Key Takeaways

- NBFCs are increasingly using location intelligence to improve operational oversight, agent productivity, and recovery efficiency.

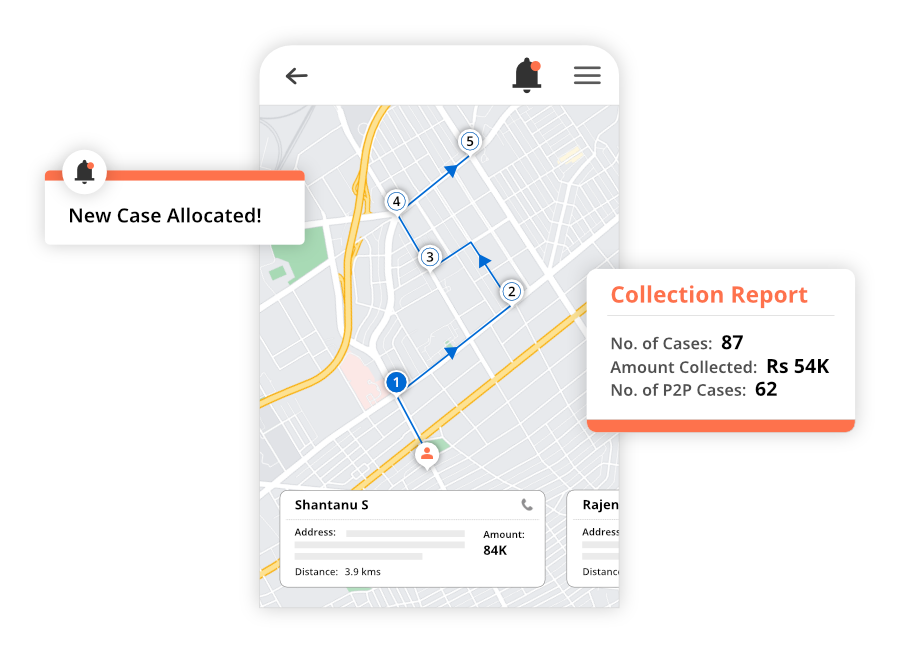

- Dista supports this transformation by enabling real-time tracking, intelligent case allocation based on proximity and priority, and optimized routing for field agents.

- According to McKinsey, such AI-led interventions can cut costs by up to 40% and improve recovery rates by 10%.

Non-Banking Financial Companies (NBFCs) are adopting operational models powered by AI, ML, and location intelligence. These technologies help them design and implement tailored products and services while increasing their customer base and reducing costs.

A recent report from McKinsey reveals that businesses implementing AI in collections are expected to see:

- 40% reduction in operational expenses

- 30% higher productivity

- 10% improvement in recovery rates

AI/ML-based solutions coupled with location intelligence have transformed NBFC operations from field force management to debt collection and recovery. In this blog, we learn how NBFCs streamline their key processes with the power of location intelligence.

1. Field Force Orchestration

NBFCs in India have a large field force catering to millions of customers with secured and unsecured loans. They have to be on the road and complete various activities like meeting customers, collecting documents, upselling and cross-selling products, and more.

The back office or the operations team needs to have a deeper visibility into the daily activities of the field agents. Field force management software like Dista offers real-time insights into ground activities by factoring in the location component. It helps orchestrate field agent movements and optimize their schedules for better productivity.

Managers and back office staff can get real-time visibility into agents’ activities and daily performance using a location intelligence platform. They can also get a complete view of the collections cycle and send prescriptive nudges to agents to increase collections coverage.

2. Debt Collection

Increasing collection throughput and improving recovery rate are the key objectives of NBFCs. Using the location data, an AI/ML-based field force management software facilitates intelligent case assignment. It auto-allocates cases to the right field agent based on multiple business variables like proximity, priority, capacity, experience, and availability. This helps increase case action and improves collection response time.

Collection leaders can also use a system that offers actionable visual intelligence to refine their debt collection strategy. A location-powered field force software like Dista analyzes geographic data from multiple sources via map-based visualization. It recommends territories and serviceable areas and tracks collections and recovery.

3. Route Optimization

Field agents spend a significant amount of time traveling, which impacts customer visit efficiency. Location intelligence leverages AI-driven route optimization to streamline field movements and reduce agent travel time. A field force management software like Dista with a location-first approach considers multiple business constraints affecting travel time, distance, and customer face time. A scheduling algorithm maps the shortest and fastest routes for field agents to visit more customers in a day.

NBFCs can also generate location-driven beat plans for agents to improve their daily productivity and overall performance. It enables agents to increase area coverage and boost collection rates.

4. Risk Management

One of the key challenges in financial services is verifying the right customer address. A location intelligence platform enables accurate address validation through AI-powered geocoding, ensuring the exact customer location. Moreover, geospatial risk assessment allows institutions to map out delinquency patterns and predict areas prone to defaults, thereby tweaking their lending strategies.

In the case of debt collections, dynamic risk profiling ensures field agents prioritize visits based on delinquency levels and repayment history. This improves collection efficiency and enhances recovery rates. Location intelligence also helps in risk management, allowing NBFCs to assess the impact of natural calamities or socio-economic disruptions on specific regions.

Real-time insights enable smarter lending, proactive risk mitigation, and optimized field operations, making NBFCs more resilient and data-driven.

Final Thoughts

Adopting location intelligence is no longer optional for NBFCs—it is essential for operational excellence. From managing field agents and optimizing collections to reducing travel costs and mitigating risks, location intelligence drives efficiency across all aspects of NBFC operations.

A location-powered field force management software like Dista empowers NBFCs to transform their operations with data-driven strategies. Companies that lead in location intelligence will leverage geospatial data to personalize customer experiences, enhance satisfaction, drive revenue growth, and optimize complex operations.

Are you an NBFC looking to revolutionize your business operations? Get in touch with our location intelligence experts for a free demo of our platform.