Risk Management

Predict and Prepare a Risk Mitigation Strategy

Detect, assess and prevent risks with a location-first approach

Power Risk Management with Location Intelligence

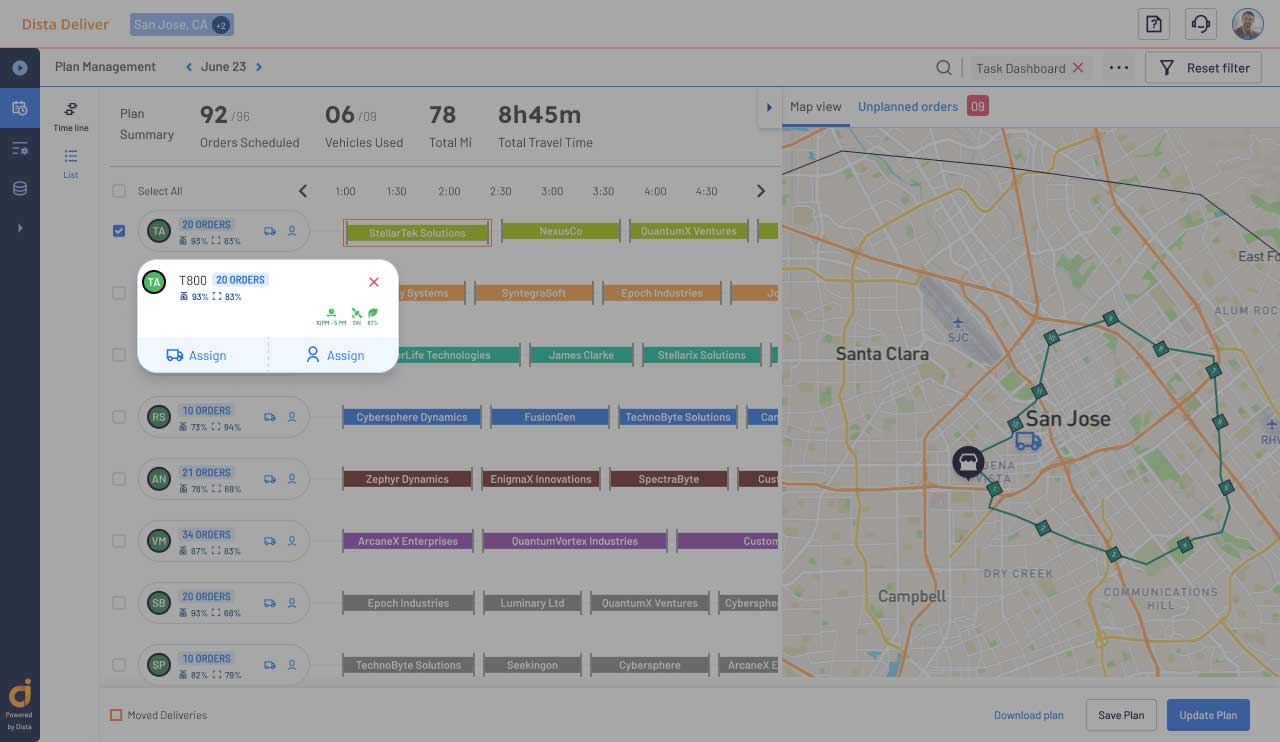

Run location-driven simulations to design effective and seamless risk mitigation strategies.

Detect Frauds Easily

Detect and predict fraudulent activities by overlaying multiple data streams such as historical claims by location, consumer profiles, demographics etc. Study spatial relationships between location and insurance claims to predict fraudulent claims easily.

Optimize Insurance Pricing Policy

Optimize property and life insurance by leveraging location data to design accurate pricing policies from disaster-prone areas, high-crime zones, etc. Assess and predict risks precisely by overlaying spatial data.

Underwrite Risk Effectively

Map insurer risk by integrating multiple data streams for better control. Underwrite risk by considering geographical components to improve claims efficiency and reduce cost.

