NBFC-MFI Landscape

With the NBFC sector in India increasing yearly, it will play an essential role in India’s financial inclusion objectives. The demand for credit from retail, micro, small, and medium enterprises (MSME) is projected to grow by 14% (Source-Financial Express) this fiscal. NBFCs and MFIs cater to the different needs of borrowers in the most effective way possible. These firms have a large geographical scope, require faster turnaround times for data processing, and sustain their competitiveness.

Location intelligence is a crucial component for the long-term growth of NBFCs and MFIs. A location-led approach is a precursor to improving credit assessment capabilities, enhancing collection coverage, predicting risk and delinquency, reducing sales operations costs, and more. Most importantly, location intelligence is capable of becoming the game changer that empowers NBFCs and MFIs to map micro markets, reach a wider audience, support different lending models, and power operational efficiency.

In this blog, we’ll look at the top five most critical use cases for NBFC and MFI that can be resolved using location intelligence.

1. Market Expansion

NBFCs have a unique advantage over their counterparts, the banks, in that their target audience is dispersed across a large geographic area. NBFCs try to capture underserved areas not touched by significant banks and access the largely underserved districts, towns, and villages. They have an enormous scope for market expansion to establish a large enough credit flow.

Expanding into geographies with similar social, income, and credit demand is key to increasing market share. Using location-specific insights, NBFC leaders can forecast market expansion and optimize the current sales approach.

With the help of geospatial analysis and intuitive map visualization, leaders can identify gaps in existing branch coverage, map high-potential areas, and select new sites for opening new branches. Map-based field force management tools such as Dista Sales offer unique visual and spatial perspectives by applying point-of-interest data variables such as working population, average household income, government offices in the area, hospitals, retail stores, etc.

Watch the video below to learn more about how NBFC-MFI firms can expand their business.

Sales and strategy leaders can make informed decisions about opening new branches by spotting high-potential geographies. Leaders can also deep dive into micro markets of specific geography to increase market penetration by customizing product offerings and building a solid credit portfolio.

2. Territory Management

Territory management is an integral part of sales and collection strategies. NBFCs and MFIs must map territories by branch locations, which are usually located in high-customer-density areas. Identifying town centers near branch locations is key to expanding sales coverage.

For effective territory mapping, sales and collection leaders of NBFCs and MFIs must consider many parameters. One of the most important is assigning the right number of field agents to each territory, which would depend on the number of town centers in each territory. Striking a balance between the number of town centers for each branch territory is mission-critical and must be optimal.

