Debt collections in India operate within a framework that is compliance-driven and closely audited. The latest RBI Financial Stability Report highlights that rising retail delinquencies and increasing digital adoption are putting immense pressure on traditional collection models. As banks, NBFCs, and MFIs tackle rising NPAs, they are often faced with:

- No single source of truth

- Operational inefficiencies

- Delayed action

- Risk Compliance

These challenges can often be attributed to the deployment of multiple systems, ranging from legacy CRMs to standalone field agent tracking apps and Telecalling tools. While individually useful, these systems usually operate in silos, lacking integration and a unified view of collection operations.

The bottom line is, that outdated manual processes are no longer adequate for managing high volumes, complex loan portfolios, and regulatory expectations.

This is where unified debt recovery software come into play. They consolidate the end-to-end collection process—from field operations and digital outreach to agency coordination and compliance tracking—into an intelligent and intuitive ecosystem.

From AI-powered debt collection tools to omnichannel borrower engagement, the right loan collection software boosts agent productivity while driving collection throughputs and true visits.

What are the Top 5 Debt Collection Software in India?

1. Credgenics

Credgenics supports lenders across the full debt collections lifecycle from early-stage digital outreach to legal recoveries. It combines AI-driven segmentation with automated communications across various channels, including SMS, WhatsApp, IVR, and voicebots.

Why choose Credgenics?

- Digital-first borrower engagement: Automates communication across multiple digital channels.

- Legal workflow automation: Its core strength lies in streamlining legal workflows and notices.

Best For: Lenders prioritizing legal escalations and digital-first communication.

2. LeadSquared

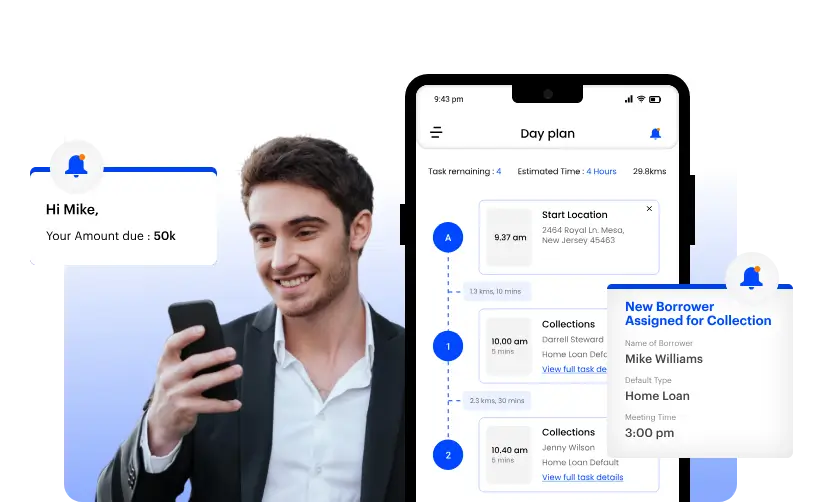

LeadSquared is a debt collections CRM built around operational efficiency and team productivity. It offers borrower segmentation, automated recovery workflows, and real-time field tracking through an intuitive mobile app. Its day-planning tools help agents optimize their daily routes while managers gain visibility into agent performance.

Why choose LeadSquared Collections CRM?

- Field operation visibility: Offers real-time tracking and performance dashboards.

- Task management: Structures agent workflows for mobile-first operations.

Best For: Lenders prioritizing early-stage collections, structured agent workflows, and mobile-first operations.

3. Vymo CollectIQ

Vymo Collect IQ is an end-to-end collections platform designed to streamline field operations and improve recovery rates. It enables lenders to run tightly coordinated, high-volume recovery operations with features like journey planning and real-time agent tracking.

Why choose Vymo CollectIQ?

- A mobile-first platform for field collections: Designed for agents on the ground.

- Intelligent nudges and guided workflows: Helps agents follow the best course of action.

- Integrated incentive and performance management: Enhances field force accountability.

Best For: Organizations running high-volume, field-intensive recovery operations.

4. Mobicule

Mobicule offers a modular debt collection platform designed to digitize recovery operations for telecom, BFSI, and utilities. It supports case allocation, digital payments, and repository workflows alongside detailed audit trails to ensure regulatory adherence.

Why choose Mobicule?

- Industry-specific compliance and audit features: Addresses unique regulatory needs. For more on this, read about the Top Compliance Challenges for MFIs & How to Solve Them.

- Modular platform: Allows organizations to choose the modules they need.

- Integration-ready architecture: Connects easily with existing systems.

Best For: Enterprises in telecom, utilities, and BFSI looking for a modular and integration-ready platform.

5. Dista Collect

Dista Collect is a location-powered, end-to-end debt collection software built to manage everything from early delinquency to settlement and repossession. As an RBI-compliant collections platform, it brings together AI-powered allocation, geo-based field force planning, and digital outreach into a single system. Lenders can run predictive simulations and monitor performance in real-time. The platform has delivered proven results, such as 85% increase in case actioning and 35% increase in true visits for a leading NBFC.

Why choose Dista Collect?

- AI + Location-based operations: Uses SPACE-based allocation and intelligent case allocation to assign the right case to the right agent.

- End-to-end lifecycle management: Manages DPD-driven workflows, repossession + disposal, and resource forecasting.

- Centralized coordination: Unifies agency, telecaller, and on-ground teams.

- Complete visibility: Offers a single view across the entire BFSI Collections lifecycle.

Best For: Banks and NBFCs seeking a comprehensive, AI-driven, and audit-ready platform for complete BFSI Field Operations

How to Choose the Right Debt Collection Software?

Selecting NBFC debt recovery solutions is no longer just about ticking off a feature list. Leaders must ask a sharper question: which software best suits my debt collections?

Here’s a more grounded approach to making that choice:

- Map software to your operational reality: For early-stage collections, choose mobile-first CRMs. For legal recoveries, prioritize audit-ready systems with integrated legal workflows. For identifying risk areas, consider how Location Intelligence Helps Spot Delinquency Hotspots.

- Focus on execution intelligence: Look beyond dashboards. Opt for systems that prioritize cases intelligently based on risk, geograph, or agent skill.

- Don’t overlook integration and compliance readiness: Choose platforms that integrate with your LOS/LMS and support real-time data sync. For Indian lenders, RBI-compliant audit trails are foundational.

- Run a stakeholder pilot: Before making a switch, test the platform in a high-stakes segment. Track changes in case closures, true visits, and collector productivity with a tool like Dista Insight for forecasting.

The choice should be guided by how well a platform supports your field collections, adapts to regulatory needs, and improves recovery outcomes.

Book a demo to see how Dista Collect delivers AI + Location Intelligence-powered collections.

Note – All images have been sourced from the official webpages of the concerned companies.