Streamline Field Force Operations for NBFCs

Enhance collection coverage, amplify debt collection rate, and orchestrate field collection agents.

Business Impact

Location-powered Solutions for NBFC Operations

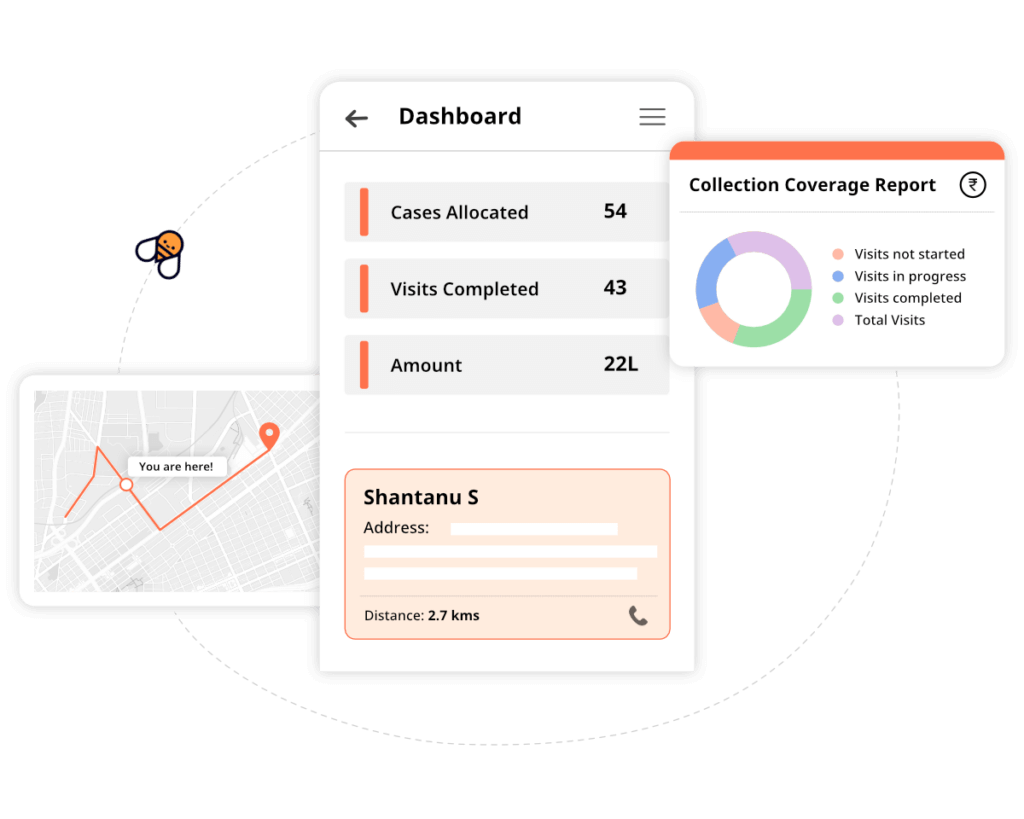

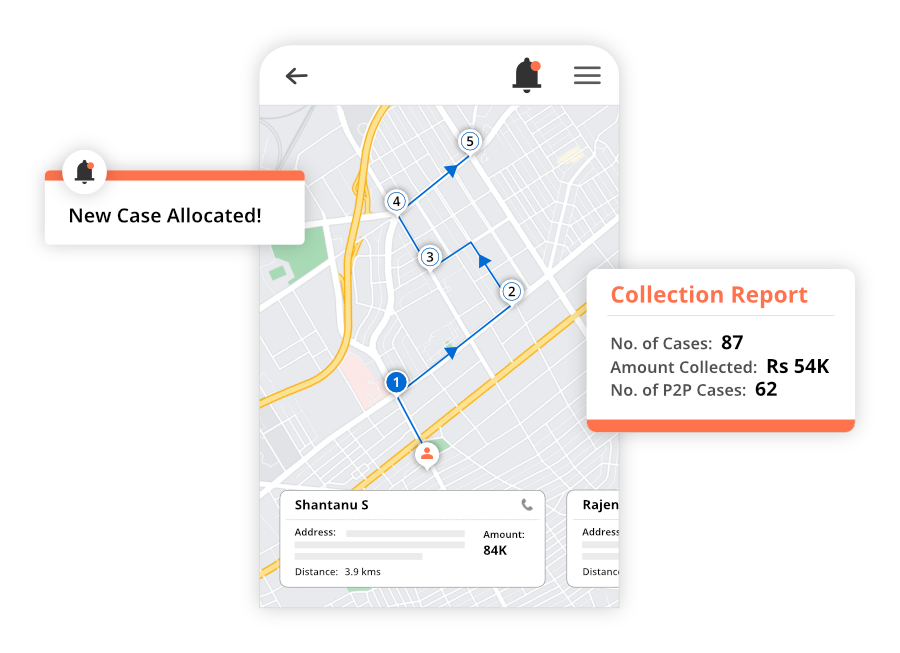

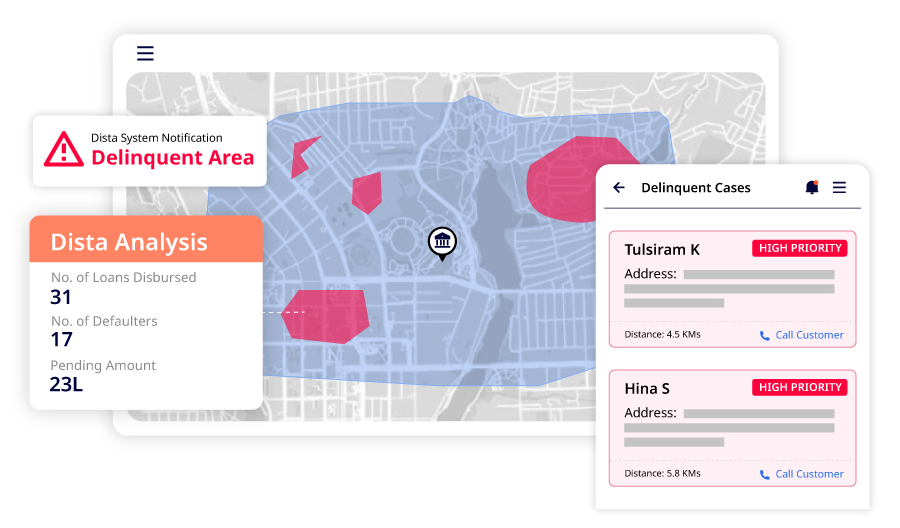

Debt Collection and Recovery

