Realize the True Value of Operational Transformation with Location Intelligence

Boost insurance agent productivity, expand reach, and mitigate risk. Bring reliability and flexibility to your insurance operations and drive breakthrough performance.

Challenges for Insurance Businesses

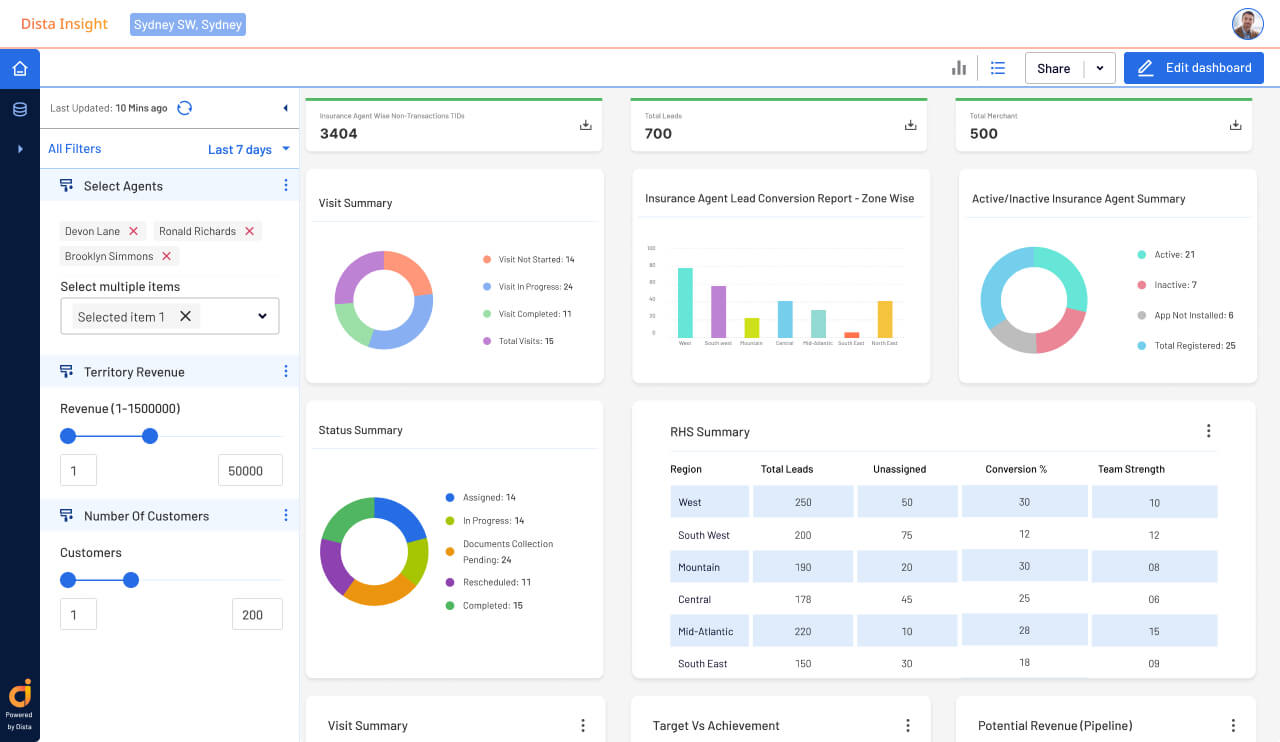

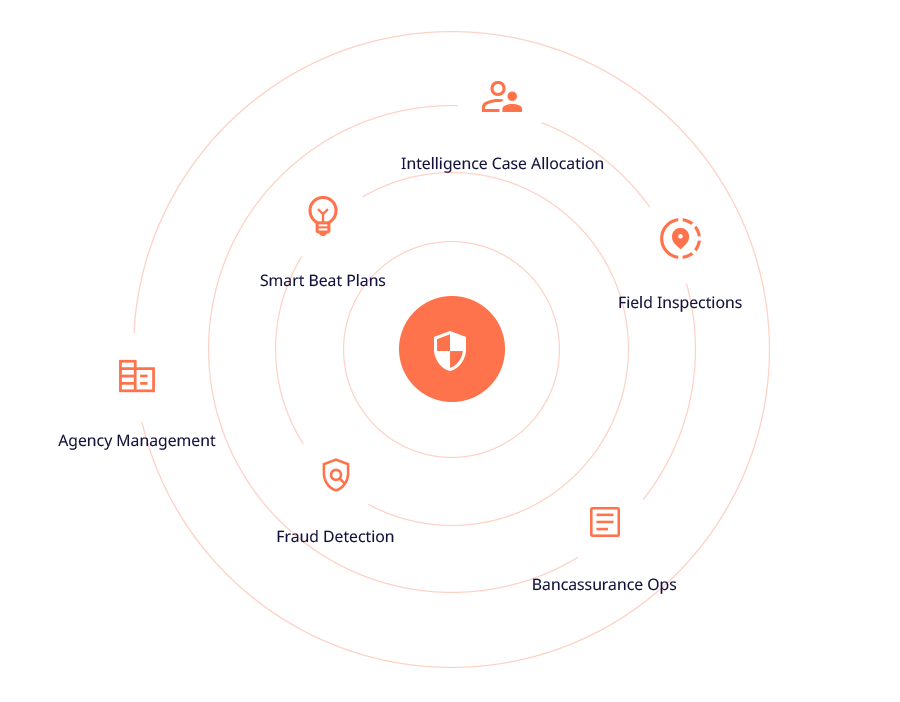

How Dista Powers Insurance Organizations

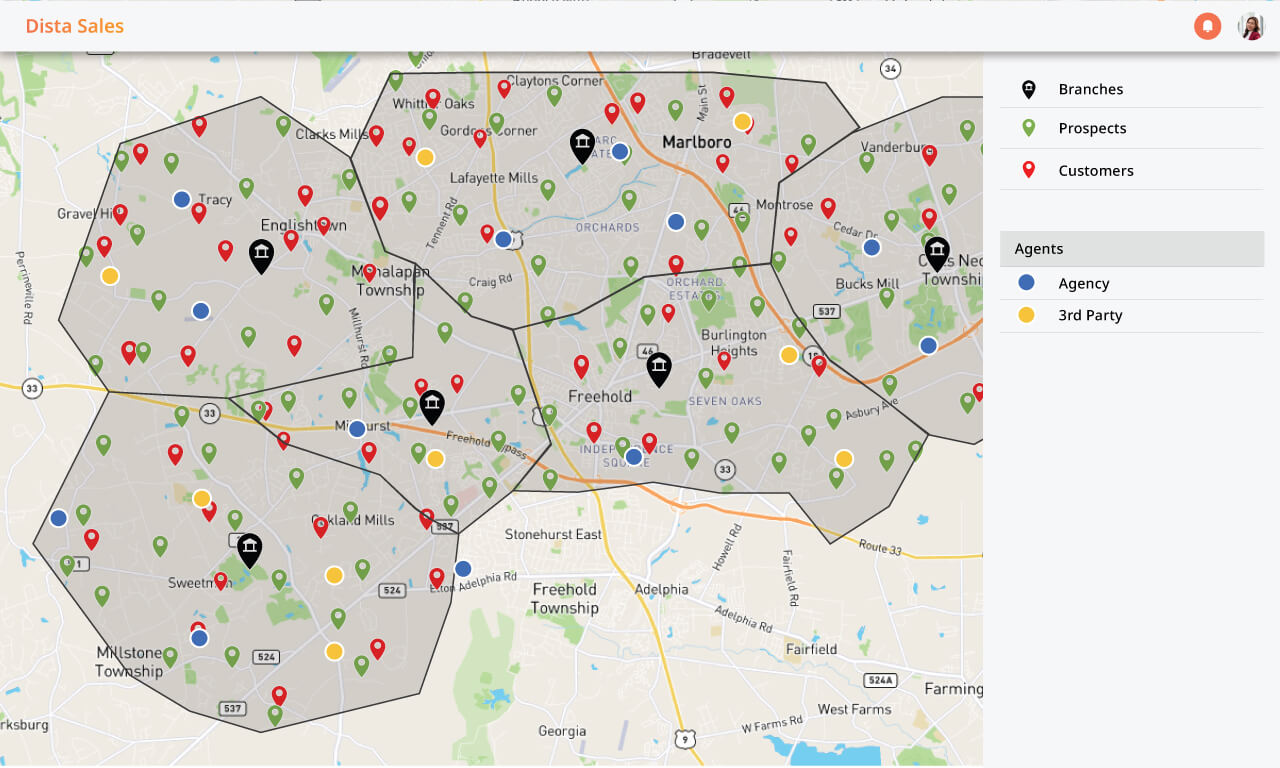