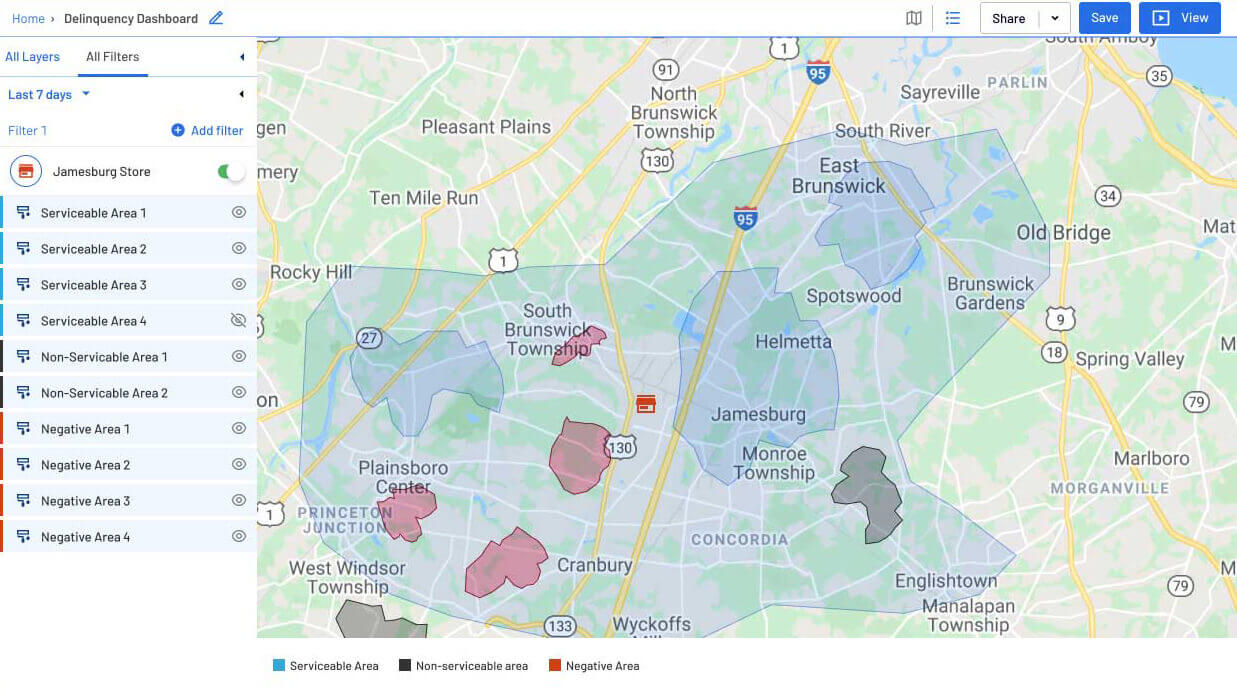

Identify Delinquent Areas

Banks and financial services can design delinquent area clusters by overlaying multiple data points, such as poor loan recovery and collections, fraudulent insurance claims, etc. Eliminate fraud risk by deriving unique insights from location-based behavior.

Eliminate Data Silos

Integrate multiple data sources into spatial analysis to get meaningful insights. Identify complex data interdependencies with spatial analysis to remove data silos and aid strategic decision-making.

FAQs

Browse our FAQs section to know more about our risk management tool and how it can contribute to your success.

Still have questions ?

You can overlay multiple data streams using Dista’s location intelligence platform, such as historical claims by location and consumer profiles. By studying spatial relationships between location and insurance claims, you can quickly identify and mitigate fraudulent claims, enhancing risk management effectiveness.

Dista helps you optimize property and life insurance pricing policies by leveraging location data to assess risks from disaster-prone areas and high-crime zones accurately. By overlaying spatial data, evaluating and predicting risks is possible to design more competitive pricing policies.

Dista integrates multiple data sources into spatial analysis, enabling you to gain meaningful insights and identify complex data interdependencies. By removing data silos and leveraging spatial analysis, businesses can make more informed decisions.

Dista’s software for risk management improves fraud detection, optimizes insurance pricing policies, underwrites risk, identifies delinquent areas, and eliminates data silos. These benefits lead to enhanced operational efficiency, reduced costs, and improved overall performance.