Field agents are the backbone of Microfinance Institutions (MFIs), that are fostering financial inclusion in villages and remote areas. Most MFIs have thousands of agents in the field as they aim to tap over 59 million borrowers in India, as per the MFIN Report 2023⁽¹⁾.

The responsibility of field agents extends beyond simply visiting customers—they are tasked with strengthening customer engagement, collecting documents, facilitating debt collections and recovery, onboarding new customers, meeting prospects, initiating cross-sell offers and more.

However, most of the time, back office managers have low/no visibility of the movement of the field teams and their visit outcomes. Moreover, there is no way for them to validate customer visits and get transparency into their daily tasks.

In this article, we will learn about the key challenges and how MFIs can combat them and improve true customer visits with location-first field force management software.

True Customer Visits Explained: A Key Metric for MFI Success

A true customer visit is when a field agent visits a customer at the right address. The meetings are for various reasons, including collecting debt from group or individual loan customers, delinquent customers, and engaging with prospects. True visits go beyond merely meeting the prospect or customer, as agents primarily focus on effective customer engagement.

Field agents, back office managers, and business leaders are the key stakeholders of the MFI landscape. All of them have specific operational challenges that may not be resolved owing to factors like high manual dependency, legacy systems, multiple tools, and more.

Let’s learn about their key challenges and how they can combat them by using location intelligent field force management.

Key Challenges of MFI Stakeholders

- Low Transparency into Field Activities

With thousands of agents in the field, managers have low to no visibility into their location, movement, and tasks. They need a way to validate whether the agent conducted the center meeting, did they visit a specific P2P customer, did they initiate upselling of a financial product and more.

- Limited Market Penetration

Business leaders largely struggle with low market penetration as they lack a scientific method to identify untapped customers, view and understand the existing market coverage, and support field agents to tap more prospects.

- Poor Agent Productivity

Unorganized day plans, ineffective scheduling of customer visits, and long-distance travel to meet customers result in poor agent productivity, which affects the debt collection and market penetration.

How Field Force Management Software Improves True Customer Visit Orchestration; In-turn Improving Productivity

Location-first field force management software, like Dista Sales, helps MFI stakeholders combat these challenges with AI/ML-packed smart features. Let’s learn more about them.

1. Snug Territory Clusters

MFI field agents have a portfolio of group and individual loan customers. Group loan customers with good credit history may also be ideal customers for individual loans. Therefore, along with group loan borrowers, field agents can convert them to individual borrowers.

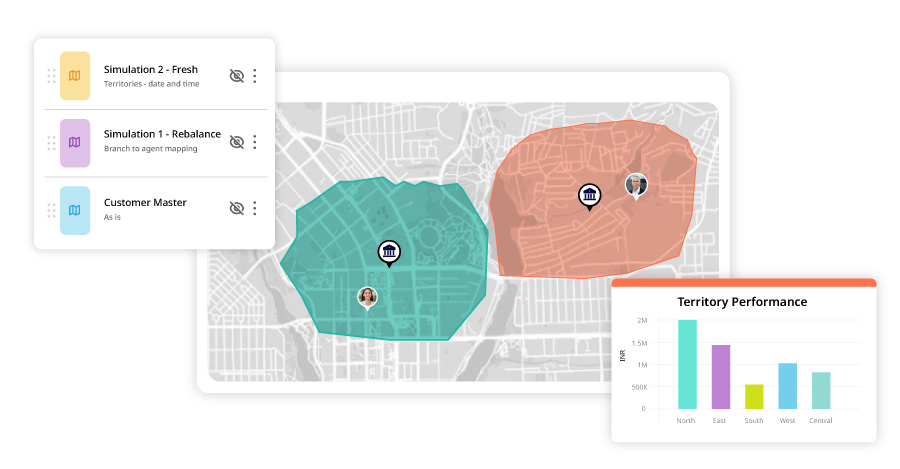

However, most MFIs heavily focus on group loan borrowers or Joint Liability Groups (JLGs), while the individual ones are untapped or met less frequently. Typically, agents focus on individual borrowers only in the case of delinquencies. Hence, to tap into this opportunity, Dista Sales, our location-first field force management software, creates small territory clusters consisting of branches, centers, and both types of borrowers.

The system maps a single field agent to these snug territories, which helps him travel less distance, meet more customers in a day, improve market penetration, facilitate cross-selling activities, and enhance customer face time. With smaller territories, MFIs improve field agent productivity and reduce the number of agents in the field. This helps them tap more customers every 100 meters and helps expand customer coverage.

2. Location-driven Beat Plans; Interlaced with Dynamic Day Visits

MFIs use loan origination systems that help them with loan application and processing. However, tools with limited capabilities or heavy reliance on manual methods can miss out on the location component while designing daily beat plans for field agents, which is one of the main reasons for low productivity and poor customer engagement.

