Banks and NBFCs don’t lose money because customers miss one EMI. Debt collections suffer when poor communication strategy keeps the right agent from reaching the right borrower at the right time.

At a time when regulatory scrutiny by RBI is at its highest and customer expectations are on the rise, communication is a strategic lever for effective debt collection. It can also help you hire better, operate leaner, and reduce delinquency. Modern debt collection platforms need to facilitate personalized, timely, and empathetic outreach.

Why is Strategic Communication Important in Debt Collections

Traditional communication in debt collection was linear—send a reminder, wait for response, escalate to field staff, if the EMI was still unpaid.

However, this approach leads to missed opportunities and mounting costs due to the strain on field resources, rising early-bucket volumes, and compliance scrutiny.

Here’s what that looks like in numbers:

- On average, 35–40%* borrowers never pick up the first call or respond to generic SMS reminders.

- Field visits can cost ₹120–₹300* per case when unplanned, especially in semi-urban or rural zones.

(Data obtained from independent sources in the industry.)

Also Read: Top 5 Debt Collection Software for 2025

The difference between a collected EMI and a write-off often boils down to whether the right borrower was contacted through the right channel, at the right moment.

Yet, many collection teams still rely on blanket SMS blasts, repetitive calls, or sporadic field efforts without the intelligence to guide who to reach, when, and how. That lack of unified direction leads to bloated costs, agent inefficiency, and missed recoveries.

How Does Dista Collect’ s Strategy Builder Optimize Your Communication Strategy?

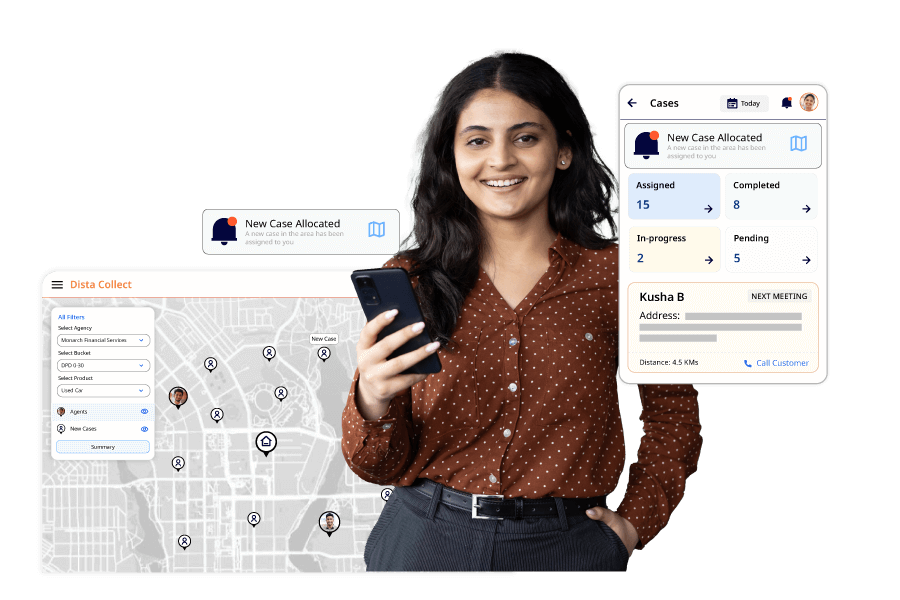

Dista Collect is a location-powered, end-to-end debt collection software built to manage everything from early delinquency to settlement and repossession through a combination of digital and field channels. It brings together AI-powered case allocation, geo-based field force planning, agency coordination, digital outreach, and RBI-compliant audit trails into a single system.

The Strategy Builder feature in Dista Collect orchestrates communication strategies that can drive positive collection outcomes. Every borrower responds differently. The timing, channel, and message can determine whether an EMI is recovered or missed.

The Strategy Builder manages this complexity with precision. It allows you to automate and optimize borrower engagement strategies across the entire delinquency lifecycle according to your business rules and constraints.

Here’s what it enables collection head and strategy managers to do:

1. Execute Communication Journeys

Design and implement automated digital and physical outreach based on risk segment, repayment history, and borrower response. These strategies adapt in real time as borrower behavior evolves.

2. Accurate Contextual Nudges

Leverage behavioral, temporal, and external signals like salary credit days, previous payment dates, or even weather disruptions to send the right message, at the right time, through the right channel.

The strategy manager in Dista Collect, can ingest all this information, formulate journeys, and deploy them to the centralized agency dashboard powered by Customer 360.

3. Optimize Case Allocation

Cases are auto-assigned to the most relevant agent based on business demands and SPACE framework. These can also change dynamically as collection efforts evolve. This ensures efficient routing and improves the likelihood of true visits.

4. Dynamic Prioritization

Through a centralized dashboard and Customer 360, telecallers see a ranked list of borrowers to contact. The segmentation is driven by repayment likelihood, past contact outcomes, and time-sensitive events. It reduces guesswork and ensures every call counts.

Communication is a Strategic Lever, not a Script

Debt Collection is about deploying effort where it truly matters; knowing precisely who to reach, when, and how.

This cannot be a script, it is the foundation of an effective collection strategy. For your team, this translates directly to reducing NPAs, increasing PTP rates, and fostering stronger relationships, all while ensuring compliance.

Let’s talk about how Dista Collect can help you accelerate recoveries with an empathetic, intelligent, and efficient strategy.