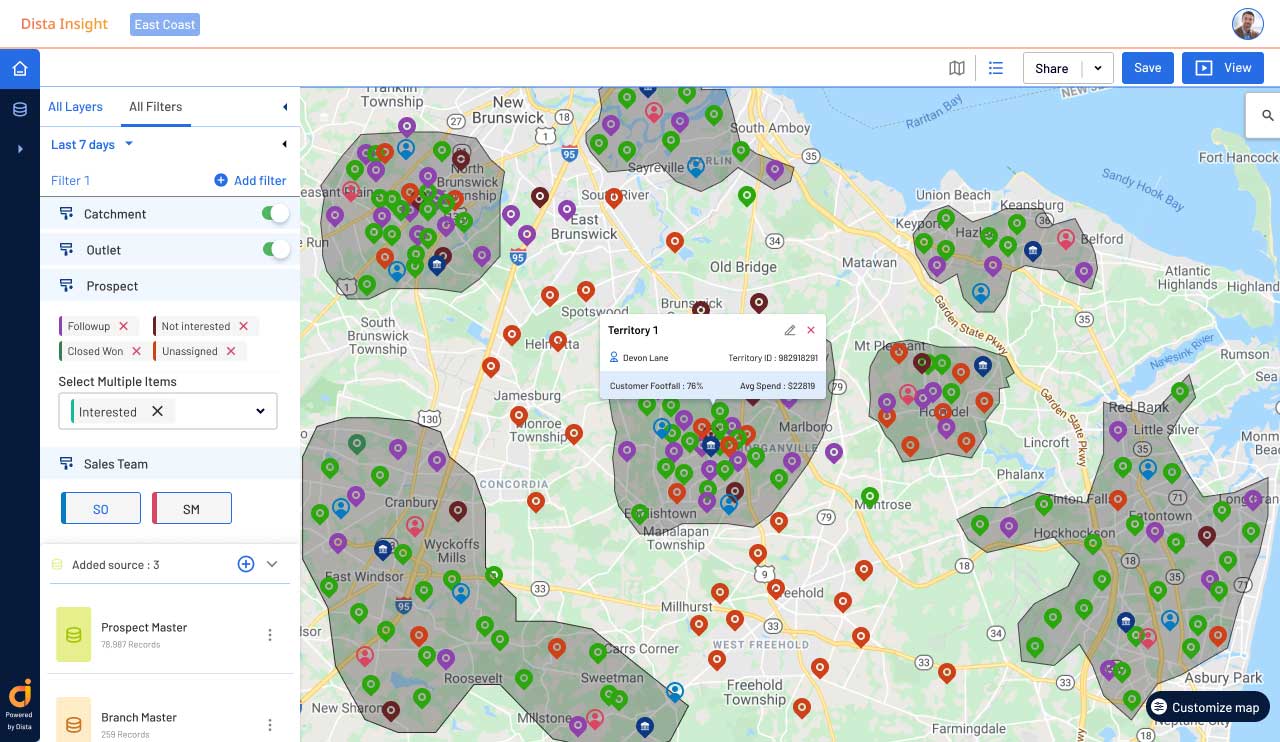

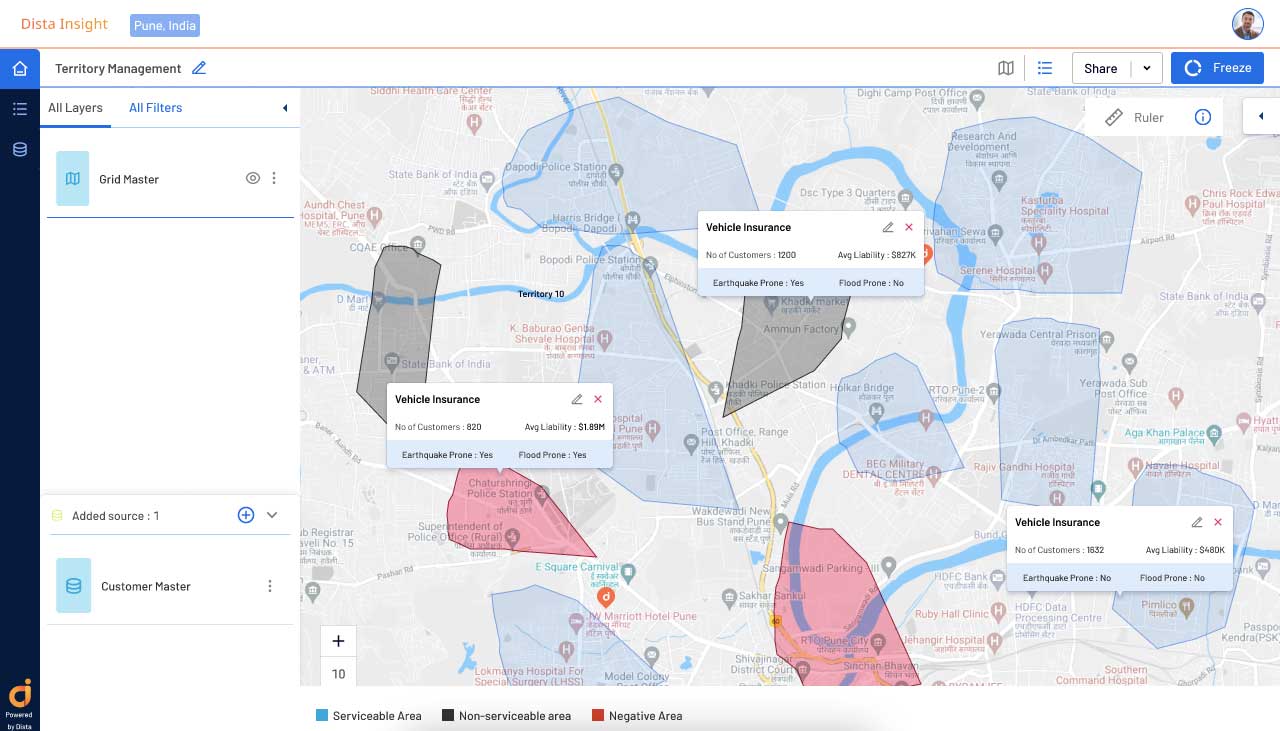

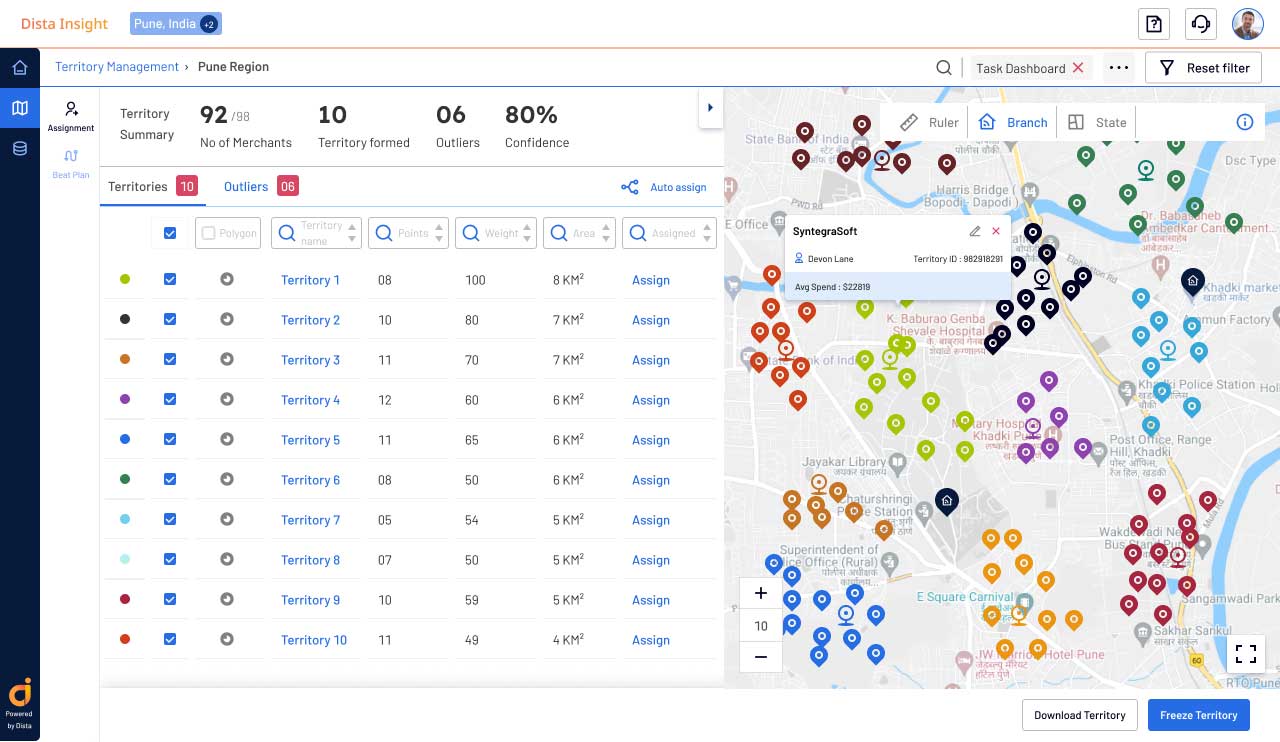

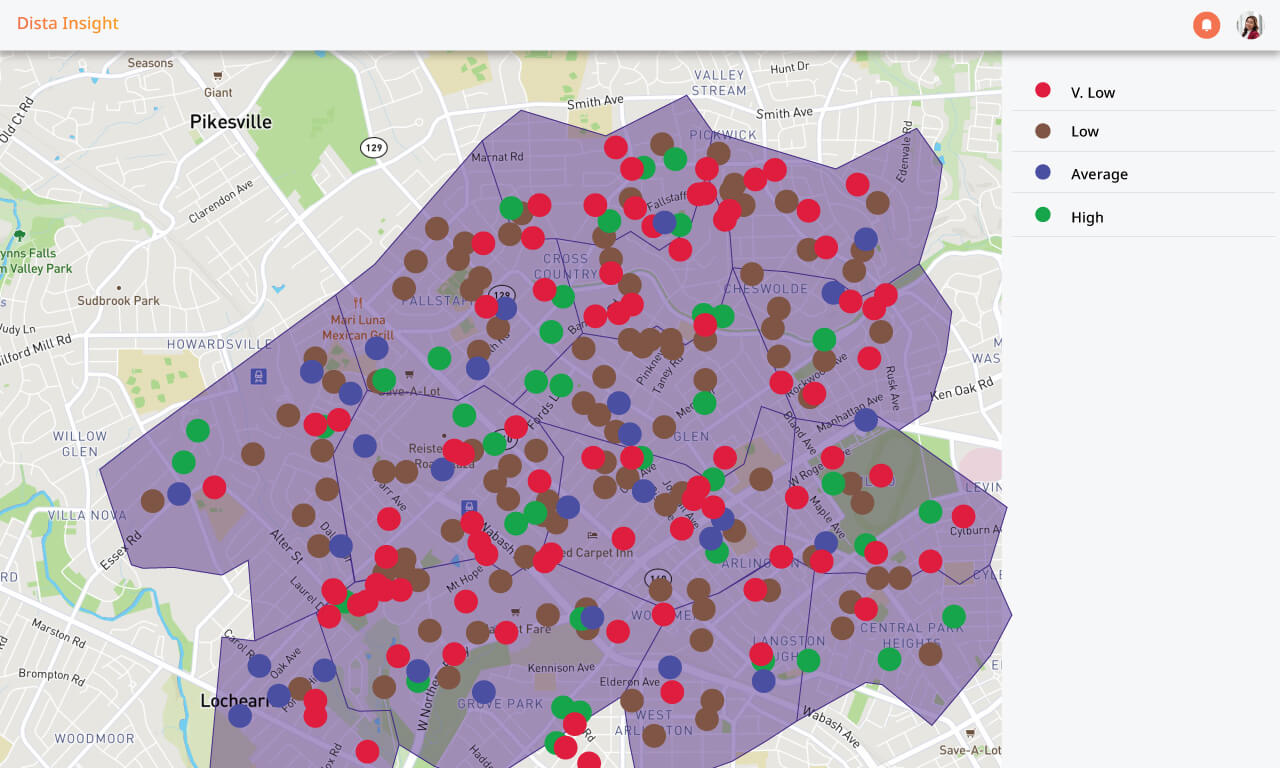

Strategically Align Sales Territories

Design dynamic sales territories with visual tools and location data layers. Manage sales coverage by accessibility, volume, market potential, etc. Enable insurers to align insurance agencies by territories for better visibility.

