Field agents of banks, NBFCs, and MFIs have many field tasks that must be covered in a day. This includes meeting customers, processing doorstep requests, portfolio management, debt collection, service requests and more. All these functions require agents to travel and meet more customers in a day.

However, owing to operational challenges like suboptimal route planning, ineffective branch-to-center mapping, unoptimized and unbalanced territories etc, they spend more time traveling longer distances and knocking on fewer customer doors daily.

Let’s look at the top three ways agents can maximize customer face time by using location-powered field force software.

1. Optimal Branch Network Mapping

Optimizing branch networks is essential for NBFCs and MFIs to improve penetration in underserved areas. They often map town centers around branches, but as centers expand, manual mapping becomes complex and inefficient as it fails to consider critical factors like distance and travel time.

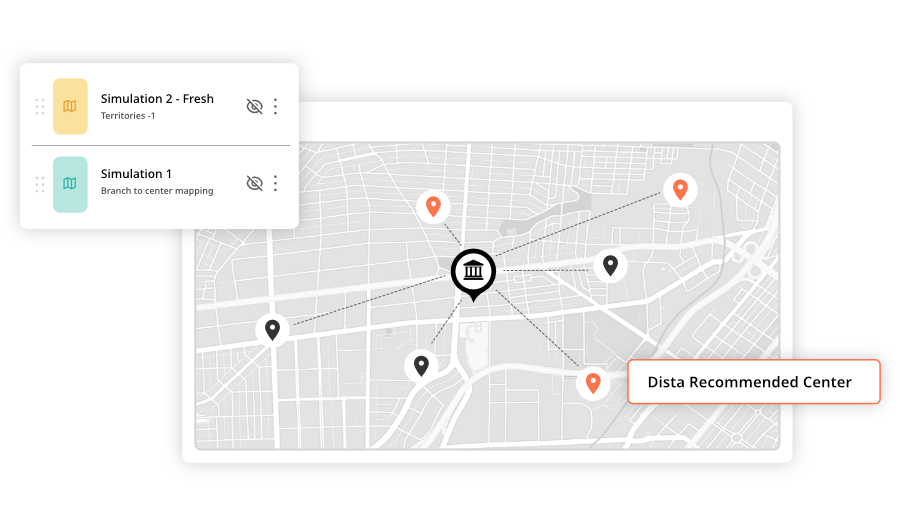

Dista Sales, our location-first field force management software optimizes branch networks with a 3-step framework.

- Visualize branches, town centers, and field agents on a map.

- Run simulations to identify the most optimal branch-to-center mapping, considering factors including agents per branch, distance to centers, travel time, and meeting requirements.

- Use location intelligence to create an optimized branch network, aligning centers with the nearest branches and reducing agent travel time.

2. Location-driven Smart Beat Plans

Field agents need to manage their portfolio of individual and group borrowers, and they have to meet them frequently at town centers. However, with ineffective beat planning, agents fail to meet customers for months, resulting in poor face time and engagement.

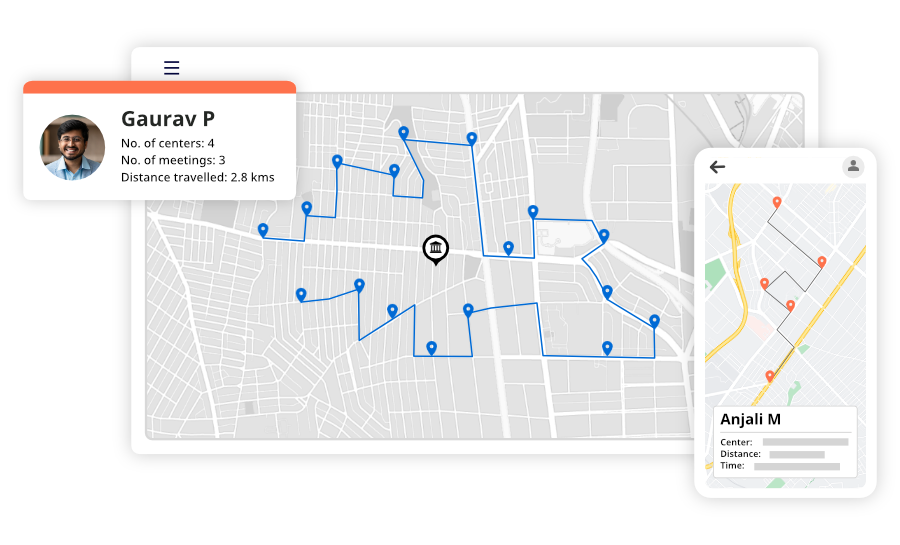

Dista Sales creates small territories to boost customer face time by considering variables like branches, centers, and individual and group loan customers and mapping them to field agents. This enables them to meet more customers daily, boost penetration, and balance workload to reduce travel time.

Here’s a video explaining how our system creates location-driven beat plans.

3. Route Optimization

Route optimization is critical for NBFC-MFI firms as their large team of field agents spread across bank branches. Boosting customer engagement and face time helps with sustainable credit flow. Our system offers a systematic and scientific method to manage field agents with dynamic route optimization.

The scheduling algorithm creates shortest and fastest routes for field agents for seamless center visits. It ensures agents avoid dead runs or make redundant visits to the same center.

Final Thoughts

The location component is an essential factor that supercharges your field force productivity and maximizes customer coverage. With a field force management software like Dista Sales, leading NBFCs and MFIs have increased their daily customer visits by 230% and doubled their debt collection rate.

Take the first step to adopt location intelligence strategies with Dista. Get in touch with us for a free demo.