Key Takeaways

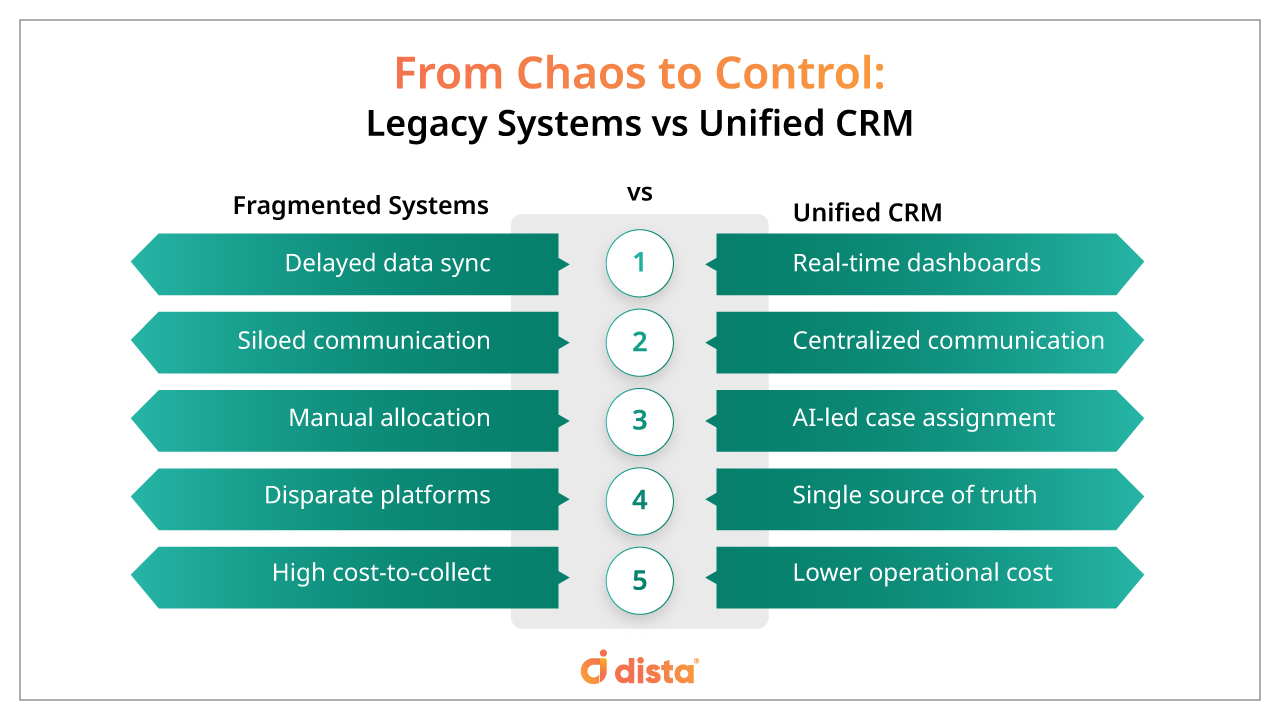

- Fragmented systems create critical delays in collections, hinder borrower engagement, and elevate operational risk, especially in the face of rising GNPA trends.

- Dista Collect unifies the entire debt recovery journey—from pre‑due reminders to repossession—using a location‑first CRM that centralizes borrower data, communications, and workflows.

- The platform supports intelligent, hyper‑local case routing, optimized beat planning, digital settlements, and a full audit trail—all powered by Customer 360° insights.

- Institutions leveraging this unified system benefit from enhanced real‑time visibility, compliance, productivity, and significantly improved recovery efficiency across stages.

As NBFCs and MFIs navigate the evolving credit landscape, the need for a unified debt collection CRM is apparent. Despite a temporary dip in Gross Non-Performing Assets (GNPA) to 4.0% in March 2024, FY2025 has brought renewed stress. Many mid and large players still rely on siloed, legacy systems that hinder visibility, delay actioning, and soar recovery costs.

Challenges such as inconsistent borrower assessment, insufficient early warning systems, and weak credit underwriting continue to impact collections. Given the diversity of loan products and repayment behaviours, operating without a unified collections system is no longer an option, but a necessity.

A unified debt collections CRM is the operational backbone required to ensure speed, compliance, and control across the collections lifecycle.

Role of a Unified Debt Collection CRM

The core strength of a unified debt collections CRM lies in its holistic integration of the data, systems, and processes. Centralizing loan and delinquent data, communication channels, and field collections into a single platform, empowers banks, NBFC, and MFIs to streamline the debt collection process.

