Key Takeaways

Optimize Territories and Enhance Coverage

Implement location-enabled field force software to design equitable territories using simulation‑based clustering. This approach helps balance workloads, reduce travel time, and maximize customer face time.

Leverage Catchment Insights for Smarter Resource Allocation

Visualize customer density and demand patterns around branches or ATMs to pinpoint high-potential zones. These geospatial insights guide field operations, ensuring targeted engagement and effective deployment of resources.

Automate Debt Collection with Intelligent Routing and Case Allocation

Use AI/ML-driven logic to auto‑assign cases based on proximity, agent skills, and priority. By crafting location-driven beat plans, agents travel less and meet more customers—boosting collection efficiency.

Drive Expansion through Data-Backed Site Selection

Combine demographic, customer, and foot-traffic data to identify whitespace opportunities. Overlaying this with competitor mapping enables BFSI institutions to pinpoint high-demand locations for new ATMs or branches before rivals do.

The Banking, Financial Services, and Insurance (BFSI) companies have a large team of field agents that regularly meet prospects, customers, and borrowers to boost penetration, maximize sales, and expand customer coverage. However, managing them is a major challenge as they are responsible for multiple tasks like doorstep services, cash management, debt collection, account hunting and farming, and more.

Manually managing the field agents and tracking their activities without a scientific and systematic method hampers their productivity. Using field force management software that ingests the location component with your data, streamlines BFSI operations and improves customer service.

Let’s learn more about the key areas where location intelligence elevates field agent productivity and maximizes coverage.

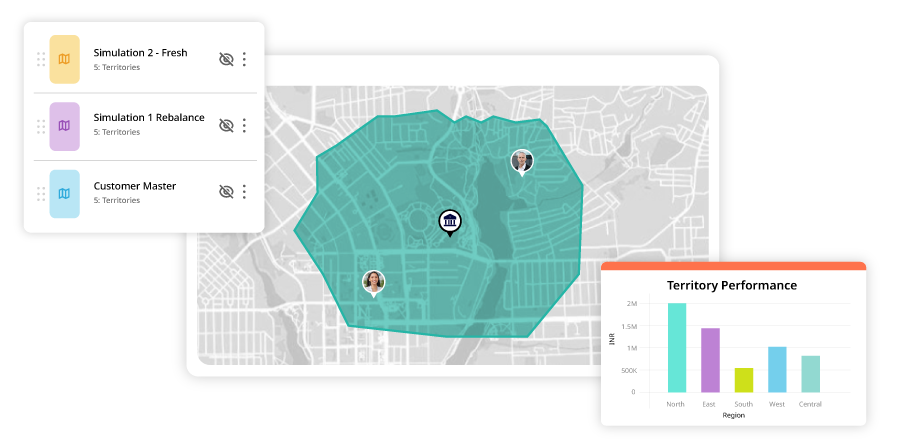

1. Territory Management

Sales territories expand regularly, and to improve penetration and reach more customers, banks and financial institutions need to improve territory planning. A report from SMA Research says, nearly 65% of organizations struggle with inadequate sales territory planning and design.

With field force management software like Dista Sales, banks, NBFCs, and MFIs can design equitable territories to balance sales and collection workloads among field agents.

The system runs multiple simulations to design optimized area clusters and map them with agents to improve customer coverage, reduce their travel time, and improve customer face time.

