India’s Non-Banking financial company (NBFC) sector continues to remain instrumental in driving credit growth for the country’s underserved segments. Identifying the right customer address, relying heavily on manual processes and legacy systems, and lacking tools to empower NBFC stakeholders are key challenges impacting debt collection coverage.

However, increasing adoption of digital transformation tools like AI, ML, geospatial analytics, and location intelligence are helping them tap underserved markets and improve collection rates.

In this article, let’s explore seven ways location intelligence shapes the NBFC landscape and maximizes collection coverage.

1. Address Geocoding

NBFCs mainly offer microloans to customers in Tier-1, Tier-2, and Tier-3 cities, where most of the customer addresses are inconsistent and incorrect. By using an address geocoding tool, companies can eliminate invalid and incorrect customer data, verify customer addresses, and improve data accuracy. It provides accurate borrower locations, helps field collection officers (FCEs) visit more customers in a day, reduces travel time, and improves collection efficiency.

2. Visual Actionable Insights

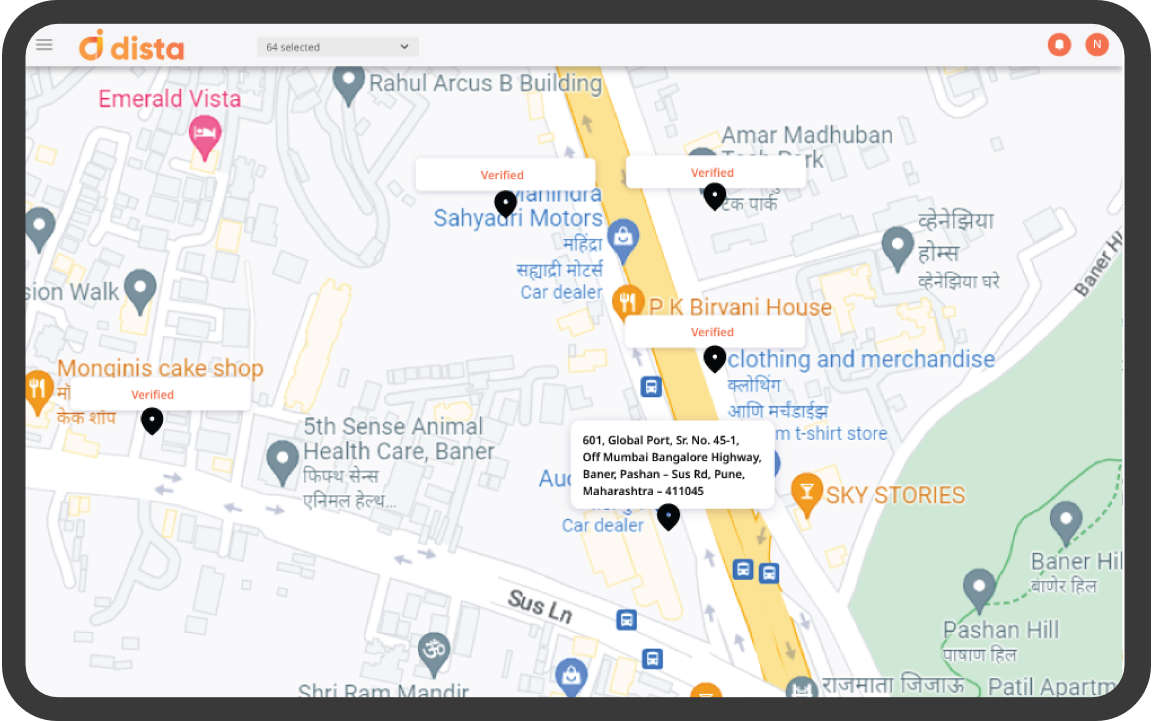

Analyzing lakhs of customer data on spreadsheets is cumbersome as it fails to offer visual insights to collection leaders. Using a comprehensive field force management platform with a location-first approach enables decision-makers with powerful visualization. It offers a 360-degree map-based view of multiple geo data layers, such as the spread of collection agents, branches or centers, agencies, and more, in a single view.

By leveraging visual insights, collection leaders can analyze performance by clusters and tweak their collection and recovery strategy.