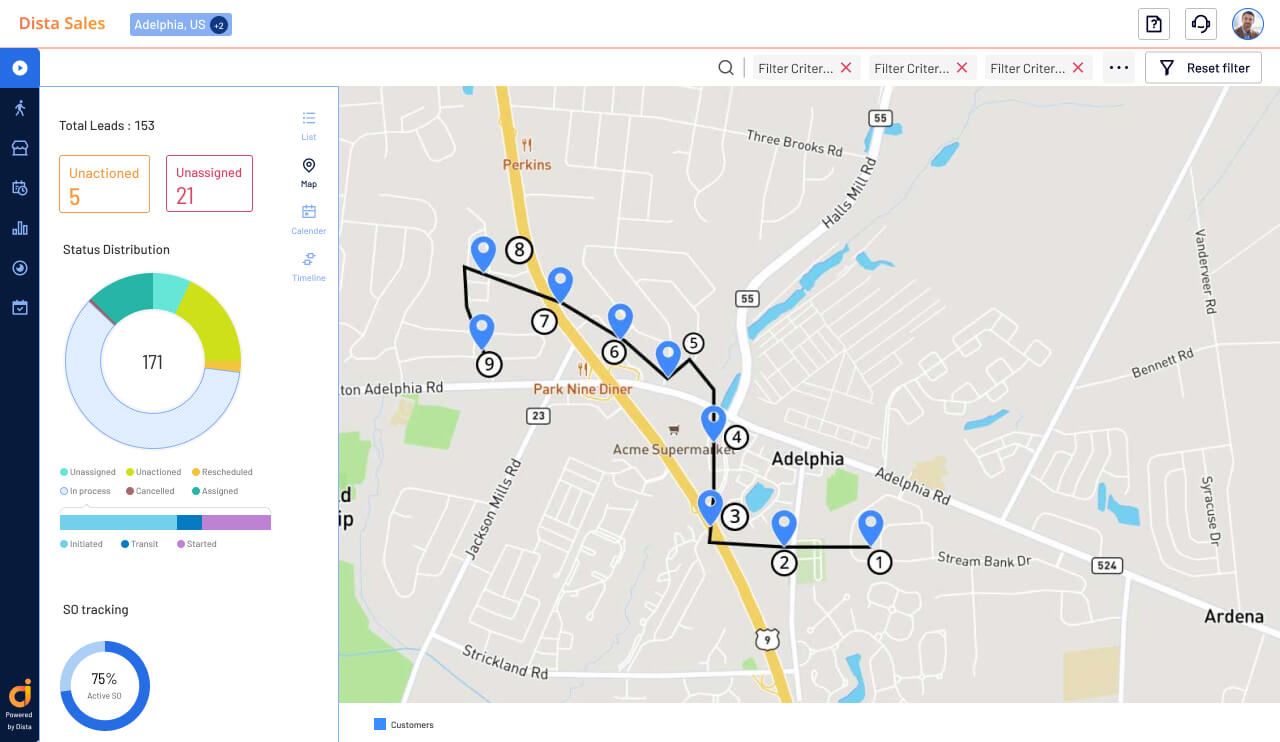

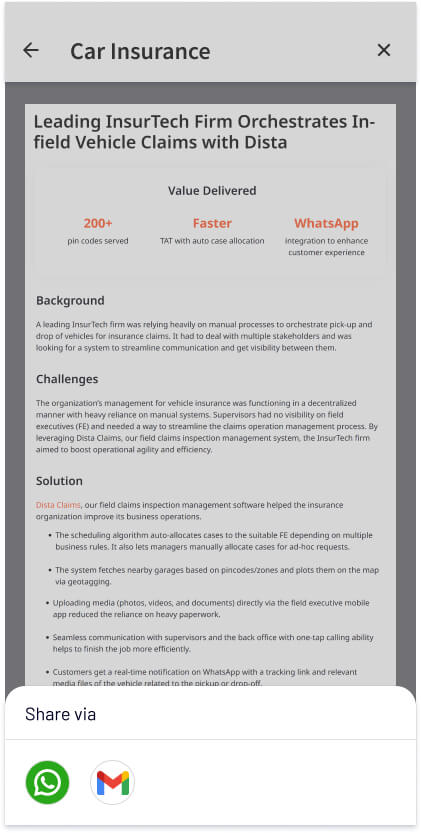

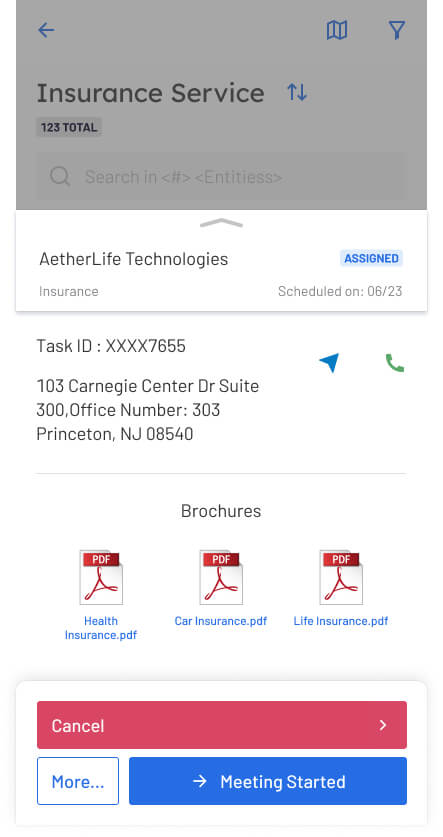

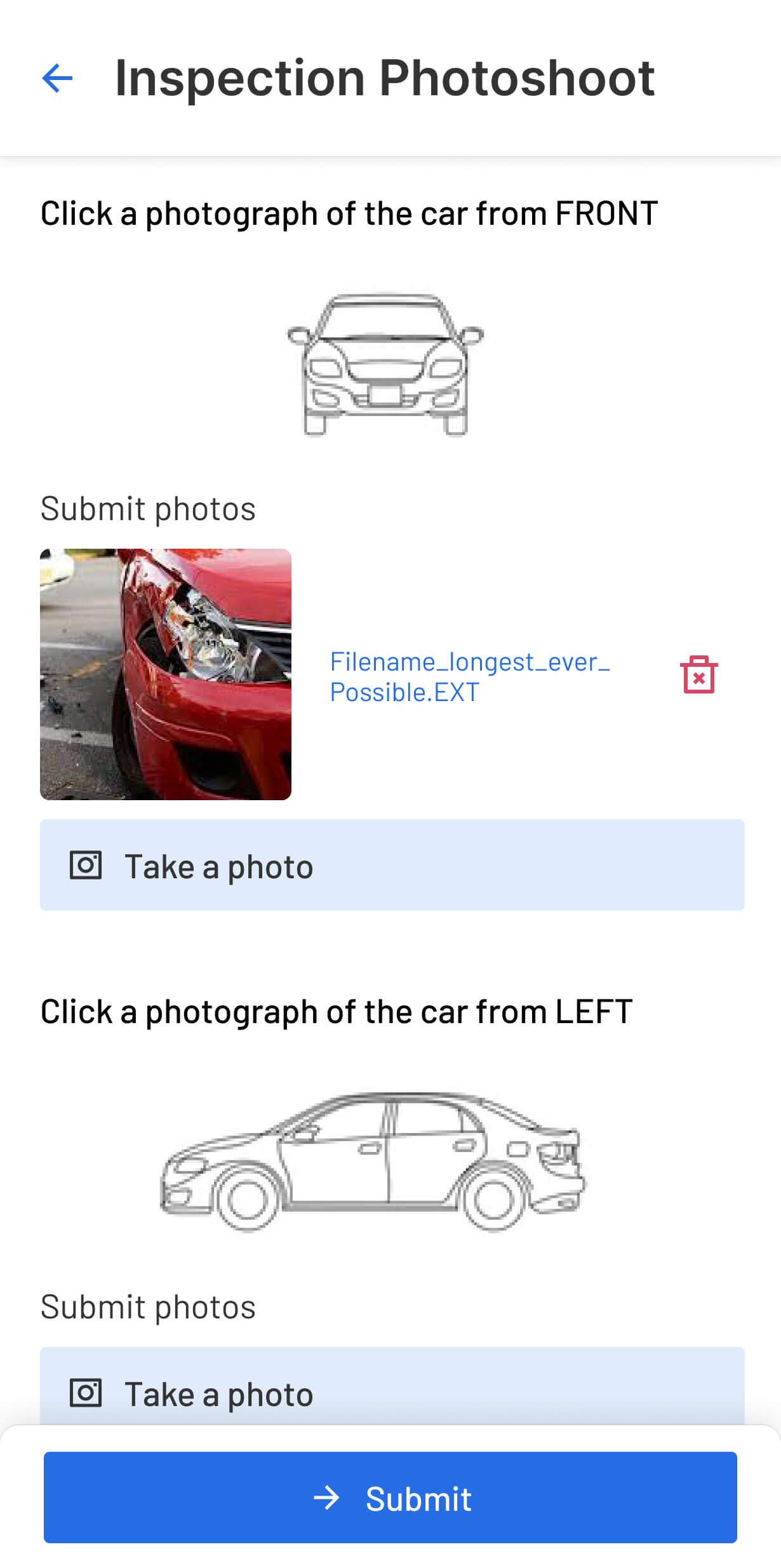

Seamless Onsite Claims Adjustment

Manage onsite inspections on a consolidated, mobile-first platform for a faster response time. Reduce manual touchpoints in the claims process to boost efficiency and reduce claims leakage.