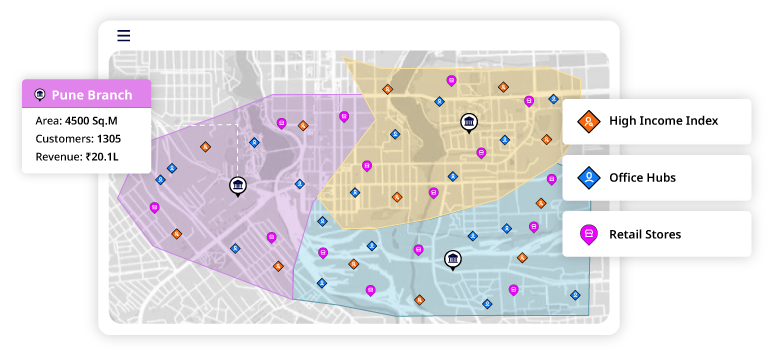

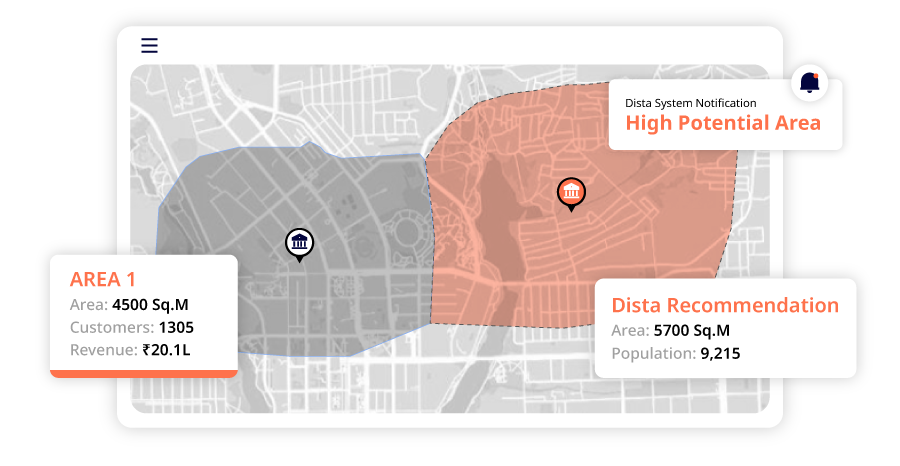

2. Catchment Area Analysis

Catchment area analysis is vital for banks to understand customer distribution, identify high-demand regions, and optimize resource allocation. With location-first, field force management software offers visual insights by plotting prospects and customers on a map. This helps them visualize catchment areas around branches or ATMs, identify zones with high customer density, and more.

They can identify areas with low/high customer density, demand, high potential, and more. By using these geospatial insights, decision-makers can tweak their field operation strategy and improve customer engagement.

