NBFCs and MFIs play a pivotal role in advancing financial inclusion in India, catering to a diverse customer base spread across varied geographies and socioeconomic segments. A majority of these firms operate in remote or semi-urban regions where challenges such as poor infrastructure, limited digital connectivity, and unpredictable repayment behaviours make debt collection complex.

Field Collection Executives (FCEs) form the backbone of the collections process, in this intricate landscape. Their ability to cover vast territories, engage borrowers in person, and ensure timely repayments is central to maintaining healthy loan portfolios. However, ensuring consistently high performance from FCEs is challenging due to the fragmented and traditional collection workflows.

Common Challenges of FCE management

- Manual processes: Field visits are often recorded manually, increasing the risk of errors or missed entries.

- Inconsistent follow-ups: Follow-up schedules rely heavily on individual discretion, which can lead to delays.

- Poor visibility: Managers lack real-time insights into agent movements, visit outcomes, or borrower interactions.

- Low visit compliance: Especially in remote areas, validating field agent visits is tricky.

These inefficiencies not only impact recovery rates but also reduce the overall field agent productivity.

Optimizing Field Collections Throughput with Location Intelligence

A McKinsey report suggests that adopting a location-intensive, AI/ML-powered approach can improve collections performance in NBFCand MFIs by up to 10%. This underscores the need for tech-enabled solutions that can bring structure, transparency, and efficiency to the field collections process.

Dista Collect is one such platform, built with location intelligence at its core. It unifies fragmented workflows, improves field visibility, and helps optimize FCE productivity by enabling smarter territory planning, route optimization, and real-time tracking. For institutions looking to scale their field operations without compromising on control or compliance, location-first platforms like Dista Collect offer a competitive edge.

NBFC leaders can move from simply reacting to overdue accounts to becoming proactive by employing strategically planned collection activities and executing them.

This proactive approach, driven by efficiency due to location-backed insights, leads to better collections and lower operational costs.

Key Applications of Location Intelligence for FCEs

1. Address Geocoding

NBFCs offering microloans to customers in Tier-1, Tier-2, and Tier-3 cities, often end-up with incorrect and inconsistent customer addresses. By using an address geocoding tool, they can eliminate invalid and incorrect customer data, verify customer addresses, and improve data accuracy. It provides accurate borrower locations, helps field collection officers (FCEs) visit more customers in a day, reduces travel time, and improves collection efficiency.

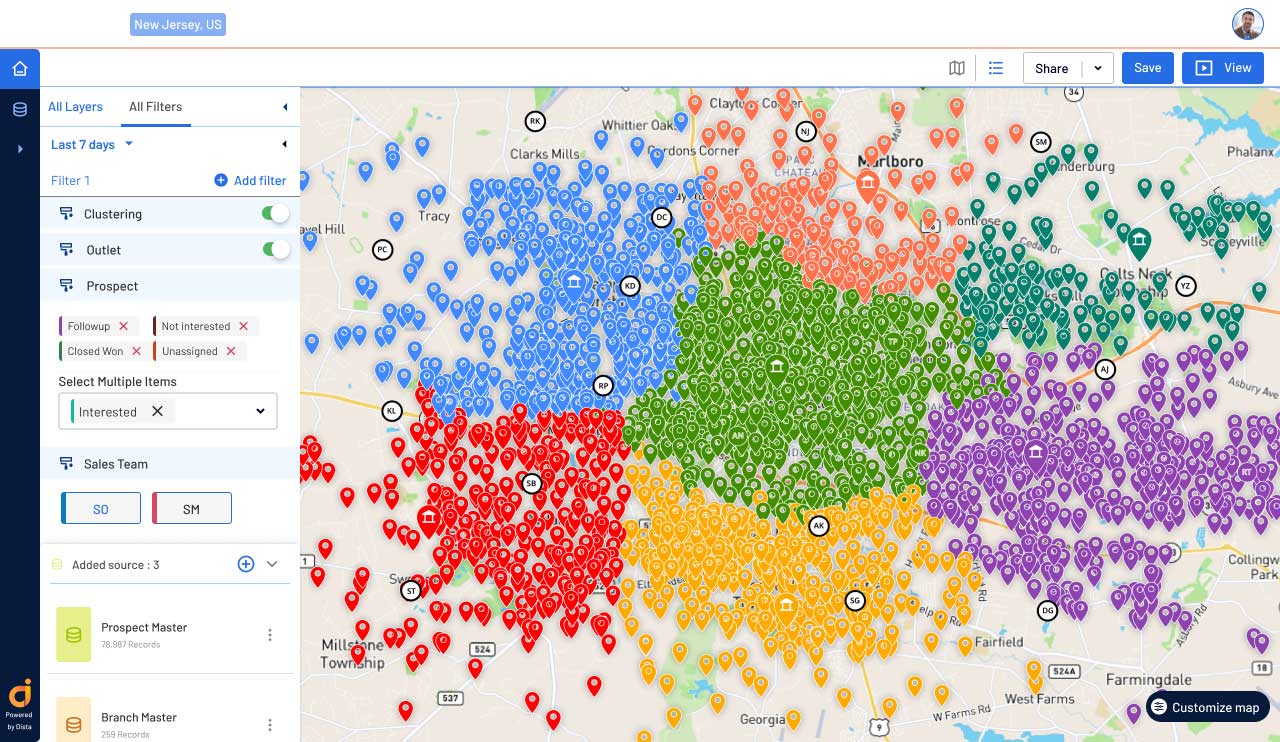

2. Auto Allocation of Cases to FCEs

Instead of random assignments, Dista Collect ensures that FCEs receive cases intelligently based on key factors that directly impact their effectiveness. This includes matching cases to their specific skills, minimizing travel by considering their current location and the proximity of assigned cases, according to their workload capacity and availability, and prioritizing high-impact cases. This means FCEs spend less time on less suitable cases and more time on those where they are most likely to succeed.

