A Loan Origination System (LOS) is a digital platform that banks and financial institutions use to manage the loan application process, from application to disbursement. It streamlines and automates workflows, improves accuracy, and enhances customer experience. This blog delves into a Loan Origination System, its working, and the critical stages in the loan origination process. More importantly, this blog takes a look at how location data can be put to meaningful use to compliment the LOS.

What is a Loan Origination System?

A Loan Origination System (LOS) is software designed to manage the end-to-end loan origination process. It encompasses all the steps in processing a loan application, including data collection, document verification, credit assessment, underwriting, approval, and disbursement. By digitizing and automating these processes, a LOS reduces manual intervention, accelerates processing times, and minimizes errors.

What is a Location-First Loan Origination System?

A LOS that factors in location data of customers and agents is a location-first LOS that increases the efficiency of the entire process manyfolds. It takes into account bank branch location, branch territories, agent mapping to these branches, town centers (agent and customer touch point), and road networks used by agents to reach the center locations.

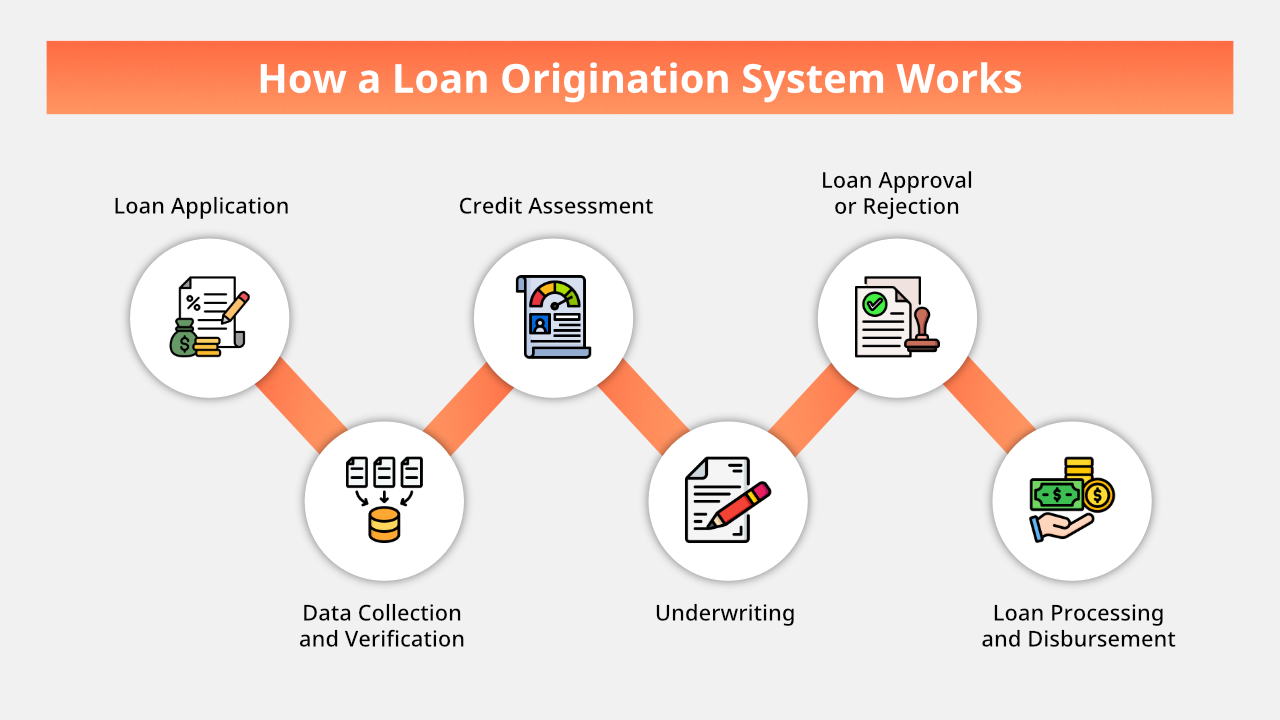

How a Loan Origination System Works?

A LOS integrates various functions and processes involved in loan origination into a single platform. Here’s a step-by-step breakdown of how it typically operates:

1. Loan Application

A LOS integrates various functions and processes involved in loan origination into a single platform. Here’s a step-by-step breakdown of how it typically operates

The loan application phase involves the borrower submitting an application form and necessary documents. Application submission is usually done online or in person.

The LOS provides an online portal that is user-friendly. Through the portal, applicants can fill out forms and upload necessary documents. The portal validates the information entered in real time, ensuring completeness and accuracy before submission, making the process comfortable and easy for the applicants.

