For years, banks and NBFCs have relied on ‘negative PIN code’ lists to manage credit risk. If delinquency spikes in a particular pincode, lending is restricted or stopped entirely.

While simple, this method is increasingly out of step with reality. A single pincode in India often blends diverse realities; from premium gated communities, mid-market apartments, and lower-income housing, to thriving commercial activity.

Take for example, Koramangala in Bengaluru (560034), where start-up offices, cafés, and co-working spaces sit beside residential blocks; or Andheri West in Mumbai (400053) where film studios, small businesses, and high-end societies coexist. By blacklisting such pincodes due to stress in one pocket, lenders risk shutting out salaried professionals, profitable SMEs, and young first-time borrowers who are financially sound, ultimately missing growth opportunities.

The Reserve Bank of India’s June 2025 Financial Stability Report flags elevated slippages in unsecured retail loans (particularly in segments like personal loans, credit cards, and microfinance) making granular cluster‑based risk strategies a necessity.

Why are Lenders Moving From Pincodes to Micro-Clusters?

For NBFC lenders, the future lies in delinquency micro-clusters—smaller, data-driven geographies that reflect borrowing behavior at the street or even neighborhood level.

Instead of marking an entire pincode as “negative,” banks can use location intelligence to build micro-clusters that:

- Capture borrower patterns with greater precision

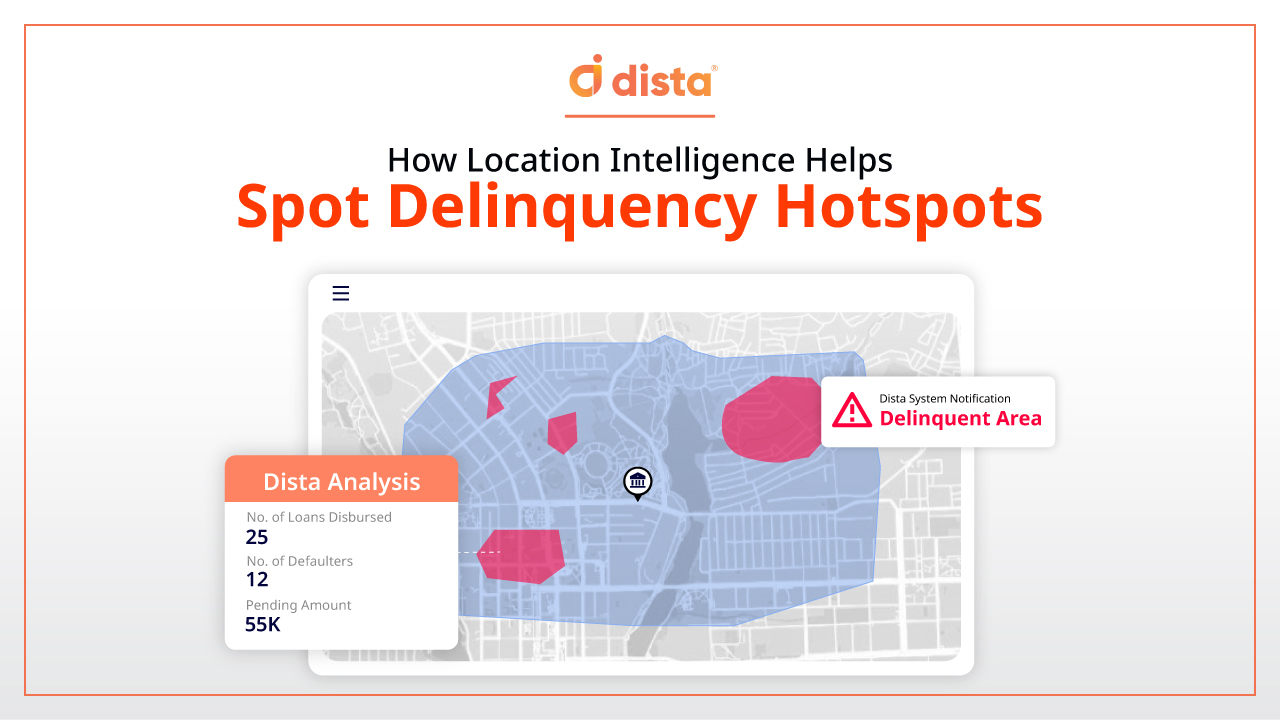

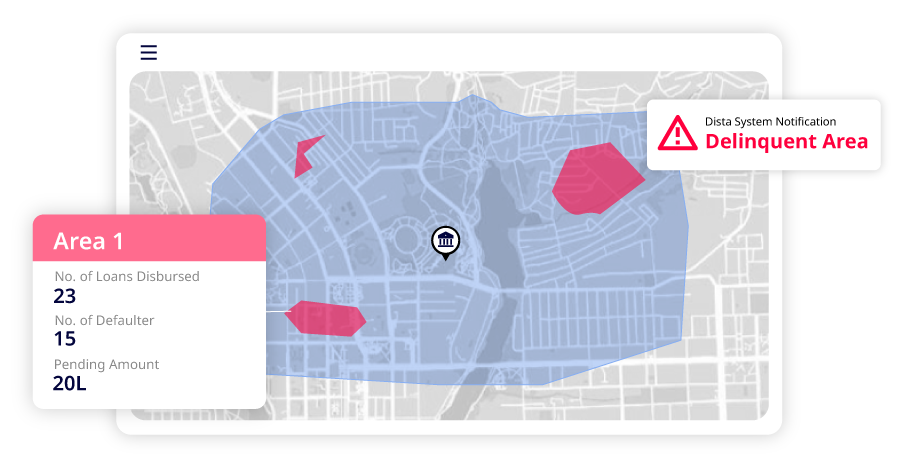

- Reveal hidden delinquency hotspots within large areas

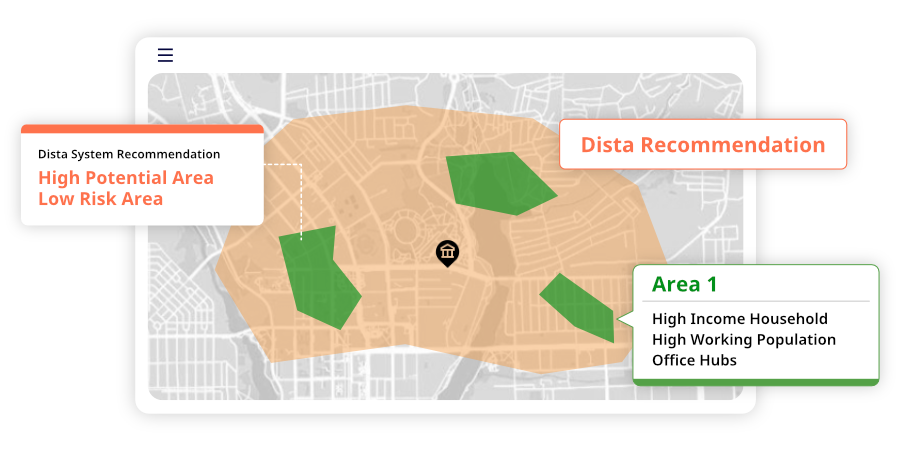

- Identify low-risk segments where expansion is still viable

Dista enables this transformation by ingesting customer data, running through its patented clustering algorithms, and creating a dynamic view of high, medium, and low-risk areas.

What Is the Delinquency Index in Credit Risk Policy?

At the core of this approach is the Delinquency Index—a ratio of delinquent to non-delinquent customers in each micro-cluster.

- High-risk clusters indicate areas where fresh lending should be restricted or subjected to stricter checks.

- Medium-risk clusters allow lending but may trigger additional verification.

- Low-risk clusters emerge as green zones for safe expansion.

By quantifying risk in this way, banks move from subjective, static rules to data-backed, agile measures.

Dista operationalizes this by continuously refreshing clusters and recalculating delinquency indices so lenders always work with the latest data.

How Do Micro-Clusters Improve Credit Risk Policy in Practice?

The impact of micro-clustering goes beyond analytics. When embedded into policy frameworks, it enables:

- Smarter underwriting: Applicant addresses can be checked against cluster risk categories before loan approval.

- Dynamic verification: Medium-risk clusters may trigger field checks, alternate reference validation, or income proof.