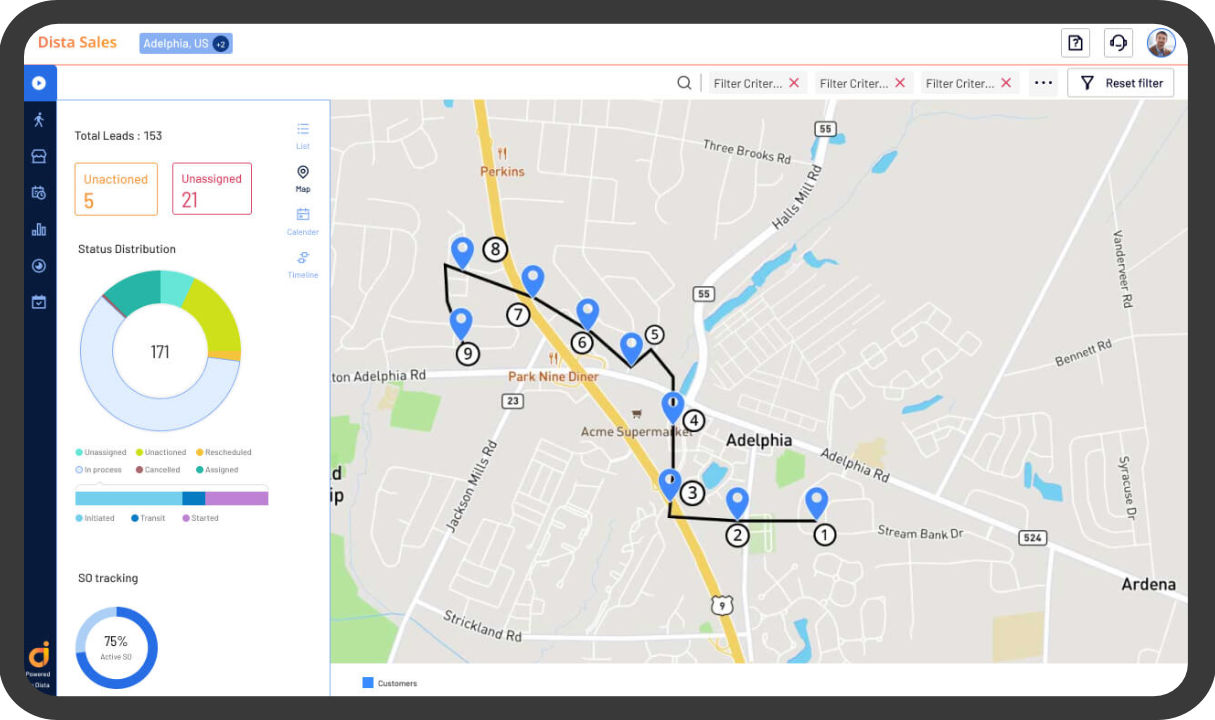

A location-first field force management software like Dista Sales creates beat plans to incorporate agent visits to individual and group loan customers. The AI/ML-based system considers multiple business constraints like travel time, distance, type of customer, P2P collection case, etc, to create the best suitable beat plan. Dista Sales additionally interlaces structured beat plans with dynamic day plans.

Typically, field agents meet group loan members for center meetings, during which they either collect debt or inform customers about a new offer. MFIs also create offers for individual members of a group loan or JLG, depending on their credit and repayment history.

Dista Sales incorporates these ad hoc visits with the planned beat plan and notifies the agent to meet the customer. If the agent visits a branch center, it sends them nudges asking them to cross-sell loan offers to individual loan customers.

This increases agent productivity, faster customer onboarding, and helps them meet more customers in a day.

3. Dynamic Route Optimization

Field agents’ daily tasks involve them traveling by road to meet customers. Along with efficient beat plans, field force management software empowers agents with dynamic route optimization. Due to ineffective beat plans, field agents need to cover larger areas and drive longer distances to meet customers, resulting in low productivity and poor customer facetime.

A location-focused field force management software like Dista Sales creates multiple simulations to identify the shortest and fastest route. It designs the most suitable route that covers the maximum area, enabling agents to meet more customers in fewer kilometers. This also helps MFIs optimize their resources and manage customer visits with fewer agents in the field.

Final Thoughts

MFIs invest in multiple tools which may not be fully equipped to manage the orchestration of field agents. With a comprehensive location-first field force management software like Dista Sales, leading MFIs in India have optimized their field operations and improved true customer visits.

If you are looking to transform your field force, get in touch with us to see our platform live in action.

Source: MFIN Report 2023