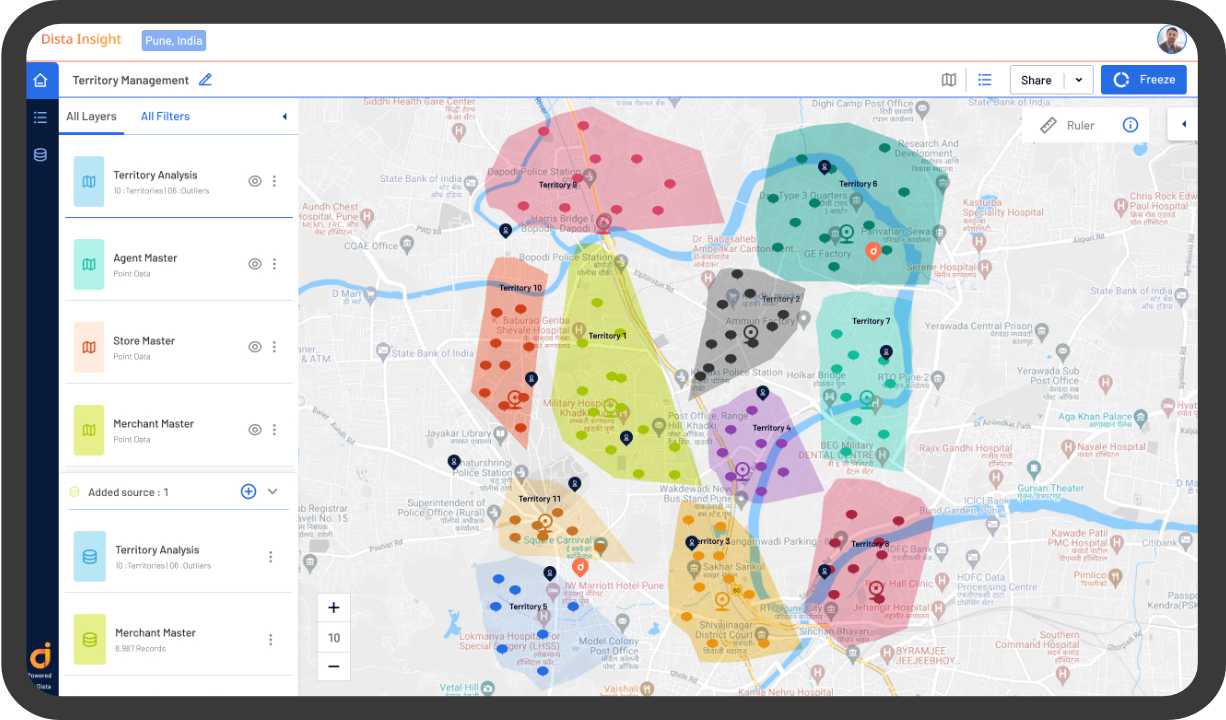

Dista Sales, a location-first field force management software, designs balanced territories to find harmony in field operations. It allows users to run multiple simulations using Dista’s patented clustering algorithm to create balanced, equitable territories that align centers and field agents.

These simulations consider multiple variables such as:

- Total number of centers in a specific territory cluster

- Number of center visits required

- Distance between branch and center, as well as between two centers

- Field agents required,

- Number of routes, etc.

Leaders can compare simulation results and select the most optimal territory design option. The software automates field agent assignment by considering their location, proximity to branches, availability, agent experience, and capacity to handle the workload.

Watch the below video to know more about sales territory management.

