Today, MFIs use multiple tools like CRM, loan origination systems, and connected enterprise architecture to scale and manage field operations. They also want to improve market penetration, expand customer coverage, and orchestrate debt collections. For this, MFI leaders need to know about the addressable space to carve market penetration strategies.

However, the above mentioned tools fail to factor in the location component and derive actionable insights. This is where a field sales platform like Dista Sales can help MFIs with market penetration. Let’s learn more about it.

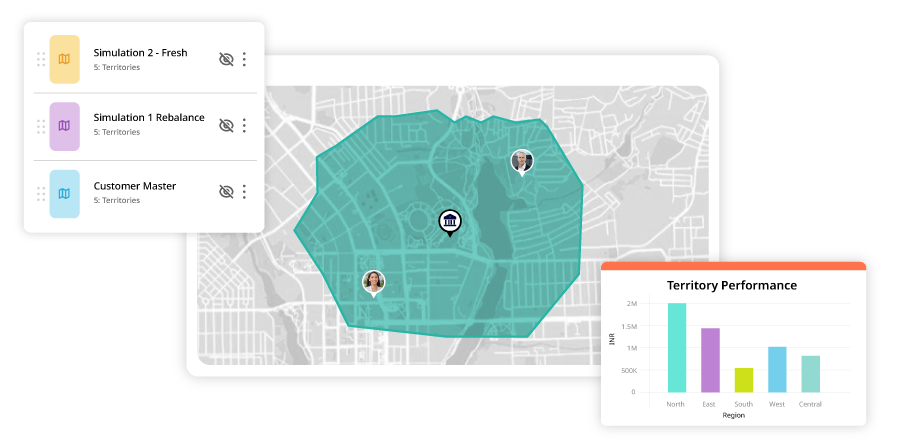

1. Territory Management

With location intelligence at its core, Dista’s territory management solution uses geospatial data, runs AI-powered simulations, and creates equitable territories. The system offers a comprehensive map-based view of a specific geographic location. It then layers multiple PoI and spatial data like – types of industries, nationalized banks, number of ATMs, customer demographics, number of households, village counts, pincode boundaries, competition, and more.

The system uses the data to create polygons or clusters and analyzes them to identify addressable space for market penetration. Dista Sales runs AI/ML-powered simulations to recommend branches for each cluster. Moreover, it determines the accurate location to open branches to serve these clusters based on distance and many other variables.

2. Agent-to-Territory Mapping

After creating equitable clusters, the system optimizes and recommends the number of resources to cover the market. If the territory management of targeted areas is done manually or without considering the location component, it can result in poor customer engagement.

The AI/ML system maps all centers in the clusters to a single field agent. With smaller territory clusters, the agent meets more customers, travels fewer kilometers, and knocks more doors in a day. The agent can conduct center meetings for a few days a month and focus more on engaging with individual loan customers with frequent visits.

3. AI/ML-powered Simulations

Our field force management software uses data including the number of branches and centers, number of routes, field agents needed, travel time, number of days in the field, and more. The system runs multiple simulations focusing on the above business constraints to optimize the orchestration of field agents.

It considers variables like branch to center, agent to center, center to meeting date and runs simulations to recommend the best plan that uses fewer agents in the field, reduces their travel time, and takes fewer days to meet more customers.

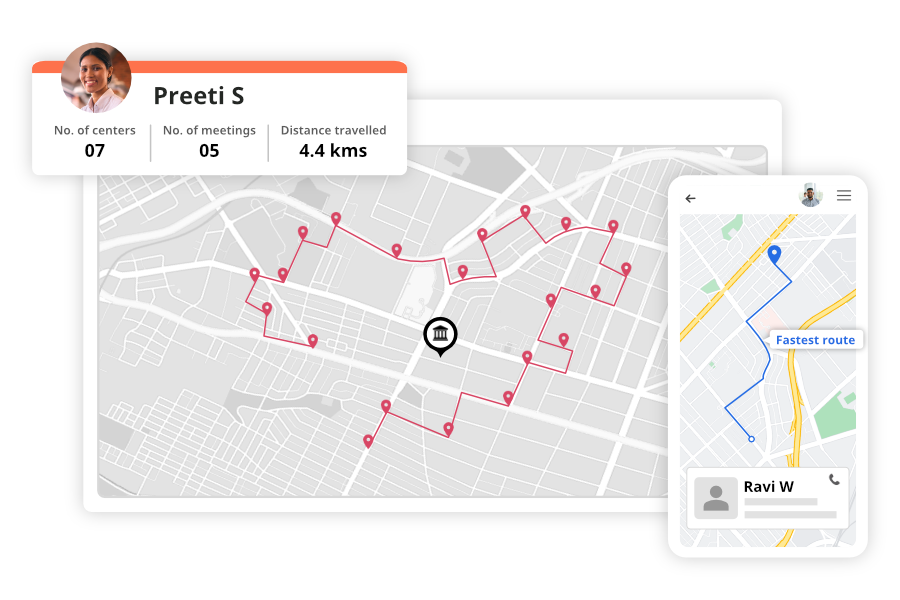

4. Dynamic Route Optimization

The Dista system creates beat route plans that consider group loan customers and helps agents plan their day and conduct meetings. Moreover, it interlaces individual loan customers, P2P customers, delinquent customers, and general meet-and-greet customers in the original beat plan to create a new schedule.

The system dynamically recommends which customers to meet based on how the field agent’s day plan progresses. This helps MFIs improve market penetration and tap more customers in a specific area.

Final Thoughts

MFIs heavily rely on smart beat plans to improve daily customer meetings and debt collection. However, they are also looking for opportunities to enhance market penetration. Using a location-driven field force management platform, helps agents optimize field operations and meet individual loan customers more frequently. This results in stronger customer engagement and helps them with better upsell/cross-sell opportunities.

Location-first field force management software like Dista Sales has been instrumental in helping leading microfinance firms expand customer coverage and boost market penetration. Get in touch with us to see how our platform can help you with your market goals.

Source: KPMG