Banks and NBFC managers have a lot on their plate, with tasks ranging from designing agent schedules to tracking collection performance results. This results in poor case allocation, missed visits, and inefficient field productivity.

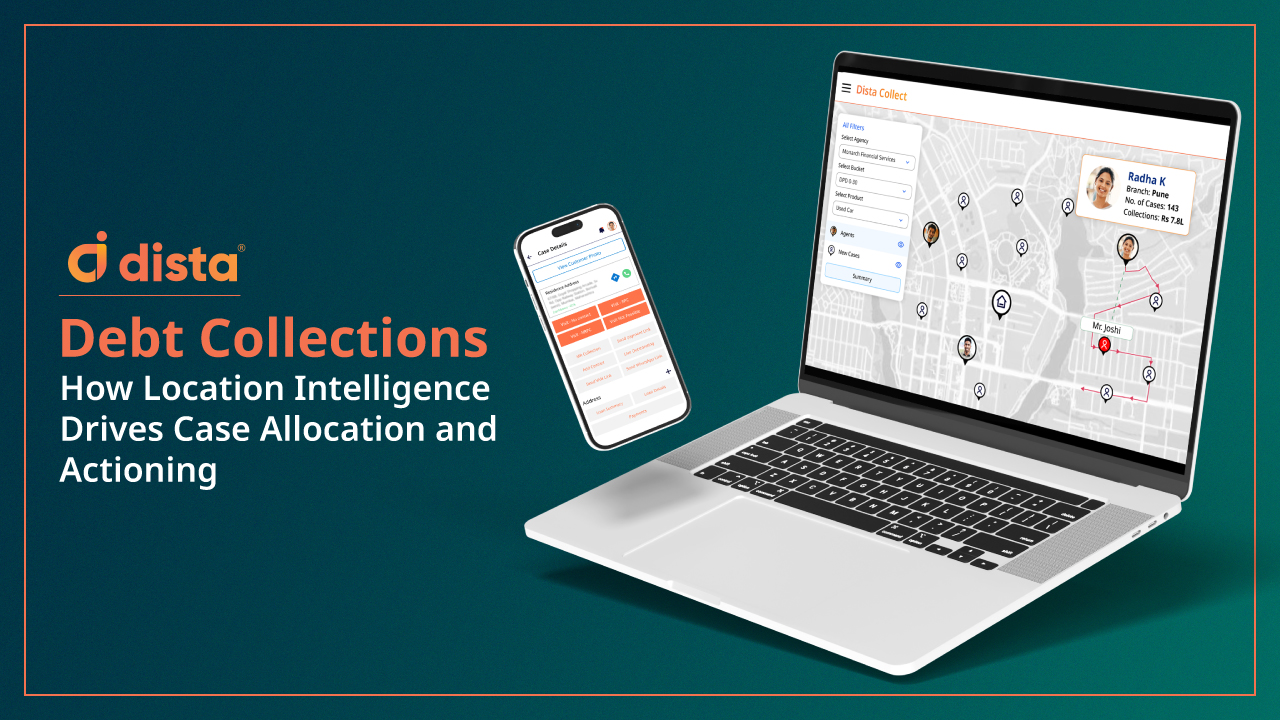

Many financial institutions use various tools and software to manage debt collections; however, they often fail to offer a key functionality – auto and intelligent case allocation. They need a platform that uses location intelligence and AI to drive faster and smarter real-time case allocation.

Let’s learn how location intelligence helps with auto case allocation to improve overall debt collection performance.

How Location Intelligence Helps with Collection Case Allocation

1. AI and Location-based Case Allocation

Allocating lakhs of collection cases via legacy systems, manual methods, and without considering multiple business variables leads to poor agent productivity and ultimately hampers case actioning. Many debt collection software fail to factor in the location component while allocating cases to field agents and collection agencies.

This is where a unified debt collection CRM, like Dista Collect, stands out. Combining AI and location intelligence, the platform enables intelligent case allocation by considering multiple business variables, including agent proximity, availability, and capacity, among others.

The software assigns the right case to the right agent and agency using the SPACE framework. Skillset ensures agents are matched to cases based on their strengths, improving resolution rates. Proximity prioritizes cases to reduce travel time, which also aligns with agents’ availability. The framework also considers the agent’s capacity and experience to ensure a balanced workload and efficient collections.