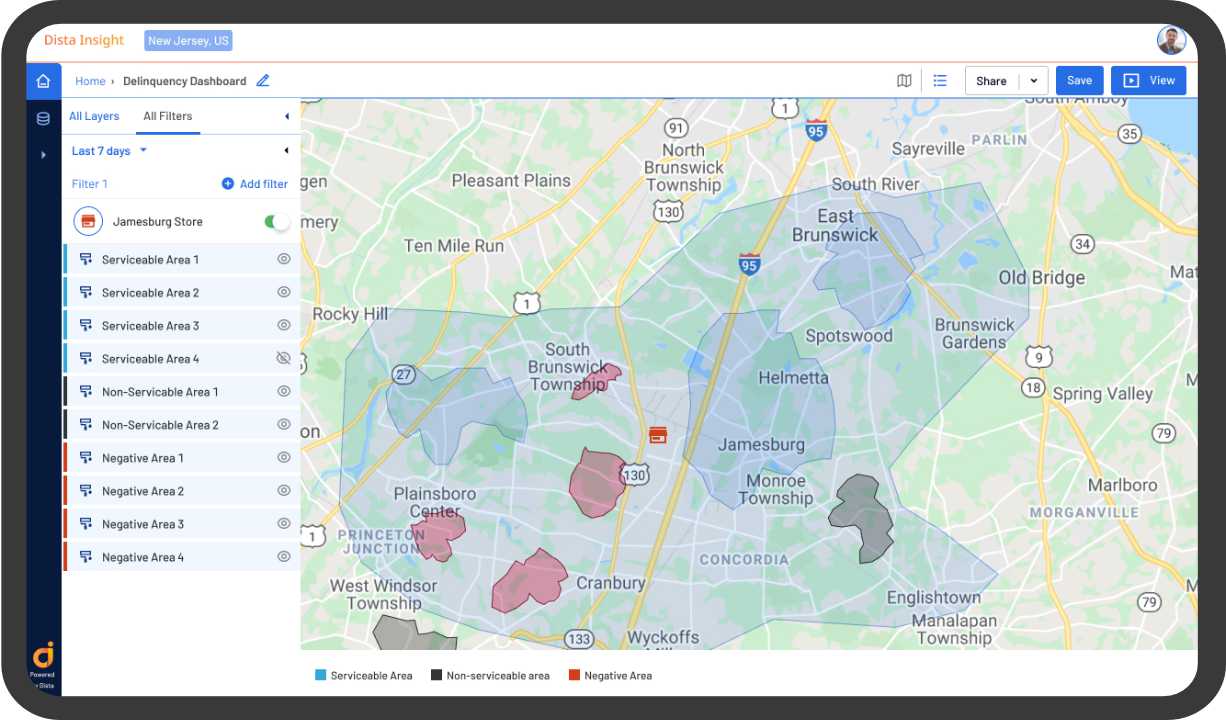

Territory mapping helps collection leaders accurately map field collection officers and prioritize customers. For example, promise-to-pay cases or delinquent cases are prioritized before any other case. Leaders can easily identify and classify high-delinquent zones to ensure effective underwriting and mitigate risks.

3. Branch Network Optimization

Managing and optimizing branch networks is critical to achieving seamless credit flow and catering to the high credit demand from underpenetrated geographical territories. There are two ways of network optimization: one is streamlining the existing branch network, and the second one is opening a new branch or moving branches.

NBFC and MFI companies usually map town centers around a branch. However, when firms find more centers around the branch, this center-to-branch mapping becomes more complex and inefficient. Sales and collection leaders manually align centers to branches without considering the distance between these centers or the distance between centers and the branch; the time field agents take to visit these centers, the road network, or the number of routes required to reach centers from the branch.

Dista Sales offers NBFC-MFI firms with a 3-step framework:

1. Visualize the existing branches, town centers, and the field agent tagged to branches on a map

2. Run simulations to identify the most optimal branch-to-center mapping by

- considering the number of agents aligned with a branch,

- number of centers aligned to a branch,

- branch catchment area

- distance between branch and centers

- distance between each center

- The average time taken by field agent to visit each center, etc

- Meeting days for each center

- Number of meetings required across centers

3. Using location intelligence, Dista Sales lays out an optimized branch network that aligns centers with different branches and ensures field agents don’t make any dead runs to a center far from the large cluster of town centers.

Watch the below video to know more about branch network optimization.

4. Route Optimization

Route optimization is a key use case for NBFC-MFI firms as they have a field-heavy operating model. Most NBFC and MFI firms have a large field force spread across bank branches. Typically, depending on the number of town centers tagged to a specific branch, field agents are assigned to each branch.

Field agents must visit different town centers daily to ensure they meet potential and existing customers. Maximizing engagement and increasing face time with customers is crucial to boosting credit flow. Location-first field force automation platforms such as Dista Sales offer a systematic and scientific approach to organizing and managing field agents with dynamic route optimization.

The platform considers multiple business constraints that affect travel time, distance, and customer face time. By leveraging powerful scheduling algorithms, it maps the shortest and fastest routes for field agents to visit centers. More importantly, the platform ensures that different field agents do not visit the same center.

Watch the below video to know more about route optimization.

The software optimizes visit frequency based on meeting days and times and optimizes the route for every center visit. It designs beat plans for sales and collection agents that map the sequence of visits by priority, proximity, collection amount, and more. Sophisticated beat plans are like personal guides for agents to help them navigate obstacles on the field, maximize sales coverage, increase collection throughput, and boost credit flow.

5. Risk Management

Risk analysis determines the future planning of NBFC and MFI firms. It directly impacts credit policy, underwriting, geographic expansion, and field resource allocation, among other things.

NBFC-MFI firms cannot afford too many delinquent zones in their portfolio. High delinquency directly impacts NBFCs’ credit growth and liquidity management, as it disturbs cash flow. Platforms like Dista Sales share a unique geospatial perspective to spot delinquency. The bigger advantage is using location intelligence to prepare and predict delinquency probability from different geographic clusters using historical data. NBFC and MFI firms can easily detect fraudulent activities and make faster decisions on preventing them from happening.

Conclusion

The above use cases cover the most critical functionalities for NBFC and MFI firms. It emphasizes the importance of location intelligence in debt collections, field force automation, managing field force activities, fraud detections and other. Moreover, features like automated case allocation, case address verification, and true visit compliance increases field operation efficiency.

NBFC-MFI haven’t taken the full advantage of location intelligence and face inefficiencies in their field operations. Using a location-first approach is essential to streamline field force management, improve collection efficiency, maximize sales coverage and boost true visits.