Debt collections have become more demanding than ever. Rising NPAs, siloed operations, tighter RBI regulations, and evolving customer expectations all put immense pressure on collections leaders. Traditional approaches just cannot keep pace with today’s reality.

But what if there was a way to integrate all aspects of debt collection into a single, intelligent platform? Enter the concept of a Unified Collection CRM, a game-changer designed to empower collections teams and redefine how debt recovery is managed.

The Modern Collections Conundrum

Collections leaders today grapple with many challenges:

- Mounting NPAs: The increasing non-performing assets demand faster, more effective recovery strategies.

- Siloed Operations: Manual processes and a lack of real-time visibility into field operations lead to sub-optimal case allocation and missed opportunities.

- Regulatory Tightrope: Navigating complex and constantly evolving guidelines (like those from the RBI in India) requires stringent, step-by-step audit trails and a robust compliance framework.

- Agent Productivity Gaps: Disconnected tools, inefficient and manual route planning, and limited data hinder agents from making informed decisions.

- Balancing Act: The delicate balance between aggressive recovery and maintaining positive customer relationships is crucial.

These pressures highlight the urgent need for a more sophisticated and integrated solution – for leaders, ops teams, campaign managers, field agents, and agencies.

The Power of Location Intelligence in Collections

Imagine a system where the “where” of your assets, people, and customers is a core element of your collection strategy. This is the essence of location intelligence. By harnessing the power of geospatial data and AI, a unified collection CRM brings precision, efficiency, and intelligence to every stage of the debt recovery lifecycle.

This isn’t just about showing dots on a map; it’s about leveraging this critical information for:

- Intelligent Case Allocation: Assigning cases based on agent location, customer profile, and collection history for optimal results.

- Dynamic Beat Planning: Automating and optimizing daily visit routes for field agents, saving time and fuel.

- Real-time Tracking: Gaining complete visibility into agent movements, dispositions, and meeting updates, enhancing accountability and safety.

- Geo-fencing: Validating attendance and task completion within specific geographic boundaries.

- Visualizing: Intuitive maps-based insights into the lay of land, agent efficiency, customer status, agency ops, regional collection rates and more.

Introducing the Unified Collection CRM: A Paradigm Shift

A location-first, unified debt collection CRM is purpose-built for the unique needs of Banks, Non-Banking Financial Companies (NBFCs), and Microfinance Institutions (MFIs). It streamlines the entire debt recovery process, from pre-due reminders to delinquency management, digital settlements, and even repossession. Critically, it’s engineered to facilitate adherence to regulatory guidelines and enhance audit trails from its core.

Here’s how a unified approach transforms operations:

- AI & Location-based Case Allocation: An intelligent engine prioritizes cases based on risk and assigns them hyper-locally, maximizing recovery potential.

- Empowered Field App for Collectors: Agents get a comprehensive, easy-to-use mobile application with centralized access to borrower information, task management, and digital settlement options. No more fumbling with physical files or multiple systems!

- 360° Customer View: A consolidated view of the borrower’s credit history, repayment patterns, past interactions, and contact preferences enables personalized, informed, and empathetic engagements.

- Multi-channel Communication & Digital Settlements: Seamless integration of SMS, email, and voice for pre-due reminders and engagement, alongside instant digital settlement requests and payment link sharing, accelerates recovery.

Tangible Impact: Real Benefits for Your Bottom Line

Adopting a unified collection CRM delivers significant, measurable results:

