4. Enhance Cost Efficiency

In the insurance industry, inaccuracy and wrong estimations can prevent companies from losing billions. Driving down costs is a force multiplier for insurance companies, as location intelligence can help save billions through accurate assessments. They are interpreting geographical data and transforming it into meaningful, error-free, practical insight for making policy decisions, risk mitigation, and claims processing.

For instance, insurance firms can define home insurance policies based on specific geographic coordinates of the home location and combine this with other risk factors, including weather patterns, population insights, historical flood data, etc. These insights give the insurer and the consumer protection and help save costs and effort.

5. Improve Customer Experience

Insurers can use location intelligence to personalize their services and provide an exceptional customer experience. They can do this by analyzing geo-specific data like traffic and weather patterns influencing how customers behave in a specific area and how they shop and spend money there. For example, suppose a customer is shopping in a neighborhood with high unemployment rates. In that case, the insurer might send out an email offering discounts on auto or home insurance when they renew their policy.

Final Thoughts

Insurance companies must understand the local context of their customers. Location intelligence can unlock unlimited opportunities for the insurance industry, from writing a policy to processing claims and assisting on-field insurance agents. Leveraging deeper contextual insights regarding insurance data helps remove complexities in the insurance lifecycle.

As a location intelligence platform, Dista can help insurance companies and agencies to uncover hidden market opportunities by applying location data to underwriting, claims, and risk management. With the help of powerful map visualizations and location risk profiling of consumers, Dista can empower insurance professionals to understand and communicate risks across product lines.

Insurance companies must understand the local context of their customers. Location intelligence can unlock unlimited opportunities for the insurance industry, from writing a policy to processing claims and assisting on-field insurance agents. Leveraging deeper contextual insights regarding insurance data helps remove complexities in the insurance lifecycle.

As a location intelligence platform, Dista can help insurance companies and agencies to uncover hidden market opportunities by applying location data to underwriting, claims, and risk management. With the help of powerful map visualizations and location risk profiling of consumers, Dista can empower insurance professionals to understand and communicate risks across product lines.

Get in touch to know more about how Dista transforms the insurance business cycle.