Key Challenges with Fragmented Debt Collections

1. Delayed Access to Real-Time Collections Data

Situation: Collection teams often rely on fragmented legacy systems where key metrics like delinquency status, cash collection, repayment updates, and agent performance data are updated in batches rather than in real-time.

Impact: This lag hinders proactive decision-making and disrupts performance tracking as the borrower information may be outdated; ultimately slowing down recovery cycles and reducing the portfolio health.

2. Inequitable Case Distribution

Situation: Industry experts opine that on average a field agent can handle 50 cases per month. However manual assignments, especially for high-risk or geographically dispersed accounts, lack logic-based routing based on workload, capacity, or performance.

Impact: Some agents are overloaded while others remain underutilized. This inefficiency lowers morale, reduces collection throughput, and fails to maximize field team ROI.

3. Suboptimal Route Mapping

Situation: Field collectors operate without real-time routing tools integrated with borrower locations, case priorities, and live updates on repayments.

Impact: This results in increased long distance travel, missed borrower visits, higher fuel costs, and an inability to reprioritize based on dynamic field realities, directly impacting agent productivity.

4. Risk Compliance Due to Disjointed Systems

Situation: Regulatory adherence to RBI mandates requires consistent documentation, consent tracking, and audit readiness. However, collections teams are hampered by siloed platforms and manual processes.

Impact: Without clear processes and checks, NBFCs and MFIs are more likely to face compliance issues, be unprepared for audits, and risk financial penalties.

5. Lack of Centralized Communication System

Situation: Interactions with borrowers – calls, emails, SMS, WhatsApp, and field visits are not recorded or are synchronized across channels.

Impact: Field collection officers can duplicate records or miss follow-ups. This weakens engagement strategies and impairs campaign effectiveness.

6. No Single Source of Truth

Situation: Critical borrower data such as loan history, contact details, and repayment behavior is scattered across CBS, LOS, and third-party systems without consolidation.

Impact: This leads to field collectors and managers spending significant time reconciling data, leading to operational blind spots and delayed decision-making.

7. Higher Collections Cost Due to Disparate Systems

Situation: With a lack of a centralized debt collections CRM, teams operate across platforms for communication, reconciliation, and reporting. Telecalling units, field agents, and backend teams lack access to unified borrower profiles and message history, leading to disjointed workflows.

Impact: This approach drives up operational overheads such as increased headcount, IT maintenance, and risk compliance. Recovery teams struggle to personalize outreach efforts, resulting in a higher cost-to-collect.