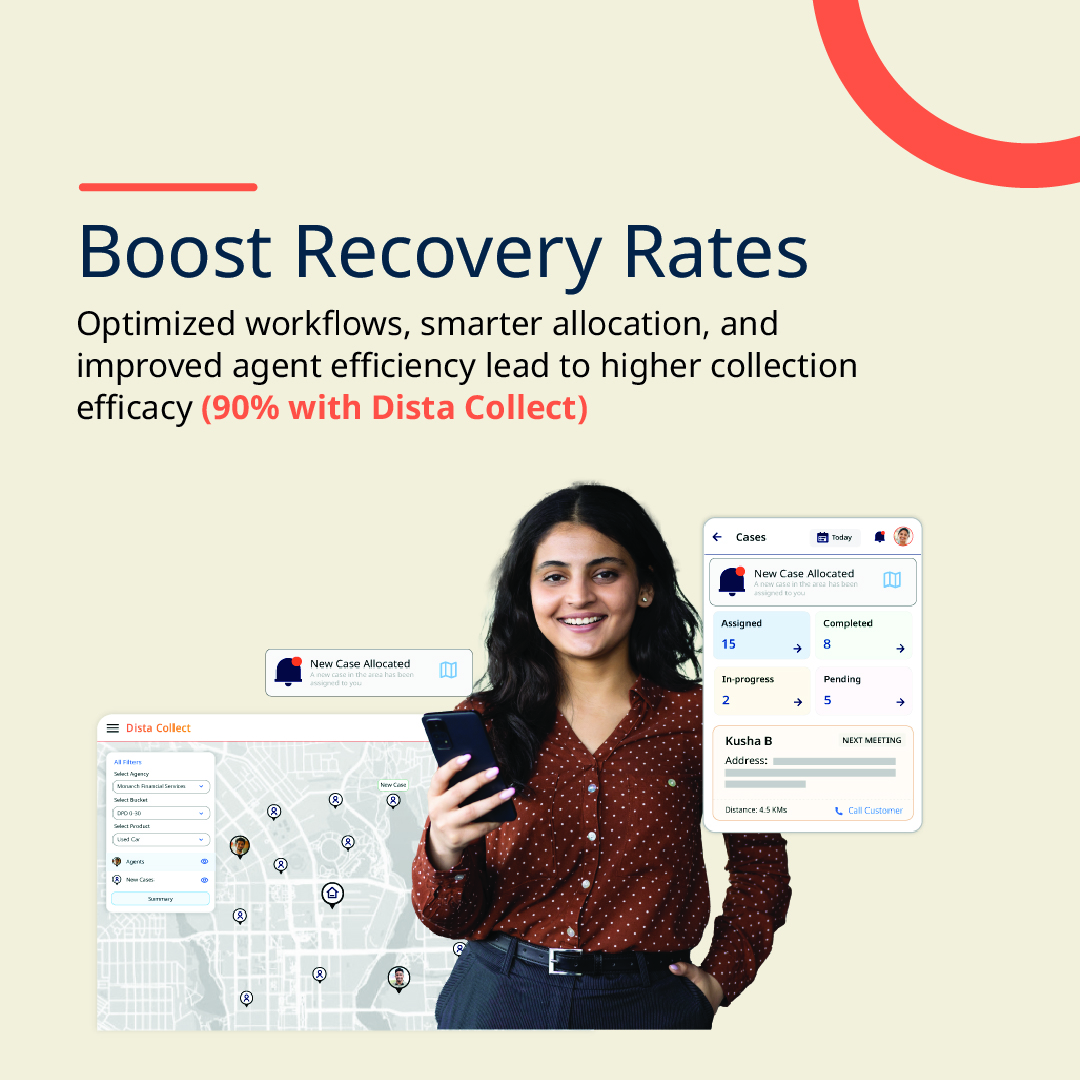

- Boost Recovery Rates: Optimized workflows, smarter allocation, and improved agent efficiency lead to higher collection efficacy (90% with Dista Collect).

- Reduce Delinquencies: Proactive reminders and faster response times in early buckets prevent accounts from aging.

