A geo-intelligent operating model is no longer a luxury; it is a core requirement for success in industries like BFSI, telecom, logistics, and last-mile services. Field teams today manage larger territories, operate under stricter SLAs, and face higher customer expectations than ever before. While many organizations have digitized their dispatch processes and standardized workflows, performance often varies dramatically across different markets.

Why Field-Force Management Needs a Location-First Approach

The missing element in efficient field force management is often geospatial intelligence. Critical factors like travel patterns, micro-market density, traffic volatility, and last-mile reachability are often left out of traditional planning models. This gap creates operational challenges that impact efficiency, costs, and customer satisfaction.

Leaders often recognize the symptoms of this problem before pinpointing the root cause.

Here are 8 key indicators that your field-force strategy needs to be location-first.

1. Indicator 1: Excessive Travel Time in Field Operations

Field staff can spend a significant portion of their day—often 30-40%—simply traveling. This is time that could be spent on value-added customer interactions. If your team’s “windshield time” is consistently high, it’s a clear sign that route and territory planning are not optimized.

2. Indicator 2: SLA Volatility Due to Inefficient Routing

Unpredictable traffic and inefficient routing can wreak havoc on service commitments. Even well-staffed teams will struggle to meet Service Level Agreements (SLAs) if their routing models don’t account for real-world travel conditions. This volatility not only frustrates customers but also puts constant pressure on your field teams.

3. Indicator 3: Imbalanced Territories and Poor Capacity Planning

When sales or service territories are drawn up based on managerial discretion rather than data, imbalances are inevitable. One team member might have a few appointments scattered across a wide area, while another handles a dense cluster of visits in a fraction of the time. This makes accurate capacity planning and fair workload distribution nearly impossible.

4. Indicator 4: Low First-Time Fix Rate in Field Visits

A low first-time fix rate is a common and costly problem. It’s often caused by a combination of factors: dispatching a technician without the right skills for the job, providing incomplete customer information, or assigning tasks so far apart that the technician is drained of bandwidth before even arriving. Each failed visit erodes customer confidence and compounds the team’s workload.

5. Indicator 5: Rising Cost-Per-Job from Inefficient Travel

For any high-frequency field operation, fuel and travel distance are major cost drivers. Many teams still rely on manual routing, a practice that directly leads to higher operational expenses. If your cost-per-job is climbing, inefficient travel is a likely culprit.

6. Indicator 6: Frequent Dispatch Disruptions

Unexpected events like agent drop-offs, sick leave, or sudden workload spikes require immediate adjustments. Without a real-time view of your team’s location and capacity, re-routing becomes a chaotic process that leads to longer detours, reduced daily output, and a higher risk of missing SLAs.

7. Indicator 7: Unreachable Locations and Last-Mile Address Issues

Inaccurate addresses, especially in smaller towns or remote areas, are a persistent drag on productivity. These “last-mile” challenges result in missed visits, time-consuming follow-ups, and wasted travel, directly impacting sectors that rely on physical verification or on-site installations.

8. Indicator 8: Workflow Failures in Low-Connectivity Areas

Field operations can easily break down in areas with poor network coverage. When workflows depend on live connectivity for updates, task closure, and evidence capture, delays are inevitable. This creates operational blind spots and stalls customer resolution.

The Operational Impact of a Location-First Field Model

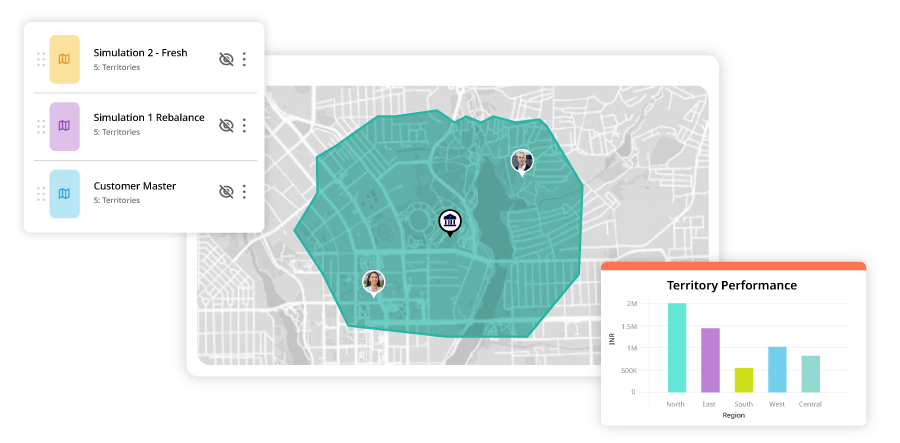

Adopting a location-first framework moves your operations from being reactive to proactive. It replaces ad-hoc routing and manual decision-making with a unified model where geography, demand, and capacity are synchronized.

This leads to tighter planning, faster execution, and more predictable customer outcomes. Location intelligence empowers you to optimize every stage of the field cycle, from initial planning and allocation to routing, performance tracking, and on-the-ground execution.

Build a Geo-Intelligent Field Strategy With Dista

As service areas expand and customer expectations grow, organizations can no longer afford to rely on intuition-led planning. The impact of leveraging location intelligence compounds across your entire field force, leading to a lower cost-per-job, more stable SLAs, and stronger customer trust.

If your organization is ready to transition to a predictive, precision-led field operations model, Dista’s location-intelligent platform can help you bridge the gap.

Explore how Dista can unlock higher productivity, sharper territory planning, and faster closure rates—all powered by real-time location intelligence.