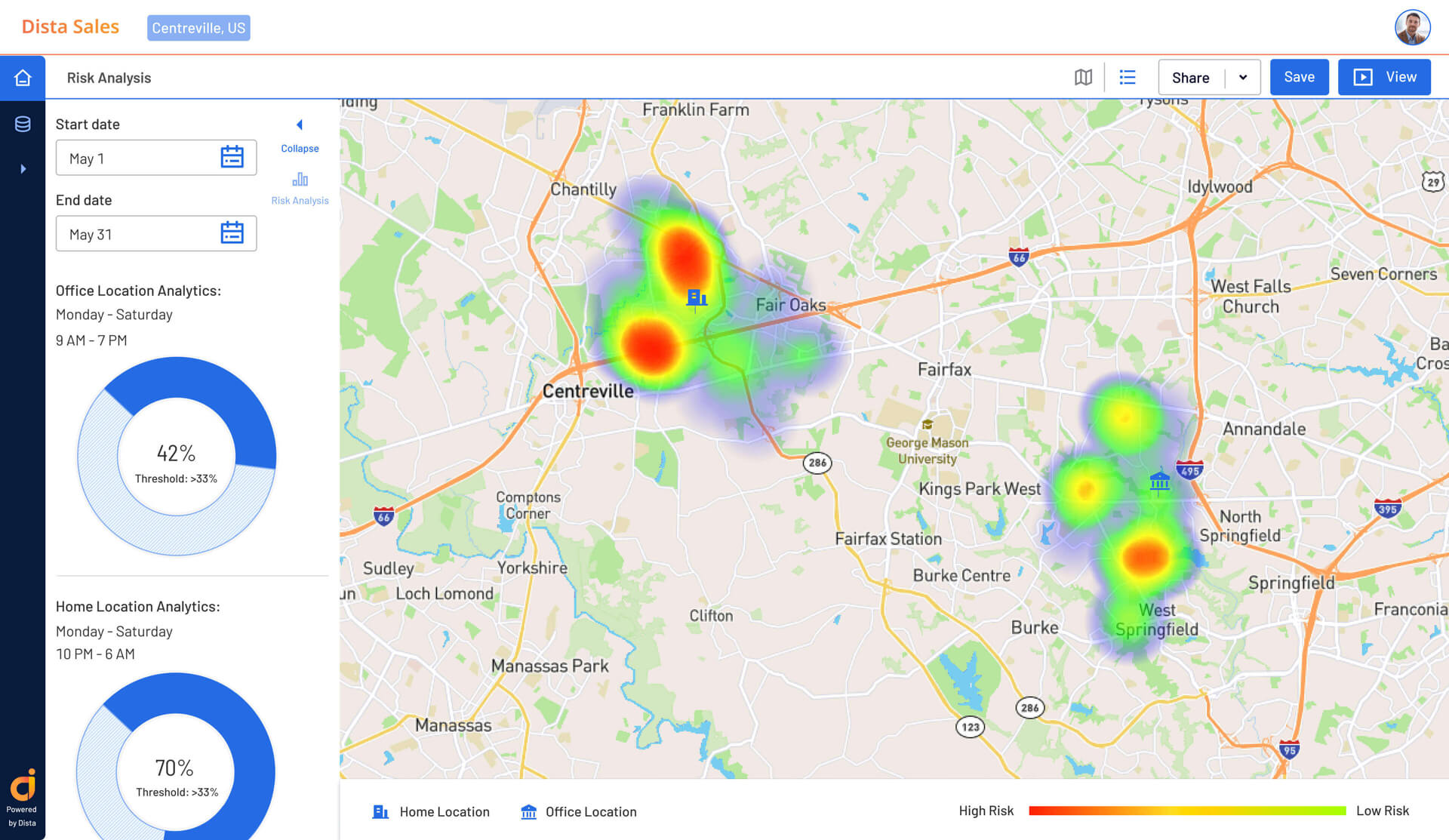

Easy Fraud Detection

Identify fraudulent claims faster via location data by using geospatial insights. Detect trends and patterns based on location-based behavior. For example, if claims inspectors suspect multiple claims filed from the same area, they can flag the location and mark it as suspicious activity.