Increase recovery rate and collection throughput with visual actionable insighs, location-specific beat plan, auto case allocation to FCEs.

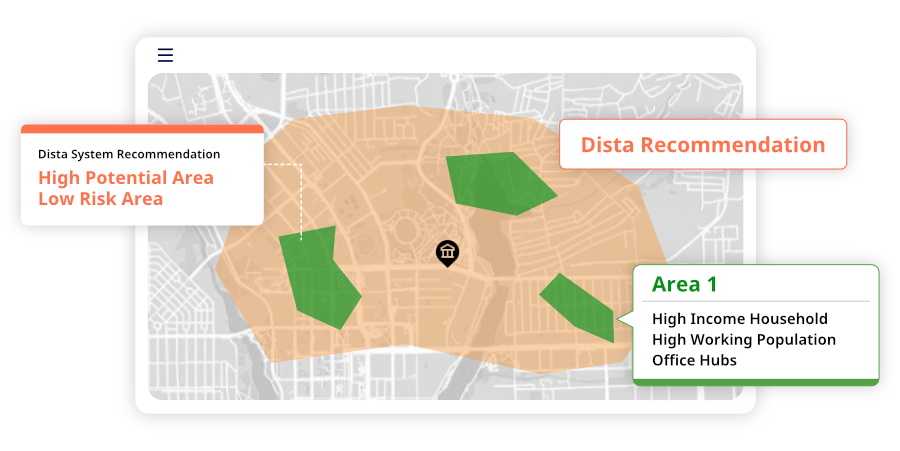

Market Expansion

Apply PoI data variables including average household income, working population, government offices in the area, etc, and identify largely underserved districts, towns, and villages. Spot high growth areas within micro markets and customize product offerings to increase market penetration.