Many NBFC-MFI borrowers belong to tier 3 and tier 4 towns and villages. This demographic prefers physical loan applications since they trust the field agents meeting them at the town centers and the employees working at the bank branches.

At this stage a location-led field force management mobile application becomes a critical component that tracks field activities, automates case allocation to field agents, optimizes routes to reach customer locations in the shortest time, and captures customer disposition.

Smart beat plan optimizes the agents’ daily journey plan ensuring they prioritize high potential town centers and touch base with all customers at regular intervals.

All loan-related documents uploaded to the field force management application seamlessly integrate with the LOS software, ensuring adaptability and transparency in the system.

2. Data Collection and Verification

Once the application is submitted, the data and documents provided by the borrower need to be collected and verified. Some documents include identity verification, address verification, income proof, and credit history. The LOS automates data collection from various sources, such as credit bureaus, banks, and government databases.

In the case of microcredit and small loans, NBFCs and MFIs employ a large field force for field collections and selling different consumer credit offers. These field agents have to visit customer locations and verify addresses physically for document verification. They modify the address data after the visit in case of any discrepancies to ensure smooth loan processing.

Location-first field force management simplifies this tedious process using location intelligence and geocoding addresses with up to 90-95% accuracy. With a high accuracy of geo-tagging customer locations, field agents can reduce travel time, spend less time on the field, and spend more time with customers.

Location intelligence simplifies large, complex, and incomplete address datasets, enabling NBFC and MFI firms to verify loans faster and reduce the time to disburse loans.

Dista Sales, location-first field force management, offers a ‘Dista Confidence Score’ for address verification and validation processed by our AI-powered location intelligence platform and this serves as the basic building block for running highly optimized field visits.

3. Credit Assessment

The credit assessment phase involves evaluating the borrower’s creditworthiness based on their credit score, financial history, and other relevant factors. The LOS integrates with credit bureaus to retrieve the borrower’s credit score and history. It uses predefined algorithms and scoring models to assess the borrower’s risk profile, automating the credit assessment process.

With a location-first field force management platform, banks, NBFCs, and MFIs can also assess the creditworthiness of individual borrowers by using their home location as a critical variable.

By leveraging the historical data of delinquent borrowers from specific locations, and layering this data with other public data sources; banks can quickly (and visually on a map layer) identify areas with a high probability of defaulters and predict borrowers from each location.

4. Underwriting

Underwriting evaluates the risk of lending to the borrower and determines the loan terms and conditions. The LOS automates underwriting by applying predefined rules and criteria to assess the loan application. It leverages machine learning to predict risk and recommend loan terms, ensuring a consistent and objective evaluation.

Similar to assessing a borrower’s creditworthiness, the underwriting process must use a location-first strategy to spot high-delinquent areas and predict the long-term impact on field collection efficiency and coverage; this simplifies framing risk strategies for underwriters accordingly.

5. Loan Approval or Rejection

The underwriting results determine whether the loan application is approved or rejected. The borrower is informed about the loan decision and its terms and conditions.

The LOS generates automated decision notifications, reducing the time it takes to inform the borrower. For approved applications, it generates the loan agreement and other necessary documentation. A well built LOS will also automate loan status communication to customers via channels like email, SMS, whatsapp and others.

6. Loan Processing and Disbursement

For approved loans, the final step is to process the loan agreement and disburse the funds to the borrower’s account. The LOS automates the generation of loan agreements and facilitates digital signatures. It integrates with banking systems to automate fund disbursement, ensuring a smooth and swift transfer.

Key Features of a Loan Origination System

1. Workflow Automation

A LOS automates various steps in the loan origination process, from application to disbursement, and improving efficiency.

2. Document Management

The LOS provides tools for uploading, storing, and managing documents electronically, streamlining document verification and retrieval. LOS combined with a location-first field force management offers all the above at the customer’s doorstep enhancing the customer experience.

3. Integration Capabilities

A LOS integrates with external systems such as credit bureaus, banks, and government databases, enabling seamless data exchange and verification. A geospatial enabled LOS will make it easy for decision makers to visualize all this data along with customers’ information on a maps based layer for easy decisioning and real time insights.

4. Compliance Management

The LOS ensures compliance with regulatory requirements by incorporating rules and checks at various stages of the loan origination process.

5. Analytics and Reporting

The LOS offers robust analytics and reporting capabilities, providing insights into loan performance, borrower behavior, and process efficiency. Combining the LOS with a field force management platform like Dista Sales leads to deep visual perspectives on specific geographies through a map-based visual interface.