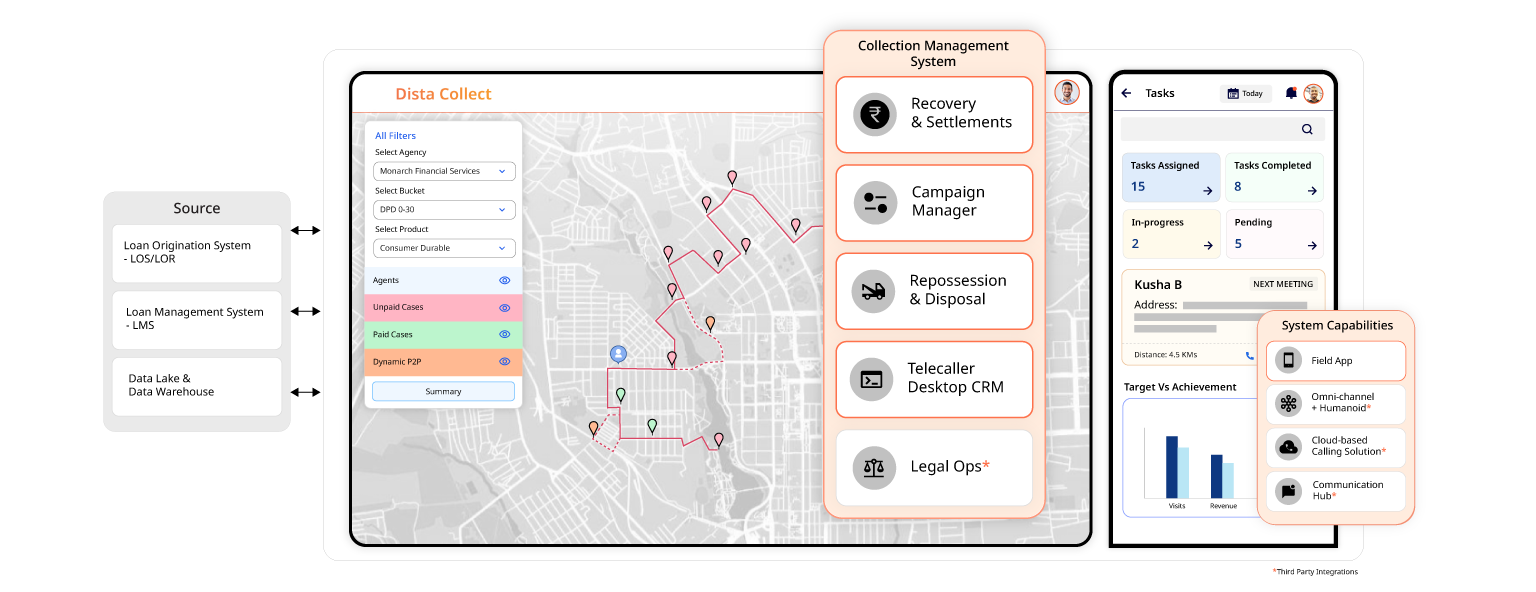

Dista Collect - A Unified End-to-End Debt Collection CRM

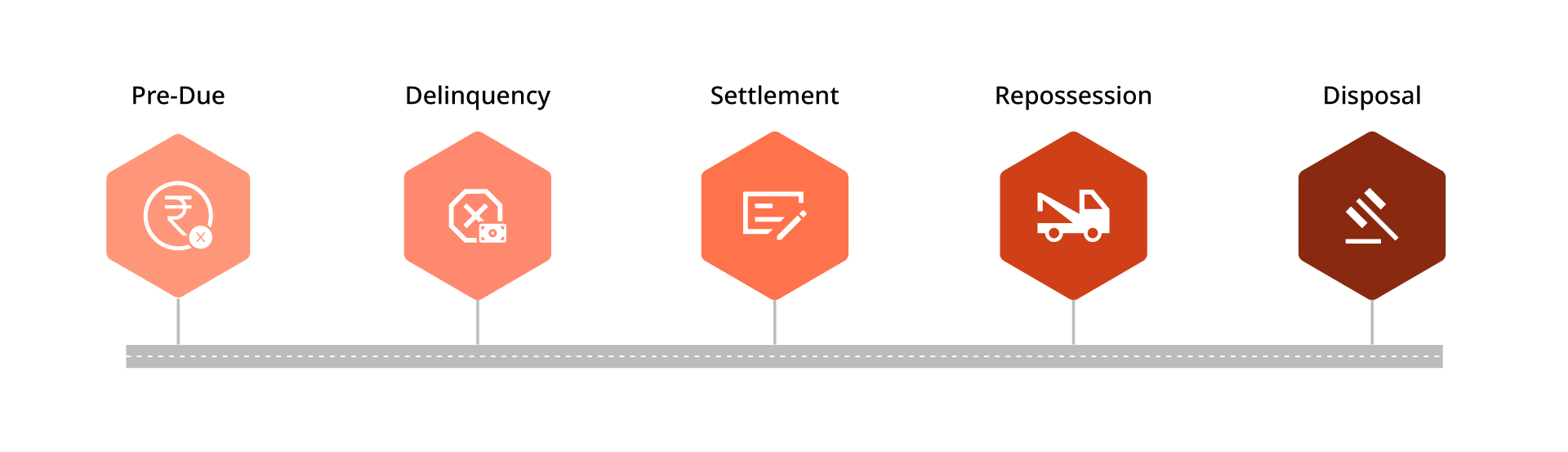

Dista Collect is a unified collections CRM designed to streamline the debt recovery lifecycle. Built with location intelligence at its core, the platform enables collection heads to manage every stage of debt collection, from early communication and digital reminders to post-default resolution.

- Reduce Early Delinquencies

Dista Collect strategically consolidates and automates outreach via digital channels such as chat, SMS, and email. This enables the system to send timely reminders and personalized interactions based on loan type and repayment history to avoid early delinquencies and boost recovery rates.

- Location-powered Case Allocation

The platform enables lenders to assign right customers to right field agents based on hyper-localized clustering based on business scenarios. It supports both static and dynamic allocations, depending on the organizational priorities.

By combining AI with location intelligence, the platform optimizes case distribution and visit plans, reducing travel time, and allowing agents to cover more ground.

- Active Default Management

Dista Collect empowers teams to manage genuine as well as intentional default accounts by equipping telecallers and field agents with a 360° customer overview. This consolidated view of borrower history enables better handling of settlement and repossession cases.

- Settlement Facilitation

Dista Collect’s Unified Field App enables field collectors to generate payment requests for settlement with a single click – simplifying settlement and repayment workflows. Additionally, the platform supports loss mitigation strategies, including repossession and asset disposal with one-click generation of requests.