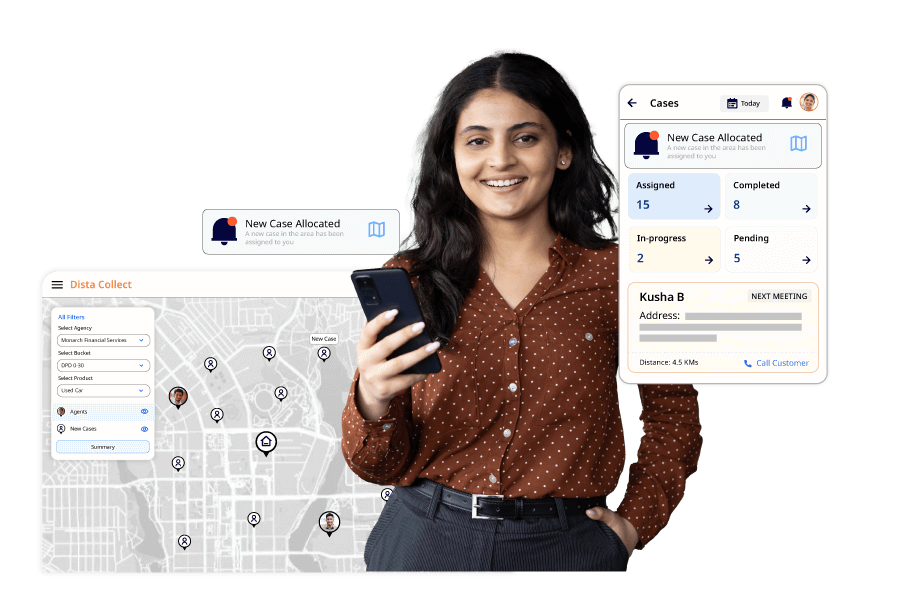

2. Field Collector App

Once cases are allocated, agents need a dedicated tool or mobile office that helps them accelerate case actioning. Dista’s Field App for Collectors showcases assigned cases, a 360-degree customer view for deeper engagement, and optimized route plans. They can update the disposition status to ensure smooth follow-up. With just a tap, they can send payment links and initiate settlements.

The agents receive a real-time update on their targets versus actual collections and track their daily and monthly collections on the app. To foster healthy competition and motivate field agents, leadership and performance dashboards enable them to track individual versus team performance.

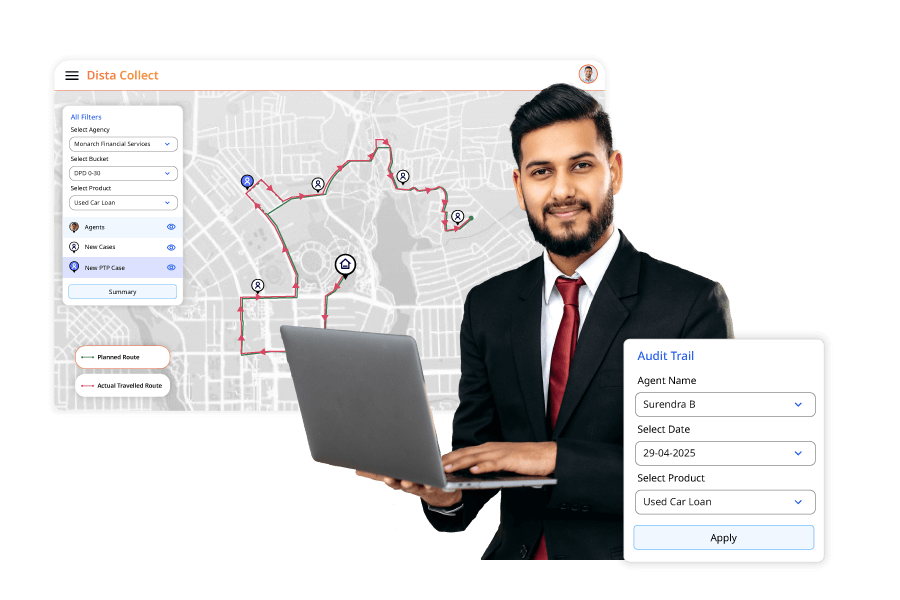

3. Route Optimization and Beat Plans

A location-first, unified debt collections CRM like Dista Collect also offers route optimization to agents, providing the shortest and fastest routes. It minimizes their travel time, reduces fuel costs, and maximizes face time with customers. This helps agents visit more customers and increase daily collection throughput. From assignment to closure, everything is tracked, guided, and optimized.

A location-driven beat plan provides agents with an optimized sequence of customer visits for their daily collections. They can manually tweak the beat plan to accommodate ad-hoc visits and P2P (Promise to Pay) customers to their pre-defined schedule.

How Dista Collect Improves the Debt Collection Process

Now that we have seen how location intelligence improves case allocation and actioning, let’s take a look at a success story to learn how Dista Collect helped a leading NBFC improve daily customer visits.

The NBFC was struggling with low daily customer visits by field agents owing to case allocation by manual and legacy systems. By onboarding Dista Collect, the system enabled auto case allocation, resulting in:

- 85% increase in case-actioning

- 230% increase in daily customer visits

- 72% decrease in the total number of days to complete customer visits

- Overall improvement in collections performance

Higher Debt Collections Start with Smart Case Allocation

To boost recoveries and resolution rates, modern collections demand more than basic software. It needs a comprehensive debt collection CRM that blends AI, location intelligence, smart workflows, and compliance to drive intelligent case allocation and seamless actioning.

Get in touch with us to see how Dista Collect can elevate your debt collections and recovery performance.