- Safe expansion strategies: White-space areas near low-risk clusters become opportunities for growth.

- Proximity-based risk: Even if a customer’s address isn’t inside a delinquent cluster, their distance-to-risk can influence lending decisions.

With Dista, this intelligence becomes real-time and actionable, thanks to APIs that provide risk scores, address traceability indices, and proximity metrics instantly.

Why Technology Is Critical for Micro-Cluster Adoption in Lending

Identifying micro-clusters is only the first step. The real challenge lies in making this intelligence usable for thousands of applications, across products, and in real time.

This is where technology becomes the differentiator. With a platform like Dista, lenders can:

- Keep risk data live and relevant: Micro-clusters are continuously refreshed, ensuring that policy decisions reflect the most recent delinquency patterns.

- Embed insights directly into workflows: Through APIs, risk scores and address traceability indices flow seamlessly into loan origination and management systems—so underwriters don’t need to switch tools.

- Standardize compliance checks: Every address is validated for completeness, geocoded accurately, and assessed against nearby delinquency clusters, creating an auditable trail that aligns with RBI expectations.

- Scale effortlessly: Whether processing 1,000 or 100,000 applications a day, the system delivers location-aware risk scores instantly, without slowing down operations.

In other words, technology doesn’t just produce insights—it ensures that every credit decision is informed, consistent, and defensible.

Why Should India’s Banks and NBFCs Adopt Micro-Clusters in 2025?

India’s credit market is at an inflection point. The RBI’s latest Financial Stability Report points to rising pressure in unsecured personal loans and the microfinance sector, with increasing urban delinquencies challenging traditional risk models.

In this context, relying solely on negative PIN codes is like navigating with an outdated map. By adopting micro-clusters, lenders can:

- Respond faster to localized delinquency spikes

- Protect portfolios with early-warning geographic risk signals

- Expand responsibly into underserved but low-risk areas

- Boost regulatory confidence with transparent, timestamped, data-driven frameworks

Dista’s location-first products are designed for exactly this need—helping BFSI institutions modernize risk policy without sacrificing growth.

Moving From Vagueness to Precision

Negative PIN codes are too broad for a complex credit environment like India. Micro-clusters, powered by delinquency indices and location intelligence, offer lenders a finer-grained, future-ready approach.

With platforms like Dista, banks and NBFCs can move beyond blanket exclusions to a model of granular inclusion by balancing risk control with expansion.

With Dista, every credit decision is location-aware, auditable, and expansion-ready.

Want to know if location-based delinquency clustering is relevant to your lending operations? Get in touch with us now.