- End-to-End Debt Collection

By bridging digital engagement for early-stage reminders with on-the-ground execution for delinquent and defaulted accounts, Dista Collect offers a unified and comprehensive approach to managing the entire debt collection lifecycle, from pre-due to post-default resolution.

- Optimized Resource Management

Dista Collect optimizes resource allocation by leveraging AI/ML-based case prioritization. It also provides operational recommendations to managers and leaders with features like mapping collectors to debt recovery agencies as well as performance tracking to drive efficiency.

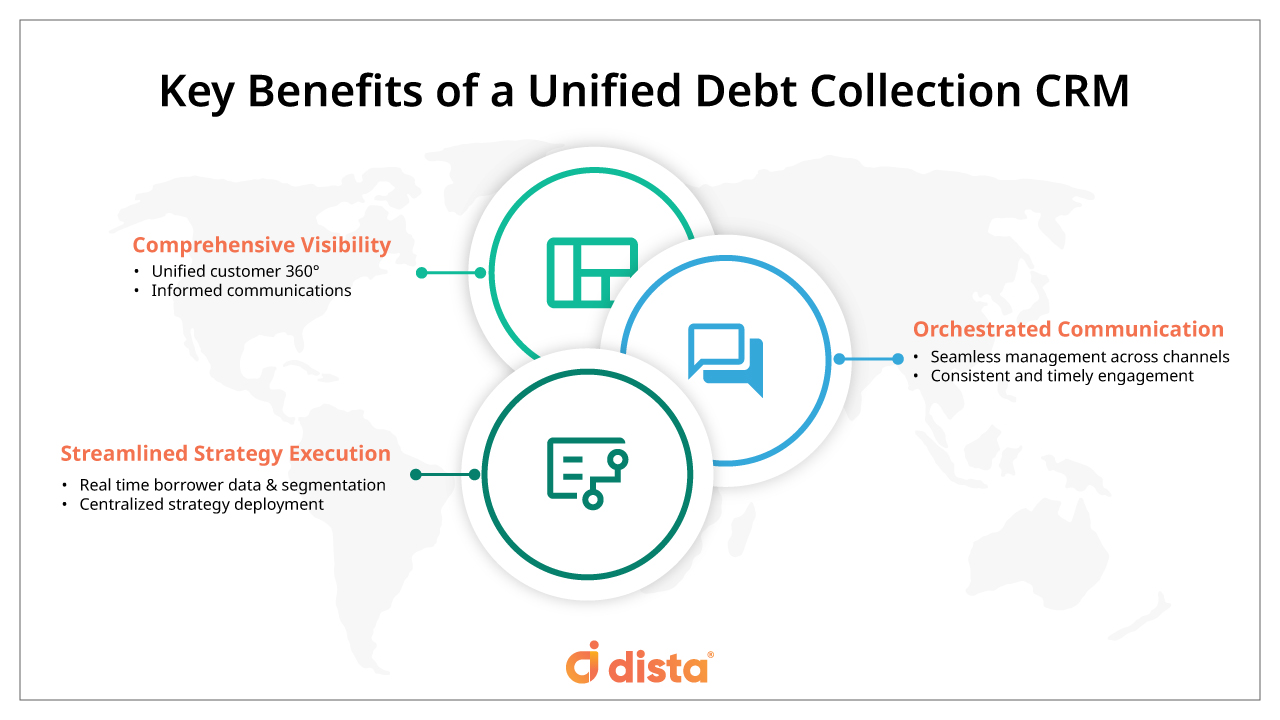

Key Benefits of a Unified Debt Collection CRM

1. Comprehensive Visibility

A unified view of all borrower information, interaction history, and delinquency status enables telecallers, managers, and field loan recovery agents to make quick and informed decisions.

2. Orchestrated Communication

Seamless management across all channels as well as agencies ensures consistent and timely engagement with borrowers and reduces communication gaps.

3. Streamlined Strategy Execution

Centralized definition and deployment of debt recovery strategies based on real-time data and segmentation allow for targeted and efficient action.

Want to Explore the Power of a Unified Debt Collection CRM?

NBFCs, MFIs, and banks need to evolve their recovery strategies to stay resilient and future-ready.

Legacy systems and fragmented workflows can’t keep up with the dynamic realities of debt collection. Financial leaders need more than digitization; they need an intelligent, unified, and location-aware collections CRM that adapts in real time.

Let’s connect and explore how Dista Collect can help you build a smarter, faster, and more adaptive recovery process.