India’s vast and diverse population has unique preferences when it comes to banking. While the world has largely moved to digital, a significant portion of India still values the “handshake” and in-person conversations before making a financial commitment. This is especially true in rural and semi-urban areas, where approximately 65% of the population resides. In these regions, access to digital banking is often limited, and there are not enough branches of established BFSI institutions.

This creates a critical need for banking and financial services companies to invest in the “in-person” accessibility of their services, reaching a large populace that expects face-to-face customer service.

The Future of Field Banking: Beyond Bricks and Mortar

Simply setting up more physical branches is not the most ideal solution. India has long been a major consumer of doorstep banking, and this trend is not diminishing. The ease of access to apps means that the financial services industry must leverage digital tools to reach consumers at their doorstep—when and where they want—and offer exceptional, timely service.

While field operations in the BFSI sector are here to stay, Dista’s work has shown that these operations are often unregulated, inconsistent, and lack significant market penetration. This results in limited financial inclusion, and the full potential of BFSI offerings rarely reaches the end consumer.

The Challenges of Traditional Field Banking

The age-old methods of acquiring new customers through word-of-mouth or reactive service requests have proven to be ineffective, prone to manual errors, and result in a poor customer experience. Key challenges include:

- High Travel Time: Leading to delayed appointments and missed SLAs.

- Low First-Time Closure: Resulting in multiple revisits and inconvenience for customers.

- Unverified Visits: Causing disputes and compliance issues.

- Uneven Workload: Leading to fatigued agents and inconsistent customer interactions.

- Lack of Transparency: Leaving customers unaware of who is visiting, when, or why.

Dista: The Solution for Optimized Field Force Management

Dista bridges the gap with a simple, yet powerful solution: an optimized and location-intelligent way of managing field forces, designed to improve customer reach and deepen market penetration.

Many Banks, NBFCs, and MFIs in India have not yet made location data central to their field operations. Dista introduces a new way of orchestrating their field force by bringing location intelligence to the core of field force management – a scientific approach designed to increase customer interactions and elevate the customer experience.

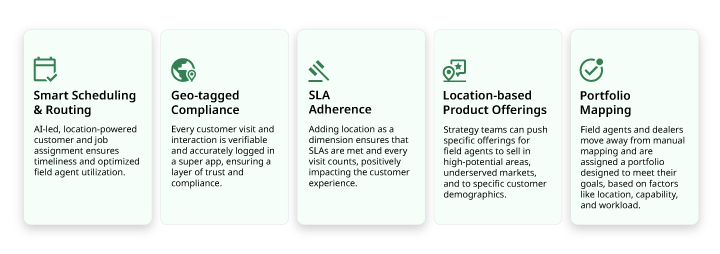

Here are the top five ways BFSI companies use Dista to integrate location intelligence into their field operations:

- Smart Scheduling & Routing: AI-led, location-powered customer and job assignment ensures timeliness and optimized field agent utilization.

- Geo-tagged Compliance: Every customer visit and interaction is verifiable and accurately logged in a super app, ensuring a layer of trust and compliance.

- SLA Adherence: Adding location as a dimension ensures that SLAs are met and every visit counts, positively impacting the customer experience.

- Location-based Product Offerings: Strategy teams can push specific offerings for field agents to sell in high-potential areas, underserved markets, and to specific customer demographics.

- Portfolio Mapping: Field agents and dealers move away from manual mapping and are assigned a portfolio designed to meet their goals, based on factors like location, capability, and workload.

The Impact on Field Agents and Customers

A location-intelligent field force translates to significant improvements for agents:

- Low Travel Time: Timely appointments and SLA adherence.

- High First-Time Closure: Meaningful, context-driven communication prevents the need for multiple visits.

- Verified and Compliant Visits: Zero disputes and audit-ready, geo-tagged proof of every visit.

- Even Workload: Productive agents spend more time with customers rather than just “reaching” them.

- 360-Degree Transparency: Connected operations offer visibility to everyone, especially customers.

While the customers benefit from:

- Turnaround Time: Faster credit, faster trust.

- First-Time Closure: Fewer revisits, higher convenience.

- Geo-validation: Verified service for peace of mind.

- Consistent Utilization: Stable, professional field enablement.

Dista’s location intelligence-backed software builds an ecosystem that allows BFSI leaders to view customer satisfaction not as a “nice-to-have” score, but as a direct output of operational excellence.

Leadership Takeaway: Customer Experience as the End Game

In this age, customer experience requires a field-driven strategy, not just a marketing campaign. When institutions connect customer experience to measurable field force metrics – timeliness, accuracy, and compliance—customer satisfaction becomes predictable, not accidental.

Dista is the partner that enables BFSI leaders to build field force excellence with AI-driven, connected, and location-intelligent technology—the foundation for making every customer visit delightful, timely, and result-driven.