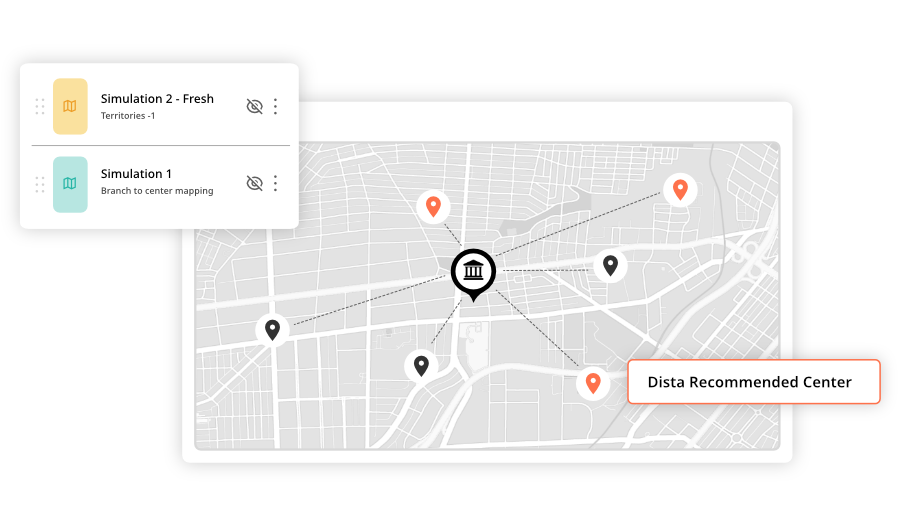

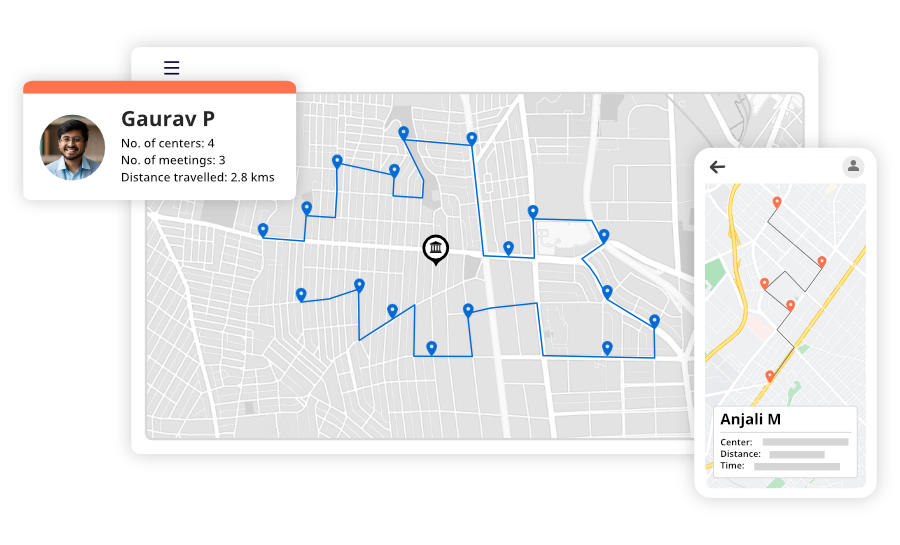

Route Optimization

Boost daily town center meetings and increase customer facetime with optimized route plans and organized beat frequency.

Risk Management

Mitigate delinquency risk insights using location intelligence and prioritize delinquent cases to improve collection efficiency. Predict delinquency probabilities in geographical clusters using historical location data.

Role-based Challenges

Functional Features

Applying Location Intelligence to NBFC