Non-banking Financial Companies (NBFCs) and Microfinance institutions (MFIs) offer group and individual loans to people from rural areas to improve financial inclusion. There are two systems that process these loans – Group Loan Origination System (GLOS) for a group of individuals and Individual Loan Origination System (ILOS) solely for individuals.

The end-to-end process of offering micro loans comprises multiple steps including group and offer creation, loan workflows, setting up branches and centers, creating market penetration strategies, and more.

Typically, NBFCs and MFIs rely on manual methods or legacy systems to manage these complex and field force incentive processes. They also onboard tools like CRM or debt collection software that can have limited capabilities and fail to consider the location component to drive strategies.

Onboarding field force management software, with a location-first approach, like Dista Sales can enable them to streamline every step of loan processing. From setting individual agent targets to orchestrating their field visits, the software uses scientific methods to drive field operations.

In this article, let’s explore how field force management software supports various stages of loan processing, with data-backed insights.

1. Quota and Target Management

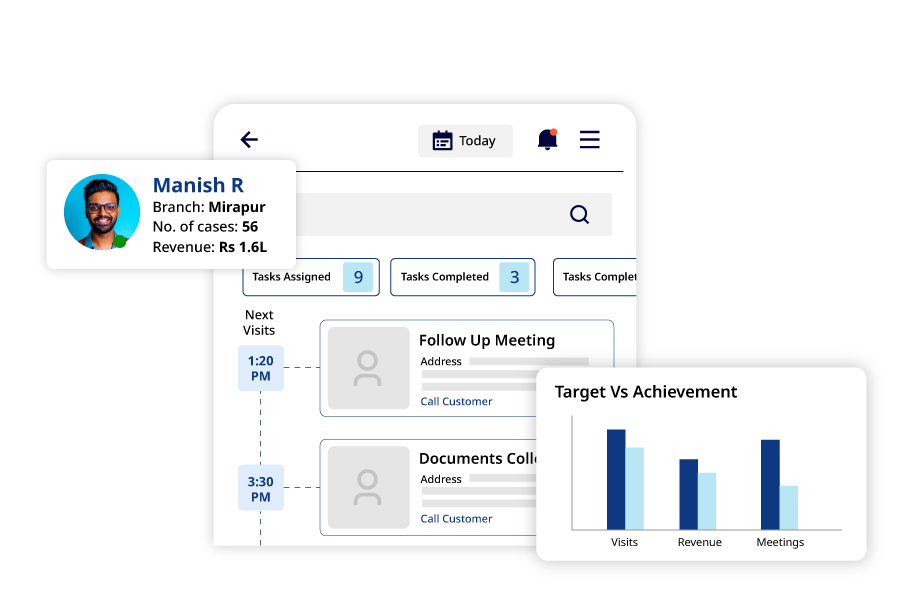

The field force management software offers a super app for field agents that acts as a mobile office. It enables them to complete tasks like lead actioning, up-selling to customers, tracking their quotas, targets, and more. Managers can set quotas and targets for the agents across regions, different hierarchies, depending on accounts, sales potential, and more.

It is an important KPI focusing on achieving revenue targets and measuring agent performance against them. Dista Sales offers a dashboard showcasing target.vs.achievement enabling managers to track individual and team achievement and coach their team in the right direction.

By closely monitoring target vs. achievement, leaders can take proactive measures to drive revenue, identify areas of improvement, and ensure sales teams consistently meet their goals.

2. Incentive Management

An incentive meter is used extensively by MFIs to help their field teams track and manage their incentives. Some common targets field agents have are – individual and group loan targets and collection and delinquency targets. The field agent app showcases incentive buckets for easier tracking.

3. Gamification and Leaderboard

Agents can check their targets vs achievements related to conversion or the total amount of collection in their mobile app.The system creates leaderboards to improve agent accountability and reward top performers. Recognize sales reps based on deal acceleration, prospect interactions, and boost productivity.

A leaderboard displays the top agent performers’ metrics, rankings, and achievements. Keeping score creates healthy competition among team members, helps boost their morale, and keeps them motivated in the field.

