Merchant acquisition is the process by which banks and payment companies bring merchants into the digital payments ecosystem. It involves onboarding stores, cafés, and retailers into a system where they can transact, access credit, and stay

For banks, it involves building a digital ecosystem where merchants transact seamlessly, remain engaged, and create opportunities for cross-selling services such as loans, insurance, and current accounts.

While the opportunity is significant, execution is challenged by,

- Delays in onboarding

- Inefficient sales processes

- Limited real-time visibility

On the other hand, fintechs are rapidly expanding their merchant networks, increasing competitive pressure on traditional banks. To keep pace, BFS leaders must address operational gaps and adopt data-driven approaches.

The Business Case for Merchant Acquisition in Banking

Merchant acquisition has evolved into a critical growth pillar for banks. Its value lies in four key areas:

- Revenue Generation: The acquiring bank generates revenue through transaction fees, POS rentals, and cross-selling opportunities.

- Financial Inclusion: Digital readiness brings small merchants into the organised economy, supporting regulatory priorities and customer preferences.

- Competitive Differentiation: With multiple players targeting the same merchants, speed of onboarding, reliability of service, and ease of adoption become key differentiators.

- Ecosystem Development: Beyond payments, merchants act as gateways for bundled services such as working capital loans, current accounts and insurance.

How Location Intelligence Solves Merchant Acquisition Challenges

Merchant acquisition efforts often break down because of operational inefficiencies in the field. Conversations with sales leaders reveal three recurring hurdles.

1. Inefficient Lead Allocation

The Challenge

When leads are assigned manually, field agents often spend hours traveling across scattered geographies. This reduces the number of true merchant visits they can complete in a day.

Solution

Dista’s lead allocation engine factors in geography, proximity, skill, availability, and capacity before assigning leads. Merchants are always routed to the right lead, not just the nearest one. This reduces travel wastage, improves daily coverage, and ensures high-value leads get priority handling.

2. Merchant No-Shows

The Challenge

Field agents frequently reach merchant locations only to find shops closed or the owner unavailable, wasting both time and resources.

Solution

With optimized beat planning factoring in merchant business hours, location density, and historical availability, Dista helps agents plan and follow efficient and effective routes.

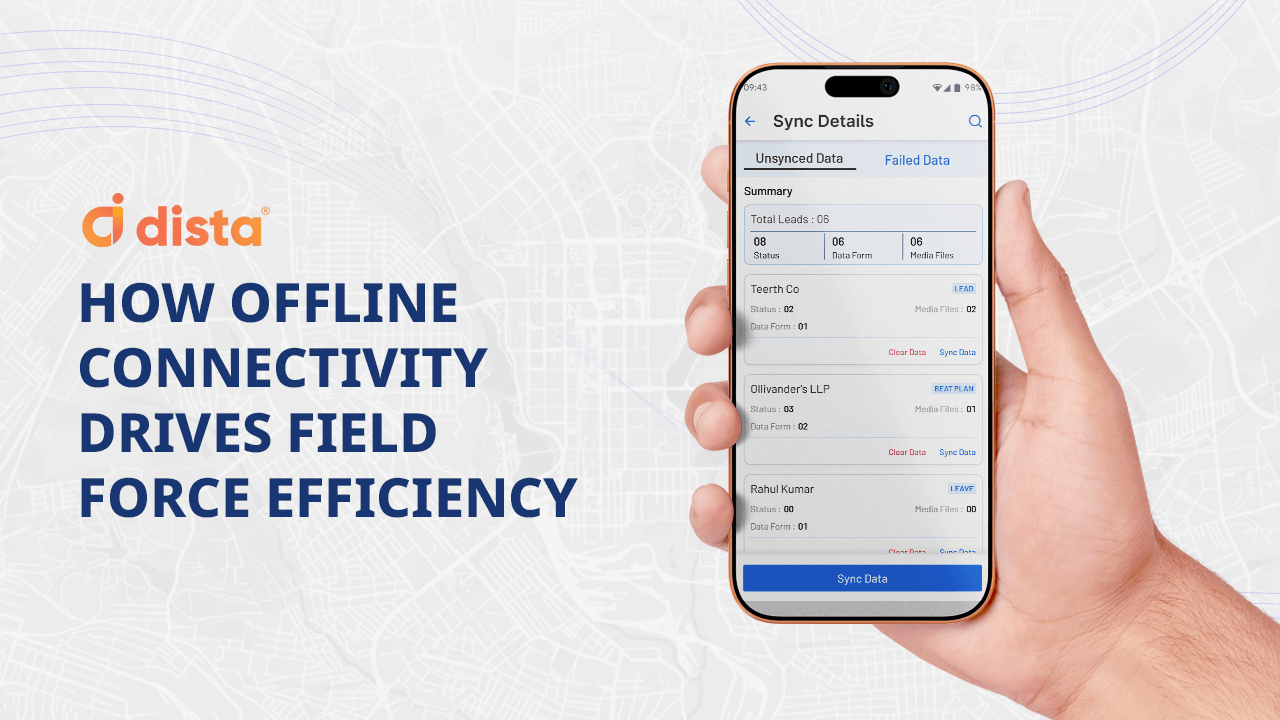

3. Limited Real-Time Visibility

The Challenge

Managers lack live insights into field agent productivity, visit status, and closure rates. By the time reports arrive, problems have already escalated.

Solution

Real-time productivity dashboards provide complete visibility into field operations. Managers can monitor pipeline health, see which visits closed, identify bottlenecks, and intervene instantly.

Proof in Action

A leading Indian bank used Dista’s merchant acquisition solution to automate lead allocation, digitise onboarding workflows, and provide managers with real-time dashboards. The results were faster onboarding, higher field agent productivity, quicker POS servicing, and improved merchant retention all powered by location intelligence at the core.

Future-Proofing Merchant Acquisition

Merchant acquisition has become a core growth pillar for banks and NBFCs. It drives payment volumes, brings small merchants into the formal economy, and deepens customer relationships through cross-sell.

Yet, scaling this opportunity demands more than adding sales teams. It requires:

- Smarter tools to maximize agent productivity and cut wasted effort

- Real-time visibility so managers can guide outcomes, not just track them

- Reliable servicing that builds merchant trust and long-term loyalty

Fintechs are already rewriting acquisition playbooks with speed and simplicity. To stay competitive, banks must evolve their own models—anchoring them in location intelligence and digital-first workflows.

The future of merchant acquisition will be:

- Intelligent: Data-driven, predictive, and proactive

- Mobile-first: Designed for field teams on the move

- Relationship-led: Focused on lifetime loyalty, not just transactions

This is where Dista makes the difference. By uniting AI, guided workflows, and location intelligence, Dista transforms merchant acquisition into a growth engine—delivering faster onboarding, more productive field teams, and stronger merchant retention.

Ready to see the impact for your business? Talk to our team today.