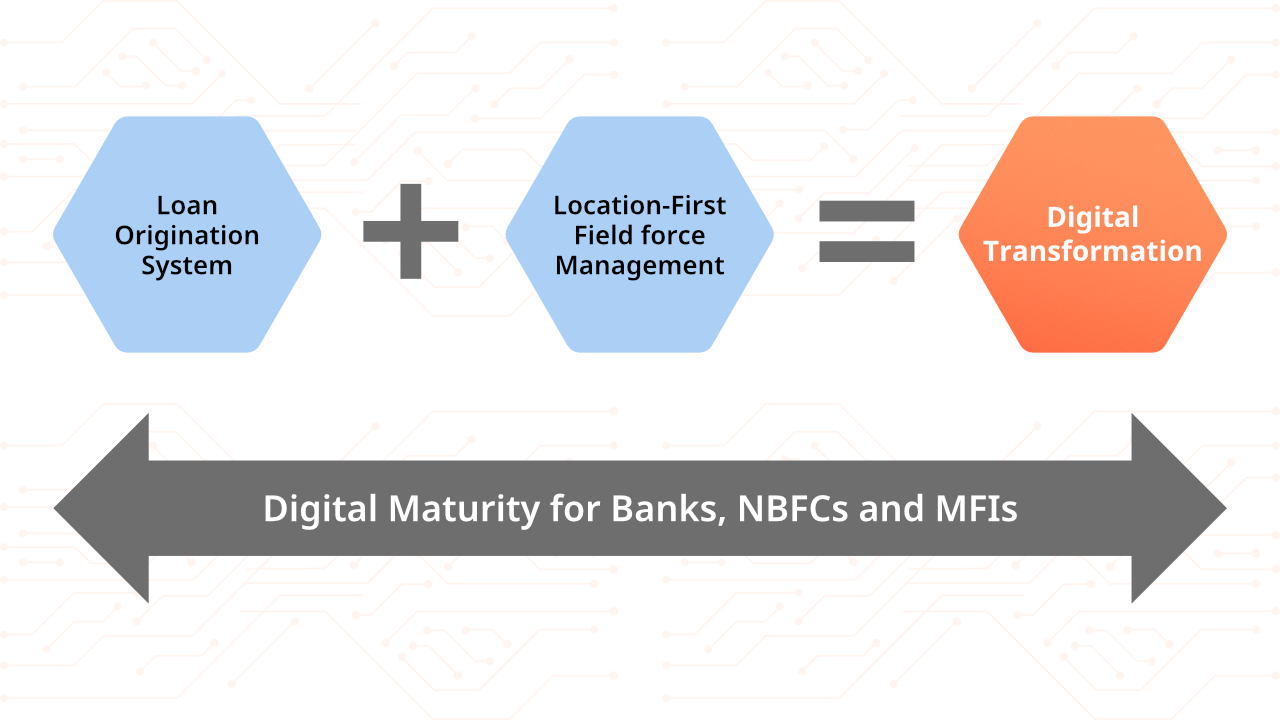

Integrating Loan Origination System with Location-First Field Force Management

Using a field force management system on top of an existing loan origination or loan application system is a key step towards embarking on a digital transformation journey for banks, NBFCs, and MFIs.

Field force management platforms like Dista Sales enhance the loan processing experience by tracking field force activities, such as daily visits to customer locations, address geocoding, geotagging customer locations, distance traveled, number of routes taken to reach the area, and more.

The platform helps capture visit outcomes and maintain visit compliance to ensure complete transparency. Integrating loan origination with Dista Sales enables seamless data flow and gives leaders complete control and visibility.

The mobile application guides field agents using scheduling algorithms and sets up multiple simulations to identify the shortest, fastest, and safest routes to customer locations. Thus, field agents can spend more time with customers and have meaningful interactions regarding loan requirements and collections.

Benefits of Using a LOS with Location Intelligence

1. Enhanced Efficiency

A LOS integrated with a location-first field force management significantly reduces processing times and operational costs by automating mundane tasks and simplifying workflows.

2. Improved Accuracy

Automation minimizes human errors, ensures accurate data entry and processing, and provides complete and accurate customer addresses, enhancing the overall quality of the loan origination process.

3. Better Customer Experience

- A seamless and user-friendly application process.

- Reducing the time taken to approve and disburse loans.

- Thus improving customer satisfaction.

4. Compliance and Risk Management

By incorporating regulatory checks and location specific risk assessment, a LOS ensures compliance with industry standards and reduces the risk of default.

Conclusion

A Loan Origination System is an indispensable tool for modern financial institutions, transforming traditional, paper-intensive loan processing into a streamlined, efficient, and accurate digital workflow.

Automating and integrating various stages of the loan origination process with a location-first field force management platform like Dista Sales enhances operational efficiency, reduces processing times, and improves customer satisfaction. As technology evolves, LOS and field force management’s combined capabilities drive innovation and efficiency in the financial sector.

Get in touch with us for a free demo.