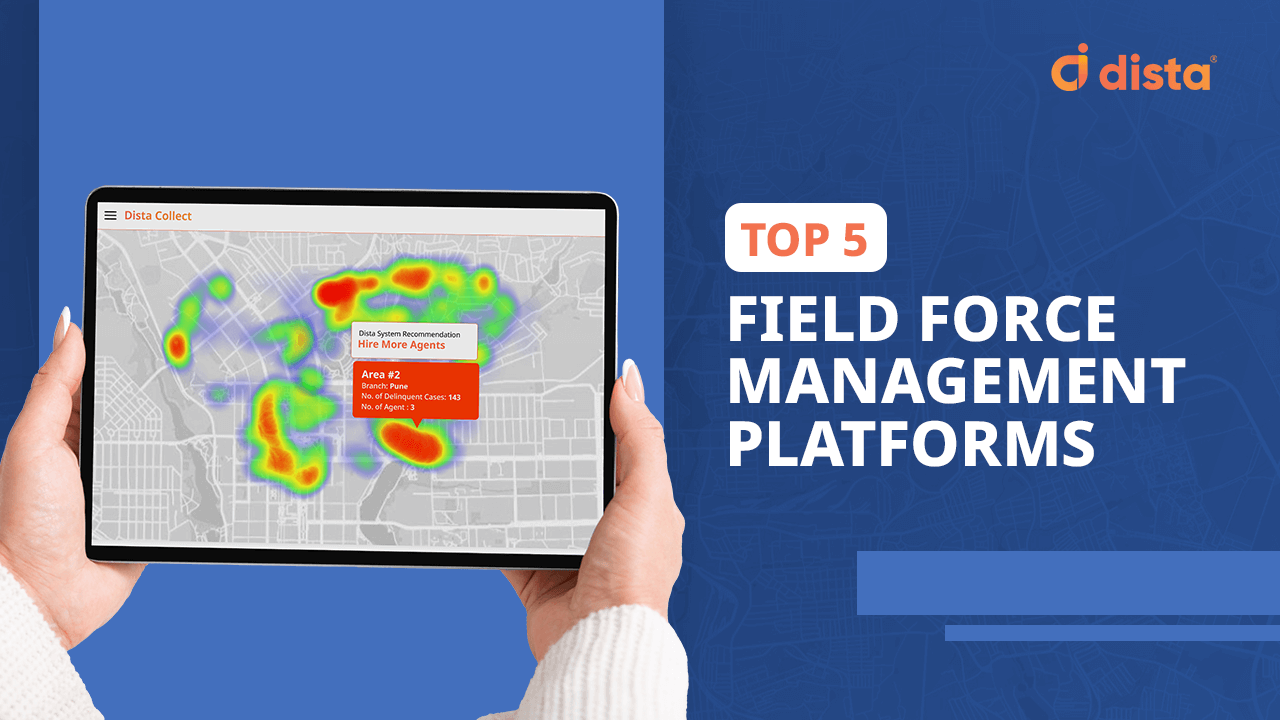

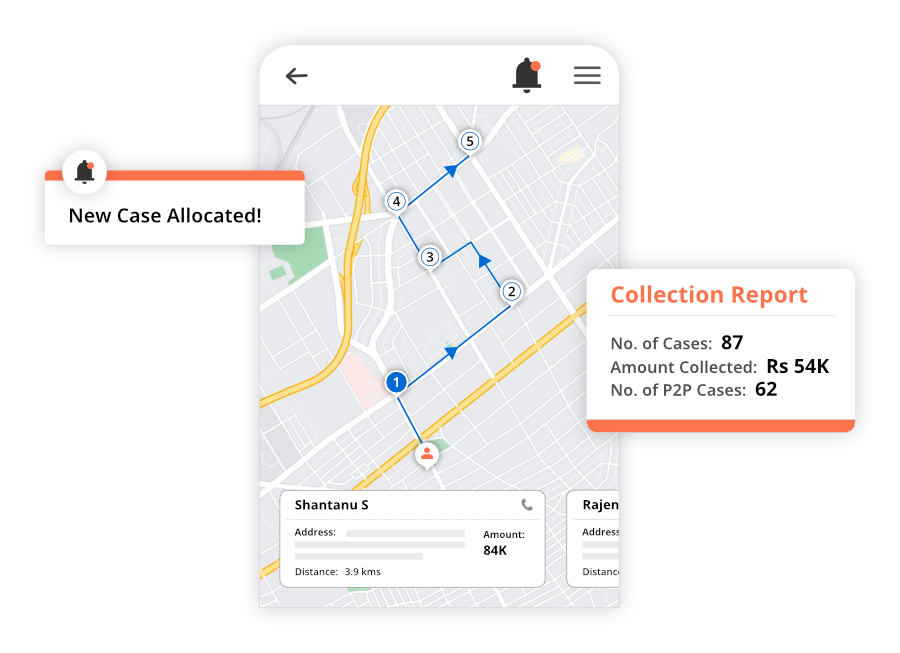

3. Debt Collection and Recovery

For NBFCs and MFIs, debt collection and recovery are critical to maintaining cash flow and minimizing loan defaults. Their team of field agents needs to regularly meet with prospects and borrowers to expand their portfolio and facilitate smooth collection operations. Using field force management software like Dista Sales, they can automate and orchestrate the debt collection process by using AI/ML-based algorithms.

The system auto-allocates cases to the right agent by factoring in multiple variables like skillset, proximity, priority, and more. The software creates location-driven beat plans to reduce agent travel time, which helps them meet more customers daily and increase face time.

4. Site Selection

Site selection is crucial for banks, NBFCs, and MFIs aiming to expand their physical presence through ATMs or branches. Field force management software with location-first insights offers a data-driven approach, ensuring new locations meet customer demand and business goals.

It analyzes multiple data points, including population density, customer demographics, foot traffic patterns, and competitor locations.

By overlaying demographic data with existing customer profiles, financial institutions can identify high-demand zones that align with their target audience. The software enables leaders to visualize competition and existing business on an intuitive map to identify whitespaces. Leverage lead density, demand patterns, and customer presence to find the optimal location before the competition.

Final Thoughts

Field force management software is transforming BFSI operations. It enables organizations to automate and streamline their field activities, improve agent productivity, and enhance customer coverage.

If you want to get fresh insights on the field sales challenges of BFSI leaders, download our exclusive report here.

Get in touch with us to see Dista Sales in action.

Gartner Peer Reviews: Dista Sales