4. Route Optimization

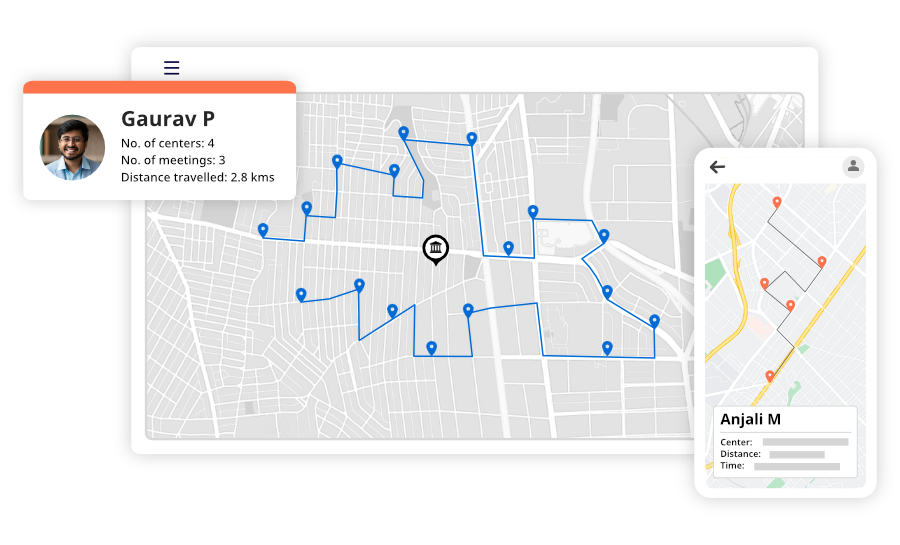

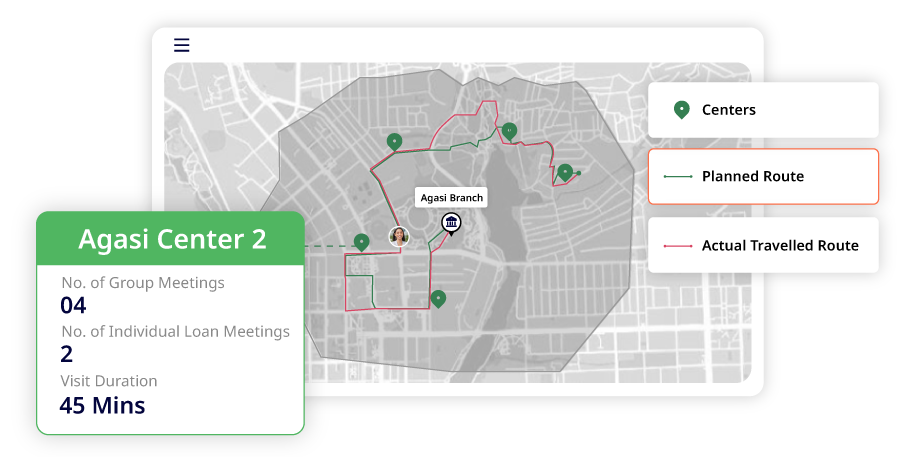

Typically, field agents are assigned to a branch depending on the number of town centers tagged to that specific branch.

As part of their cadence, field agents need to regularly visit different town centers daily and meet prospects and existing customers. Maximizing engagement and increasing face time with customers is crucial for debt collection and tapping more customers. Platforms such as Dista Sales offer a systematic and scientific approach to managing field agents with dynamic route optimization.

The platform considers multiple business constraints that affect travel time, distance, and customer face time. By leveraging powerful scheduling algorithms, the system runs multiple simulations to find the shortest and fastest routes for field agents to visit centers. It also ensures to reduce dead runs and that different field agents do not visit the same center.

5. Expense and Reimbursement

Field agents spend a large portion of their time doing administrative tasks like filing fuel expenses. Moreover, manually calculating and verifying fuel expenses can be inaccurate and cumbersome.

With field force management software, the system automatically generates detailed accurate reports of total distance traveled by agents and speeds up the reimbursement. This helps agents spend more time in meeting customers and completing their daily tasks.

