The modern debt collection process is more than just follow-ups and payment reminders. As banks, NBFCs, and microfinance institutions expand their reach, daily operations have become more complex with rising borrower diversity. On one hand, multiple tools are promising similar outcomes, while existing legacy systems lack the agility to scale, automate, and adapt.

Therefore, choosing the right debt collection software is mission-critical to improve recovery

rates, boost agent productivity, and maintain compliance. To future-proof your recovery operations, here is what you should look for in a modern debt collection platform.

What Features to Look for in Debt Collection Software

1. Location-first Field Operations

Collections in home and vehicle finance still depend heavily on in-person visits. To improve the quality of these visits, field collectors need a dedicated app. Field collectors use a mobile-first app to power geo‑tagged visit tracking, automatically capturing precise location, photos, and borrower signatures. With dynamic beat planning and real-time route optimization, agents execute more verified visits per day, ensuring first-visit resolutions.

The app works offline, syncing data seamlessly once connectivity returns, and provides real‑time status updates along with digital proof of visit. As a result, managers gain instant, transparent visibility into field outcomes, accelerating recovery timelines and boosting operational efficiency.

2. AI-enabled Workflow Automation

Modern debt recovery demands a high-performing debt collection software that offers automation. The platform should allow you to configure rule-based workflows that dynamically adapt to borrower behavior, risk segments, and account aging.

AI-powered engines should be able to trigger borrower communications, escalate unresolved cases, and automatically reassign follow-ups, eliminating the need for manual intervention. This ensures that no case slips through the cracks. By automating repetitive tasks, institutions can significantly reduce operational overhead while improving recovery accuracy and scalability.

3. Omnichannel Communication

Companies also need to engage borrowers through their preferred channels. The software should unify SMS, WhatsApp, email, voice, and IVR into a single interface. This reduces context-switching for agents and improves the customer experience.

Features like click-to-call, outcome tagging, and auto-logging of interactions enable seamless tracking, reduce drop-offs, and support audit-readiness.

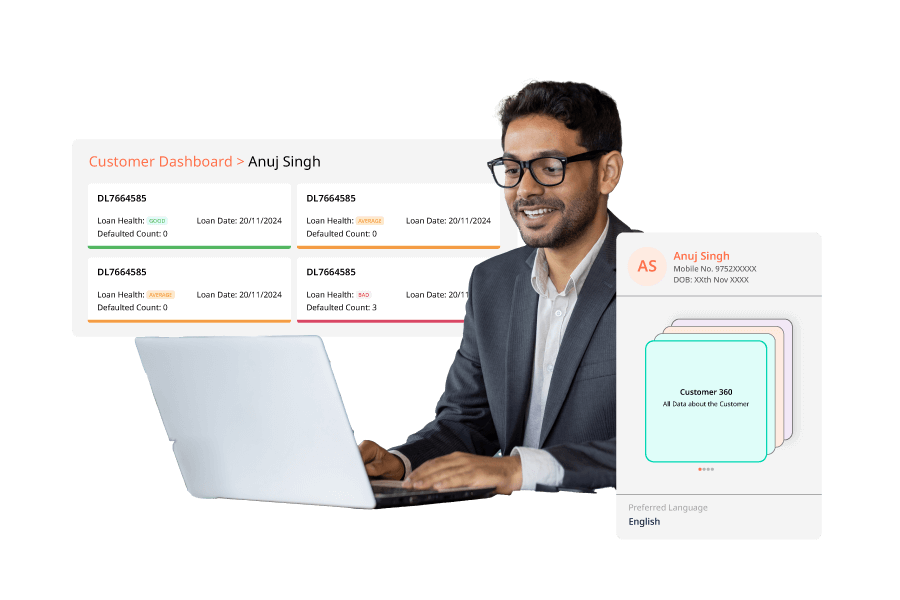

4. 360° Customer Overview

Effective collections require complete visibility into each borrower’s status, history, and interaction trail. A robust platform should offer a unified view of all account details, past payments, communication logs, field visit outcomes, promises to pay, and segmentation status in one place.

This centralized context allows agents and managers to make informed decisions faster, reduces repetitive communication, and improves the borrower experience. Whether the interaction is digital, telephonic, or on-ground, everyone should be working off the same real-time data.

5. Security & Compliance

Ensure your debt collection software offers a robust platform security with regular VAPT, is SOC 2 Type II certified, and is ISO 27001:2022 compliant. It should support data encryption, role-based access, and multi-factor authentication, while aligning with RBI guidelines. These standards ensure data protection, regulatory compliance, and build lasting trust.

6. Seamless Integrations

Scalability and interoperability are essential for growing BFSI and MFI operations. A modern debt collection platform should offer plug-and-play APIs for integration with CRMs, loan management systems, ERPs, and payment gateways.

Each module field, telecalling, analytics, and communication, should work independently or together, allowing phased rollouts without disruption. This modularity ensures faster deployment and long-term flexibility as your collections evolve.

Why Top Lenders Are Choosing Unified Debt Collection Platforms

Managing collections with different tools for field visits, communication, and tracking is a high-cost affair. High-performing banks, NBFCs, and MFIs are onboarding a comprehensive debt collection management software like Dista Collect. With location intelligence at its core, the low-code/no-code platform strengthens the collection process, accelerates recovery, and drives collection throughput.

Want to transform your debt collection process? Get in touch with us to see Dista Collect in action.