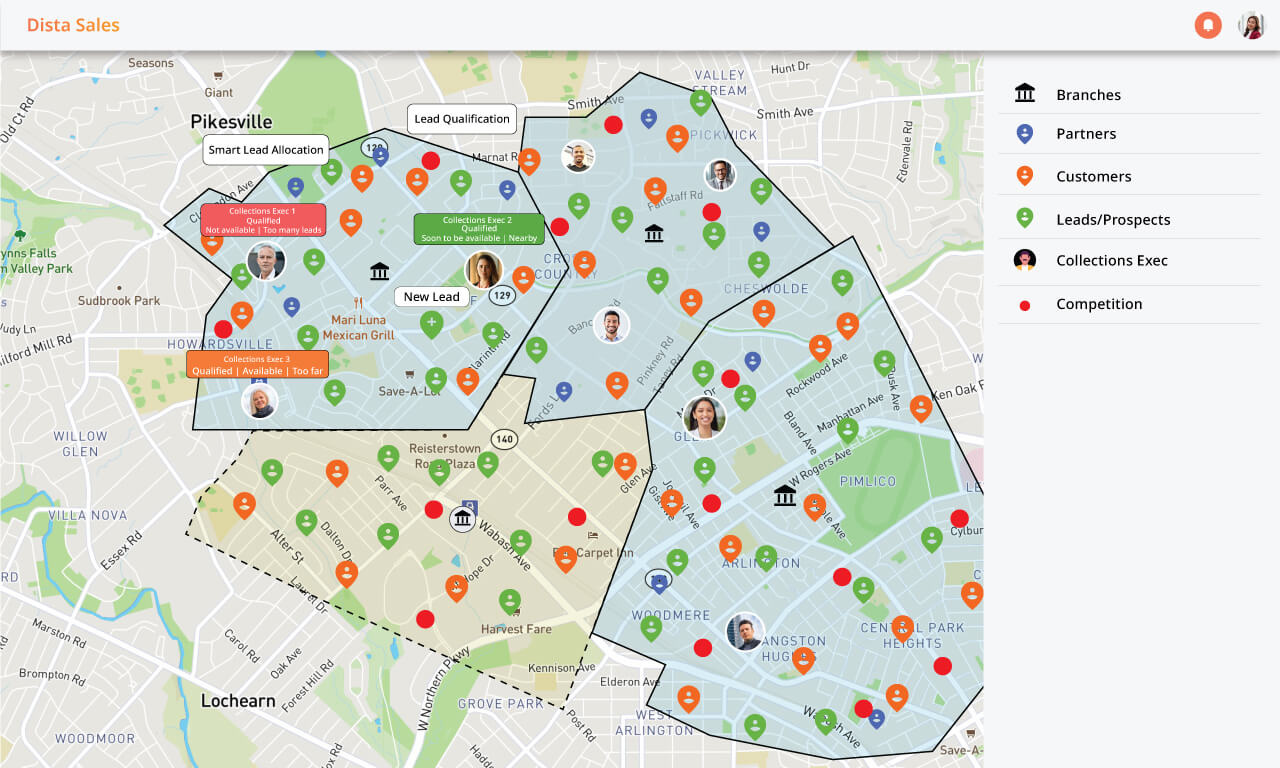

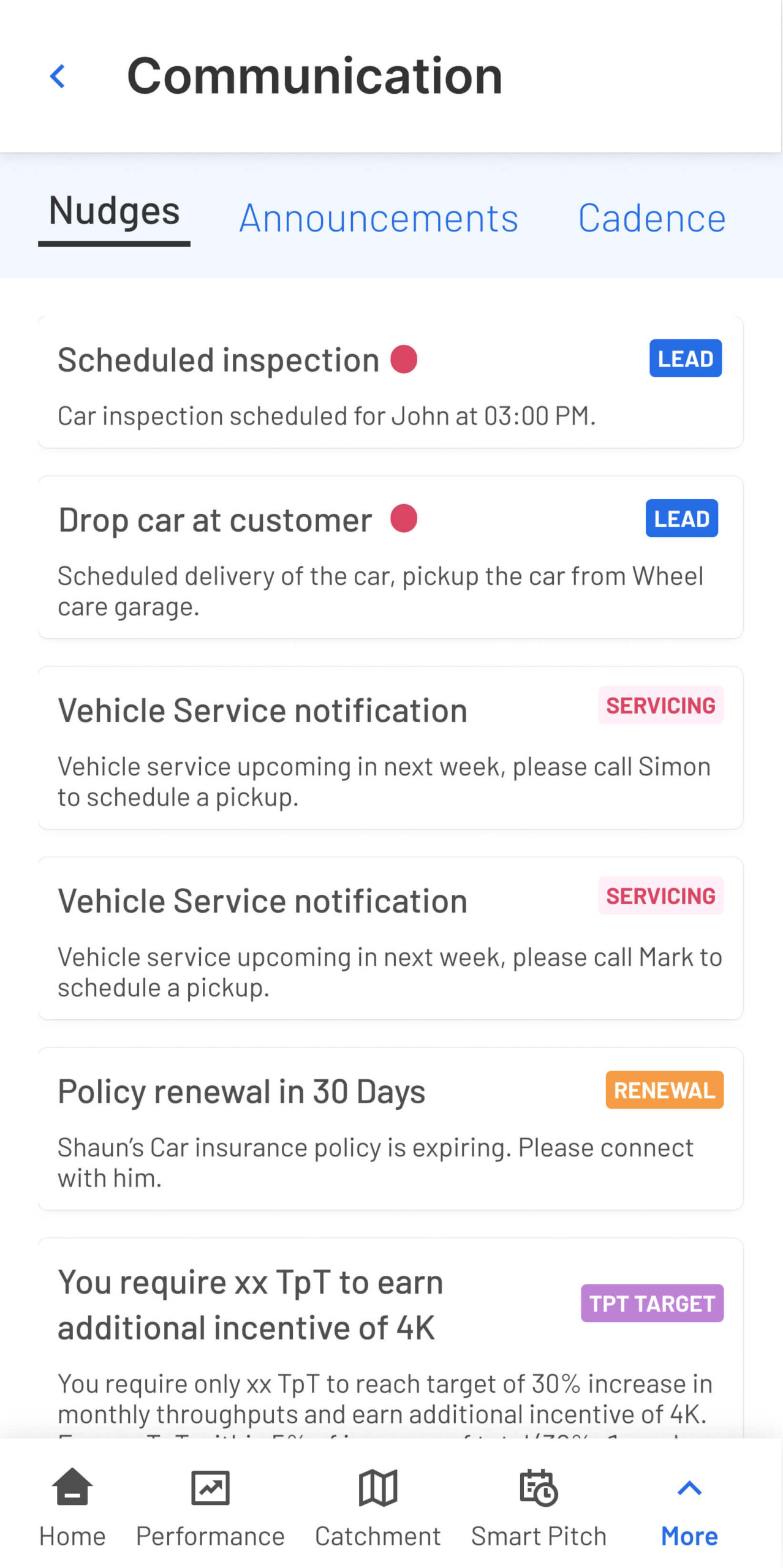

Enable Contextual Alerts

Build deeper connections with prospects and customers via contextual nudges to drive intuitive selling outcomes. Get predictive alerts and recommendations about nearby new opportunities and potential upselling or cross-selling ones.