6. Smart Nudges

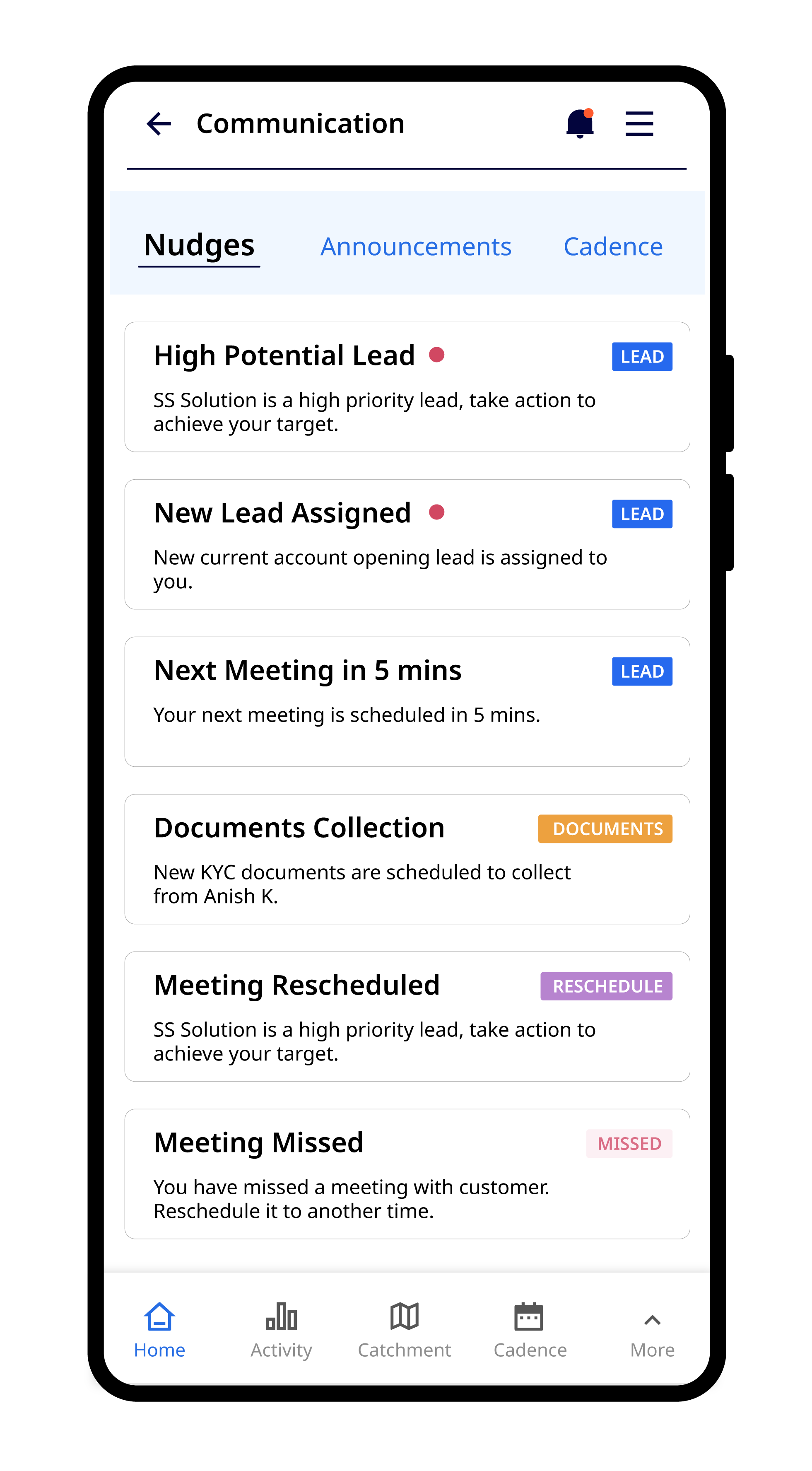

Field agents have a range of tasks they need to complete in a day. An AI-powered system recommends next-best actions to agents via real-time contextual alerts, meeting priority customers, collecting documents, upselling, and more.

Timely notifications and reminders enable agents to improve lead or case actioning and complete tasks. It improves task management with prioritization.

7. Chat and Coaching

Managers can chat with agents and guide them with any tasks instantly via the agent super app. They can create quizzes for agents and upload training videos for helping them on-the-go.

8. Meeting Compliance

One of the top challenges managers face is to validate whether agents conducted center or customer meetings. Location-first field force management like Dista Sales sets geofences near the center meeting or customer’s address. The system sends geofencing alerts to the manager when the agent enters or exits the location.

Longer center meeting duration indicates the agent has spent time in customer engagement. The system also sends reports of agent’s idle time vs productive time, helping managers improve agent productivity and performance.

Final Thoughts

NBFCs and MFIs are on a mission to improve financial inclusion in India. According to a latest report from KPMG, NBFCs contributed the highest growth of 45% YoY, and loans worth ₹54,292 crore were disbursed in aspirational districts during FY 2023-24.

A comprehensive field force management tool like Dista Sales is empowering modern NBFCs and MFIs to streamline their field operations with the power of location intelligence.

Learn more about our platform with a free demo.