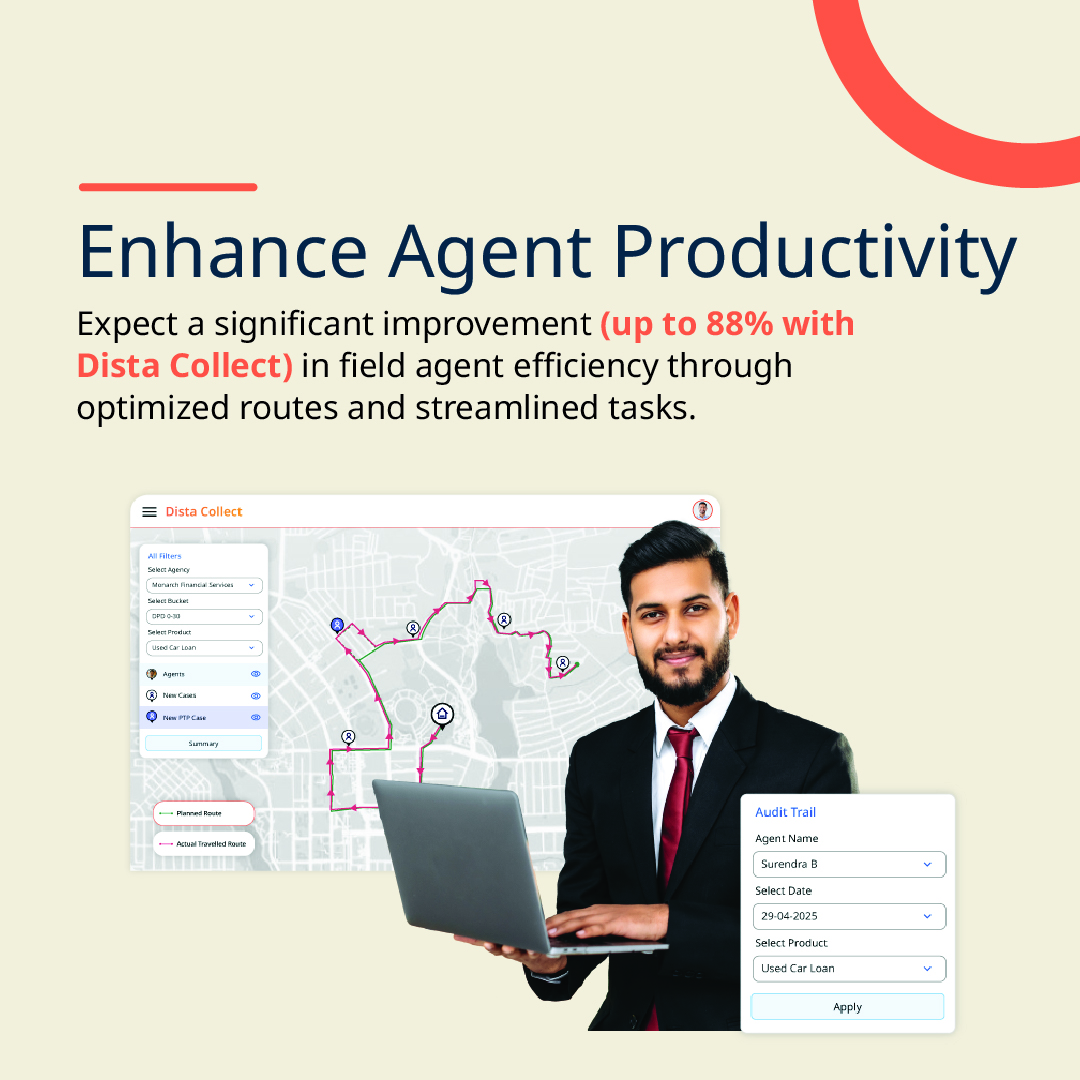

- Enhance Agent Productivity: Expect a significant improvement ( up to 88% with Dista Collect) in field agent efficiency through optimized routes and streamlined tasks.

- Ensure Regulatory Compliance: Robust security and built-in features are designed to meet the strictest regulatory mandates, offering peace of mind (100% RBI compliance with Dista Collect).

- Reduce Operational Costs: Lower fuel consumption, reduced manual effort, and optimized resource utilization directly impact your expenses.

- Improved Cash Flow & Financial Health: Faster collection cycles directly contribute to a healthier bottom line (25% boost in true customer visits with Dista Collect).

The Differentiator: Unmatched Intelligence and Compliance

What truly sets a unified, location-first collection CRM apart is its unique combination of intelligence and a commitment to compliance. It’s not just about integrating different functions; it’s about embedding geospatial data into every aspect of collections, unlocking capabilities that traditional CRMs simply cannot offer for field operations.

Coupled with a holistic view of your customers, this empowers your teams to make smarter, faster, and more effective decisions on the ground and in the call center. Built on enterprise-grade infrastructure with industry-leading security certifications, it ensures scalability, security, and compliance from day one.

A Partnership for the Future

The shift to a unified collection CRM represents a strategic partnership for financial institutions. It’s about moving beyond simply collecting debt to transforming the entire debt recovery ecosystem into a more efficient, compliant, and ultimately, more successful operation.

Are you ready to revolutionize your debt collections and empower your teams for a smarter, more compliant future? Know more about Dista Collect and see how it can help you reinvent field debt collections.