3. Route Optimization for Center Visits

FCEs need to make center visits for actioning their collection and debt collection cases. With regular business expansion initiatives, there is an increase in the total number of centers. However, NBFC firms can miss optimizing the routes of their FCEs as per the new centers and their location to the mapped branch. This results in FCEs taking longer routes and spending more time traveling and less time at the center meeting.

Dista’s AI-ML engine calculates the shortest and fastest routes by considering multiple variables and constraints, such as FCE location, the manager they are mapped to, and more.

Benefits of Location Intelligence in Field Collections

- Targeted and streamlined workflows with real-time access to borrower locations and account details

- Optimized routes and reduced travel times allowing FCEs to focus on core collection activities

- Increase in total number of successful collections per day.

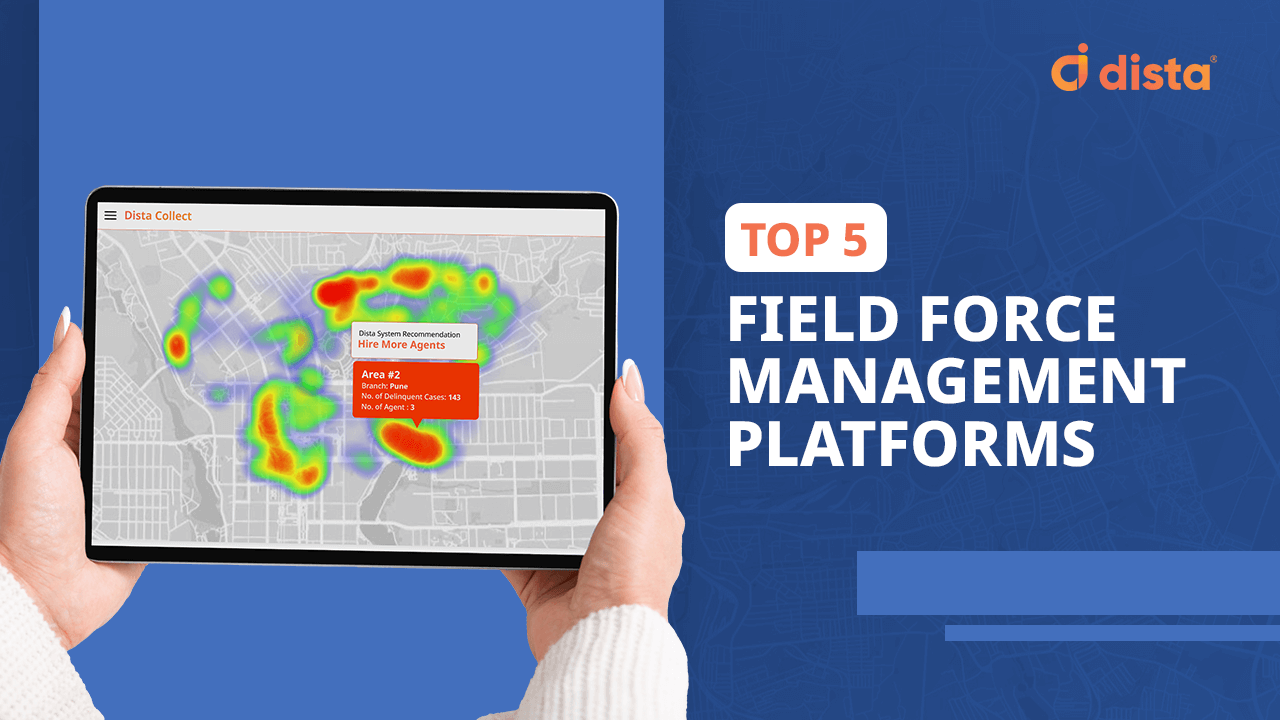

NBFCs leveraging a comprehensive field force management systems with location intelligence have reported up to a 10% improvement in overall debt collection rates.

Best Practices for Enhancing FCE and Collections Throughput

While location intelligence provides a crucial spatial dimension, its impact is amplified when integrated with other analytical strategies.

- Prioritizing High-Risk Accounts: Delinquency mapping, based on credit scores and location, can improve the accuracy of high-risk account identification allowing for focused field collection efforts.

- Developing Personalized Collection Approaches: Tailoring communication and payment options based on a borrower’s location and socio-economic profile can also increase the likelihood of successful negotiation and repayment.

Implement Location-first Collection Strategies

NBFCs must adopt innovative strategies to optimize debt collection. Location intelligence and digital tools are no longer just technological advancements; they are strategic imperatives. By embracing these solutions, NBFCs can empower their field operations, enhance efficiency, improve recovery rates, and strengthen debt collection efforts. The future of successful debt recovery for NBFCs lies in decoding the power of location and leveraging the capabilities of the digital age.

Interested in exploring how Dista Collect can help fine tune your field collection efforts? Get in touch with our team now.