3. Identify High-risk Delinquent Areas

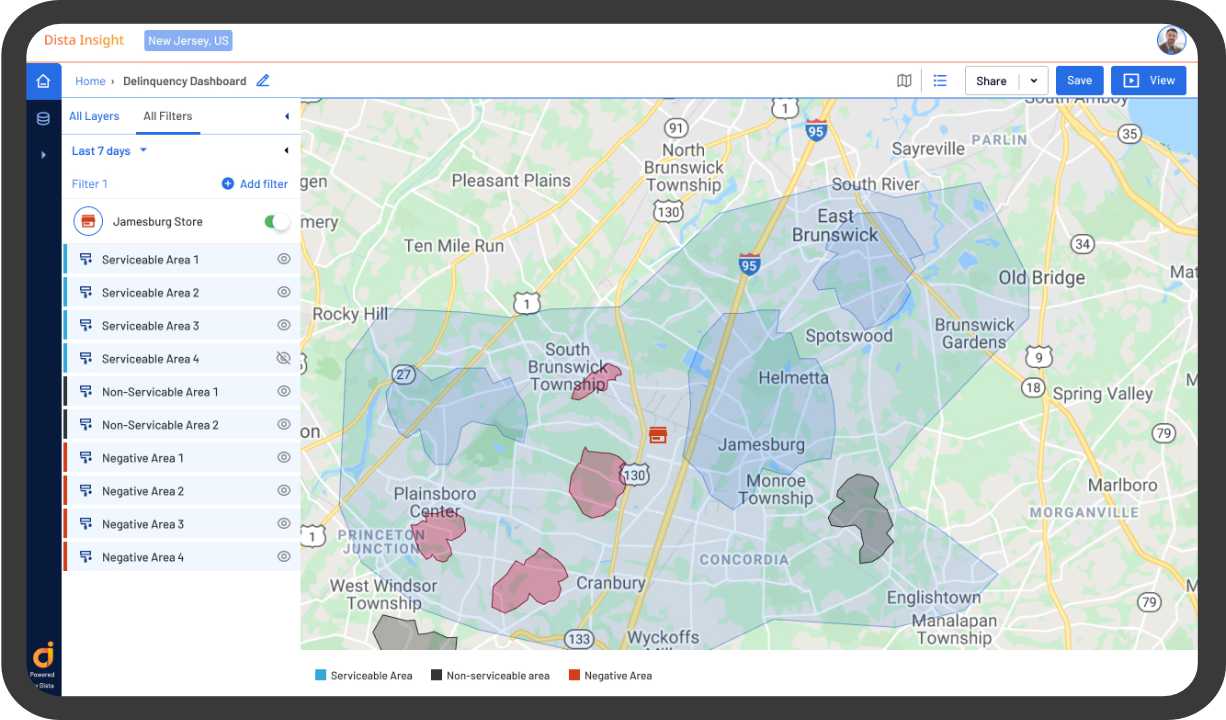

NBFCs can identify patterns and trends for borrowers and delinquency rates in specific areas by applying location intelligence to geospatial data. It allows them to assess the risk levels associated with different demographics.

They can visualize territories of high-risk borrowers and areas with more delinquent customers based on past data and collection rates. This helps segment borrowers based on their location and improves risk assessments. A geospatial analytics system also offers insights on risk exposure-based risk indicators, historical data, missed EMIs, and more.

4. Territory Management

Territory management software divides regions into manageable area clusters, enabling effective resource allocation of FCEs. It helps identify and define serviceable grids based on different parameters, such as distance from a branch location and pin-code-based grid mapping. This helps spot gaps in the coverage area, prioritize relevant territories for collections, and balance their workload.

By creating equitable territories, FCEs spend less time traveling, meet more customers daily, and improve customer facetime.

5. Branch Network Optimization

NBFC firms create new branches and centers to expand their market and collection coverage. However, mapping these centers to the branch is not optimal as they don’t consider business variables like the location of these centers, priority territories, and more.

Field force management software, like Dista Sales, uses AI algorithms to run multiple simulations considering these variables and identify the most suitable location of branches and centers for maximum productivity. It optimizes center-to-center distance to improve daily meetings and reduce FCE travel time.

6. Auto-case Allocation

Manual case allocation can be inefficient as it fails to consider any factors. Field force management software uses scientific methods to auto-allocate cases to FCEs based on multiple parameters such as their skills, location, proximity, capacity, availability, priority, and more. The system also categorizes areas and allocates FCEs by revenue, customer behavior, and potential.

7. Route Optimization

FCEs need to make center visits for actioning their debt collection cases, and with regular business expansion initiatives, there is an increase in total number of centers. However, NBFC firms can miss optimizing the routes of their FCEs as per the new centers and their location to the mapped branch. This results in FCEs taking longer routes and spending more time traveling and less time at the center meeting.

The route optimization feature in Dista Sales boosts daily center meetings and increases customer facetime. The system calculates the shortest and fastest routes by considering multiple variables and constraints, such as FCE location, the manager they are mapped to, and more.

Amplify Debt Collection Coverage with Field Force Management

In order to amplify debt collection and recovery rate, NBFCs need to reduce their reliance on manual processes and legacy systems. Using a field force management software with a location-first approach like Dista Sales, designed especially for the financial industry in India, empowers NBFCs to boost FCE productivity, expand collection coverage, and improve debt collection and recovery rate.

Looking for a comprehensive tool to attain your collection goals? Get in touch with us for a free demo of Dista Sales.